STOCK

PURCHASE AGREEMENT

dated

as

of October 8, 2008

by

and

among

Mandalay

Media, Inc.,

Jonathan

Cresswell (a/k/a Jack Cresswell), Nathaniel MacLeitch and the shareholders

of

AMV signatories hereto

relating

to the purchase and sale

of

100%

of

the share capital

of

AMV

Holding Limited

and

80%

of

the share capital of Fierce Media Limited

| |

|

Page

|

| |

|

|

|

|

DEFINITIONS

|

1

|

|

1.1

|

Definitions

|

1

|

|

1.2

|

Interpretation

|

10

|

| |

|

|

|

ARTICLE II

|

PURCHASE

AND SALE

|

11

|

|

2.1

|

Purchase

and Sale of the Shares

|

11

|

|

2.2

|

Closing

Date

|

12

|

|

2.3

|

Transactions

to be Effected at the Closing

|

12

|

|

2.4

|

Earn-Out

Payments

|

14

|

|

2.5

|

Sellers’

Representative

|

17

|

|

2.6

|

Closing

Working Capital.

|

19

|

|

2.7

|

Adjustment

of Purchase Price

|

20

|

|

2.8

|

Working

Capital Following Closing

|

21

|

|

2.9

|

Working

Capital Adjustment

|

22

|

| |

|

|

|

ARTICLE III

|

REPRESENTATIONS

AND WARRANTIES OF THE SELLERS

|

|

|

3.1

|

Authority

and Enforceability

|

23

|

|

3.2

|

The

Shares.

|

23

|

|

3.3

|

Receipt

of Stock Consideration for Seller’s Own Account

|

23

|

|

3.4

|

Accredited

Investor

|

23

|

|

3.5

|

Disclosure

of Information

|

23

|

|

3.6

|

Restricted

Securities

|

24

|

|

3.7

|

Legends

|

24

|

| |

|

|

|

ARTICLE IV

|

REPRESENTATIONS

AND WARRANTIES RELATING

TO THE ACQUIRED COMPANIES

|

24

|

|

4.1

|

Organization

and Good Standing

|

25

|

|

4.2

|

Capitalization

|

25

|

|

4.3

|

Subsidiaries

of the Acquired Companies.

|

26

|

|

4.4

|

No

Conflicts; Consents

|

27

|

TABLE

OF CONTENTS

(continued)

| |

|

Page

|

| |

|

|

|

4.5

|

Financial

Statements

|

27

|

|

4.6

|

No

Undisclosed Liabilities

|

28

|

|

4.7

|

Inventory

|

28

|

|

4.8

|

Accounts

Receivable

|

28

|

|

4.9

|

Taxes

|

29

|

|

4.10

|

Compliance

with Law

|

34

|

|

4.11

|

Authorizations

|

34

|

|

4.12

|

Title

to Personal Properties

|

34

|

|

4.13

|

Condition

of Tangible Assets

|

35

|

|

4.14

|

Real

Property

|

35

|

|

4.15

|

Intellectual

Property.

|

38

|

|

4.16

|

Absence

of Certain Changes or Events

|

41

|

|

4.17

|

Contracts

|

43

|

|

4.18

|

Litigation.

|

45

|

|

4.19

|

Employee

Benefits.

|

45

|

|

4.20

|

Labor

and Employment Matters

|

46

|

|

4.21

|

Environmental.

|

49

|

|

4.22

|

Insurance.

|

49

|

|

4.23

|

Product

Warranty.

|

50

|

|

4.24

|

Books

and Records

|

51

|

|

4.25

|

Suppliers

and Customers

|

51

|

|

4.26

|

Brokers

or Finders

|

52

|

|

4.27

|

Bank

Accounts

|

52

|

|

4.28

|

Powers

of Attorney

|

52

|

|

4.29

|

Fierce

Sale

|

52

|

|

4.30

|

Completeness

of Disclosure

|

52

|

| |

|

|

|

ARTICLE V

|

REPRESENTATIONS

AND WARRANTIES OF BUYER

|

52

|

|

5.1

|

Organization

and Good Standing

|

53

|

|

5.2

|

Authority

and Enforceability

|

53

|

TABLE

OF CONTENTS

(continued)

| |

|

Page

|

| |

|

|

|

5.3

|

No

Conflicts; Consents

|

53

|

|

5.4

|

Litigation

|

54

|

|

5.5

|

Purchase

for Investment

|

54

|

|

5.6

|

Availability

of Funds

|

54

|

|

5.7

|

Brokers

or Finders

|

54

|

|

5.8

|

Indebtedness

|

55

|

|

5.9

|

Completeness

of Disclosure

|

55

|

| |

|

|

|

ARTICLE VI

|

COVENANTS

OF SELLERS

|

55

|

|

6.1

|

Conduct

of Business

|

55

|

|

6.2

|

Negative

Covenants

|

56

|

|

6.3

|

Access

to Information

|

58

|

|

6.4

|

Resignations

|

58

|

|

6.5

|

Release

of Liens.

|

58

|

|

6.6

|

Confidentiality

|

58

|

|

6.7

|

Consents

|

59

|

|

6.8

|

Notification

of Certain Matters

|

59

|

|

6.9

|

[INTENTIONALLY

LEFT BLANK].

|

59

|

|

6.10

|

Insurance.

|

60

|

|

6.11

|

No

Solicitation of Other Proposals

|

60

|

|

6.12

|

Change

inYear End.

|

61

|

|

6.13

|

Financial

Statements

|

61

|

|

6.14

|

Directors’

Accounts

|

62

|

| |

|

|

|

ARTICLE VII

|

COVENANTS

OF BUYER AND SELLERS

|

62

|

|

7.1

|

Regulatory

Approvals.

|

62

|

|

7.2

|

Public

Announcements

|

62

|

|

7.3

|

Tax

Matters

|

62

|

|

7.4

|

Further

Assurances

|

63

|

TABLE

OF CONTENTS

(continued)

| |

|

Page

|

| |

|

|

|

7.5

|

Key

Man Life Insurance

|

63

|

|

7.6

|

Board

Observer Rights

|

63

|

|

7.7

|

Rule

144 Sales

|

63

|

|

7.8

|

AMV

Options

|

63

|

|

7.9

|

Drag-Along

|

64

|

| |

|

|

|

ARTICLE VIII

|

CONDITIONS

TO CLOSING

|

64

|

|

8.1

|

Conditions

to Obligations of Buyer and Sellers

|

64

|

|

8.2

|

Conditions

to Obligation of Buyer

|

64

|

|

8.3

|

Conditions

to Obligation of Sellers

|

67

|

| |

|

|

|

ARTICLE IX

|

TERMINATION

|

68

|

|

9.1

|

Termination

|

68

|

|

9.2

|

Effect

of Termination

|

69

|

|

9.3

|

Remedies

|

69

|

| |

|

|

|

ARTICLE X

|

INDEMNIFICATION

|

70

|

|

10.1

|

Survival.

|

70

|

|

10.2

|

Indemnification

by Sellers

|

70

|

|

10.3

|

Indemnification

by Buyer

|

72

|

|

10.4

|

Indemnification

Procedure for Third Party Claims

|

72

|

|

10.5

|

Indemnification

Procedures for Non-Third Party Claims

|

75

|

|

10.6

|

[INTENTIONALLY

LEFT BLANK]

|

75

|

|

10.7

|

Contingent

Claims

|

75

|

|

10.8

|

Effect

of Investigation; Waiver.

|

75

|

|

10.9

|

Tax

Indemnification

|

76

|

|

10.10

|

Procedures

Relating to Indemnification of Tax Claims

|

79

|

|

10.11

|

Tax

Treatment of Indemnification Payments

|

80

|

|

10.12

|

Other

Rights and Remedies Not Affected

|

80

|

TABLE

OF CONTENTS

(continued)

| |

|

Page

|

| |

|

|

|

ARTICLE XI

|

MISCELLANEOUS

|

80

|

|

11.1

|

Notices

|

80

|

|

11.2

|

Amendments

and Waivers

|

81

|

|

11.3

|

Expenses

|

81

|

|

11.4

|

Successors

and Assigns

|

81

|

|

11.5

|

Governing

Law

|

82

|

|

11.6

|

Arbitration

|

82

|

|

11.7

|

Counterparts

|

82

|

|

11.8

|

Third

Party Beneficiaries

|

82

|

|

11.9

|

Entire

Agreement

|

83

|

|

11.10

|

Captions

|

83

|

|

|

Severability

|

83

|

|

11.12

|

Specific

Performance

|

|

STOCK

PURCHASE AGREEMENT

STOCK

PURCHASE AGREEMENT, dated as of October 8, 2008 (the "Agreement"),

by

and among Mandalay Media, Inc., a Delaware corporation ("Buyer"),

Jonathan Cresswell (a/k/a Jack Cresswell) (“Cresswell”),

Nathaniel MacLeitch (“MacLeitch”,

and

together with Cresswell, the " Founding

Sellers")

and

the shareholders of AMV signatories hereto (collectively, the “Non-Founding

Sellers”).

WHEREAS,

the Sellers, at Closing, shall collectively be the registered and beneficial

owners of 100% of the issued and outstanding share capital, £0.001 par value per

share (the “AMV Shares”),

of

AMV Holding Limited (registered in England and Wales under company number

05811953), whose registered office is at 65 High Street, Marlow, SL7 1AB

("AMV");

and

WHEREAS,

the Founding Sellers are collectively the registered and beneficial owners

of

80% of the issued and outstanding share capital, £0.001 par value per share (the

“Fierce Shares”,

and

together with the AMV Shares, the “Shares”),

of

Fierce Media Limited (registered in England and Wales under company number

06467675), whose registered office is at 65 High Street, Marlow, SL7 1AB

("Fierce",

and

together with AMV, the “Acquired

Companies”);

and

WHEREAS,

Founding Sellers and the Non-Founding Sellers desire to sell the Shares, each

in

the amounts set forth opposite his name on Schedule

A,

to

Buyer, and Buyer desires to purchase the Shares from each of the Founding

Sellers and Non-Founding Sellers as set forth on Schedule

A,

upon

the terms and subject to the conditions set forth in this Agreement;

and

WHEREAS,

at Closing, the Option Holder Sellers and Tim Parsons shall sell the shares

of

capital stock of AMV that each will own at the time of Closing, each in the

amounts set forth opposite his name on Schedule

A,

to

Buyer, and Buyer desires to purchase such shares of capital stock of AMV from

each of the Option Holder Sellers as set forth on Schedule

A,

upon

the terms and subject to the conditions set forth in this

Agreement.

NOW,

THEREFORE, in consideration of the foregoing premises and the respective

representations and warranties, covenants and agreements contained herein,

the

parties hereto agree as follows:

ARTICLE

I

DEFINITIONS

1.1 Definitions.

When

used in this Agreement, the following terms shall have the meanings assigned

to

them in this Section 1.1,

or in

the applicable Section of this Agreement to which reference is made in this

Section 1.1.

“AAA”

has

the

meaning set forth in Section 11.6 hereof.

"Acquired

Companies"

has the

meaning set forth in the recitals hereto.

"Acquired

Company Owned Intellectual Property"

has the

meaning set forth in Section 4.15(b) hereof.

"Acquired

Company Registered Items"

has the

meaning set forth in Section 4.15(f) hereof.

"Acquisition"

has the

meaning set forth in Section 2.1 hereof.

“Acquisition

Proposal”

has

the

meaning set forth in Section 6.11 hereof

"Action"

has the

meaning set forth in Section 4.18(a) hereof.

"Actual

Tax Liability"

means

any liability of any of the Seller Companies to make a payment of or in respect

of Tax whether or not presently payable, whether satisfied or unsatisfied at

Closing, whether or not the same is primarily payable by any of the Acquired

Companies or the Buyer and whether or not any of the Acquired Companies or

the

Buyer has, or may have, any right of reimbursement against any other person

or

persons.

"Affiliate"

means,

with respect to any specified Person, any other Person directly or indirectly

controlling, controlled by or under common control with such specified

Person.

"Agreement"

has the

meaning set forth in the preamble above.

“AMV”

has

the

meaning set forth in the preamble above.

“AMV

Shares”

has

the

meaning set forth in the preamble above.

"Applicable

Survival Period"

has the

meaning set forth in Section 10.1(d) hereof.

"ASB"

means

the Accounting Standards Board Limited, a company registered in England and

Wales (registered number 2526824), or such other body prescribed by the

Secretary of State from time to time pursuant to the Companies

Acts.

“A

Shares”

has

the

meaning set forth in Section 4.2 hereof.

"Audited

Financial Statements"

has the

meaning set forth in Section 4.5 hereof.

"Authorization"

means

any franchise, license, approval, consent, permit or registration of any

Governmental Entity or pursuant to any Law.

"Balance

Sheet"

has the

meaning set forth in Section 4.5 hereof.

"Balance

Sheet Date"

has the

meaning set forth in Section 4.5 hereof.

"Business

Day"

means a

day other than a Saturday, Sunday or other day on which banks located in New

York City are authorized or required by Law to close.

"Buyer"

has the

meaning set forth above.

“Buyer

Common Stock”

has

the

meaning set forth in Section 2.1(b)

"Buyer

Disclosure Schedule"

has the

meaning set forth in the preamble to Article V hereof.

"Buyer

Indemnitees"

has the

meaning set forth in Section 10.2(a) hereof.

“Buyer

SEC Reports”

has

the

meaning set forth in Section 5.6(a) hereof.

“Buyer’s

Tax Relief”

means

(a) any Relief arising to the Buyer, (b) any Relief arising as a consequence

of,

or by reference to, an Event occurring (or deemed to have occurred) or income

earned after the Balance Sheet Date, and (c) any Relief the availability of

which was taken into account in the Balance Sheet.

"Capital

Stock"

means

(a) in the case of a corporation, its share capital, (b) in the case

of a partnership or limited liability company, its partnership or membership

interests or units (whether general or limited), and (c) any other interest

that confers on a Person the right to receive a share of the profits and losses

of, or distribution of assets, of the issuing entity.

“Cash

Consideration”

has

the

meaning set forth in Section 2.1(a).

"Charter

Documents"

means,

with respect to any entity, the certificate of incorporation, articles of

association, the articles of incorporation, by-laws, articles of organization,

limited liability company agreement, partnership agreement, formation agreement,

joint venture agreement or other similar organizational documents of such entity

(in each case, as amended).

"Closing"

has the

meaning set forth in Section 2.2 hereof.

"Closing

Date"

has the

meaning set forth in Section 2.2 hereof.

"Closing

Working Capital"

has the

meaning set forth in Section 2.6(a) hereof.

"Closing

Working Capital Statement"

has the

meaning set forth in Section 2.6(a) hereof.

"Companies

Act"

means

the applicable provisions of the Companies Act 1985 and the Companies Act 2006

from time to time in force and as they are supplemented and

amended.

“Company

Representatives”

has

the

meaning set forth in Section 6.11(a) hereof.

"Consents"

has the

meaning set forth in Section 6.7.

"Contract"

means

any agreement, contract, commitment, arrangement or understanding, written

or

oral.

"Copyrights"

has the

meaning set forth in Section 4.15(a) hereof.

"Deficit

Amount"

has the

meaning set forth in Section 2.7(a) hereof.

“Drag-Along”

has

the

meaning set forth in Section 7.9 hereof.

“Earn-Out

Payment”

has

the

meaning set forth in Section 2.4(c) hereof.

“Earn-Out

Period”

has

the

meaning set forth in Section 2.4(c) hereof.

“Earn-Out

Term”

has

the

meaning set forth in Section 2.4(c) hereof.

“Earn-Out

Worksheet”

has

the

meaning set forth in Section 2.4(a) hereof.

“EBITDA”

has

the

meaning set forth in Section 2.4(a) hereof.

“Effective

Tax Liability”

means

(a) the Non-availability in whole or in part of any Relief which has been taken

into account in preparing the Balance Sheet (in which case the value of the

Effective Tax Liability shall be the amount of the repayment which is not

available if the relevant Relief is a right to repayment of Tax and, in any

other case, the amount of Tax which would not have been payable but for the

Non-availability of the Relief), and (b) the utilisation or set-off of any

Buyer's Tax Relief against any Tax or against income, profits or gains in

circumstances where but for such utilisation or set-off an Actual Tax Liability

would have arisen in respect of which the Sellers would have been liable to

the

Buyer under Section 10.9 (in which case the value of the Effective Tax Liability

shall be the amount of Tax saved by such utilisation or set-off).

"Employment

Agreements"

has the

meaning set forth in Section 4.20(a) hereof.

“English

Law”

means

the laws of England and Wales.

"Equity

Securities"

means

(a) shares of Capital Stock, and (b) options, warrants, purchase

rights, subscription rights, conversion rights, exchange rights or other

Contracts that, directly or indirectly, could require the issuer thereof to

issue, sell or otherwise cause to become outstanding shares of Capital Stock.

“Excess

Amount”

has

the

meaning set forth in Section 2.7(a) hereof.

“Fierce”

has

the

meaning set forth in the preamble above.

“Fierce

Sale”

has

the

meaning set forth in Section 4.29 hereof.

“Fierce Shares”

has

the

meaning set forth in the preamble above.

"Final

Closing Working Capital"

has the

meaning set forth in Section 2.7(a) hereof.

"Final

Determination"

means

(a) a decision, judgment, decree or other order by any court of competent

jurisdiction, which decision, judgment, decree or other order has become final

after all allowable appeals by either party to the action have been exhausted

or

the time for filing such appeals has expired and is not subject to further

review or modification, (b) a closing agreement entered into under Section

7121

of the Code or any other settlement or other agreement entered into in

connection with an administrative or judicial proceeding, (c) execution of

an Internal Revenue Service Form 870-AD, or (d) the expiration of the time

for

instituting suit with respect to a claimed deficiency.

"Final

Working Capital"

has the

meaning set forth in Section 2.9(a) hereof.

"Financial

Statements"

has the

meaning set forth in Section 4.5 hereof.

“Financing”

has

the

meaning set forth in Section 8.2(i) hereof.

“Founding

Sellers”

has

the

meaning set forth in the preamble above.

"Governmental

Entity"

means

any entity or body exercising executive, legislative, judicial, regulatory

or

administrative functions of or pertaining to United Kingdom or United States

federal, state, local, or municipal government or foreign, international,

multinational or other government, including any department, commission, board,

agency, bureau, official or other regulatory, administrative or judicial

authority thereof.

“Health

Plan”

means

the Acquired Companies’ HSBC Health Cash Plan.

"Indebtedness"

means

any of the following: (a) any indebtedness for borrowed money, (b) any

obligations evidenced by bonds, debentures, notes or other similar instruments,

(c) any obligations to pay the deferred purchase price of property or services,

except trade accounts payable and other current liabilities arising in the

Ordinary Course of Business, (d) any obligations as lessee under capitalized

leases, (e) any indebtedness created or arising under any conditional sale

or

other title retention agreement with respect to acquired property, (f) any

obligations, contingent or otherwise, under bankers acceptance, letters of

credit or similar facilities, and (g) any guaranty of any of the

foregoing.

"Indemnitee"

means

any Person which is seeking indemnification from an Indemnitor pursuant to

the

provisions of this Agreement.

"Indemnitor"

means

any party hereto from which any Indemnitee is seeking indemnification pursuant

to the provisions of this Agreement.

"Independent

Expert"

has the

meaning set forth in Section 2.6(c) hereof.

"Intellectual

Property"

has the

meaning set forth in Section 4.15(a) hereof.

"Intellectual

Property Rights"

has the

meaning set forth in Section 4.15(a) hereof.

"Interim

Balance Sheet"

has the

meaning set forth in Section 4.5 hereof.

"Interim

Balance Sheet Date"

has the

meaning set forth in Section 4.5 hereof.

"Interim

Financial Statements"

has the

meaning set forth in Section 4.5 hereof.

"Knowledge"

of

Sellers or any similar phrase means, with respect to any fact or matter, the

actual knowledge of Cresswell, MacLeitch and Marcus King, together with such

knowledge that such persons could be expected to discover after reasonable

investigation concerning the existence of the fact or matter in

question.

"Law"

means

any statute, law (including common law), constitution, treaty, ordinance, code,

order, decree, judgment, rule, regulation and any other binding requirement

or

determination of any Governmental Entity.

"Leased

Real Property"

has the

meaning set forth in Section 4.14(a) hereof.

"Letter

of Intent"

has the

meaning set forth in Section 6.3 hereof.

"Liabilities"

has the

meaning set forth in Section 4.7 hereof.

"Lien"

means,

with respect to any property or asset, any mortgage, lien, pledge, debenture,

charge, rent charge, security interest or other encumbrance securing the

repayment of monies or other obligation or liability of the Acquired Companies

or any of their Subsidiaries in respect of such property or asset.

"Losses"

has the

meaning set forth in Section 10.2(a) hereof.

"Marks"

has the

meaning set forth in Section 4.15(a) hereof.

"Material

Contracts"

has the

meaning set forth in Section 4.17(b) hereof.

"Minor

Contracts"

has the

meaning set forth in Section 4.17(f) hereof.

“Nine-Month

Closing Working Capital Statement”

has

the

meaning set forth in Section 2.8(a) hereof.

“Nine-Month

Working Capital”

has

the

meaning set forth in Section 2.8(a) hereof.

"Non-availability"

means

loss, reduction, modification, cancellation, non-availability or

non-existence.

"Noncompetition

Period"

has the

meaning set forth in Section 6.9(a) hereof.

"Nondisclosure

Agreements"

has the

meaning set forth in Section 4.15(i) hereof.

“Note”

has

the

meaning set forth in Section 2.1(c) hereof.

"Notice

of Claim"

has the

meaning set forth in Section 10.4(a) hereof.

"Notice

of Objection"

has the

meaning set forth in Section 2.6(b) hereof.

“Observer”

has

the

meaning set forth in Section 7.6 hereof.

“Option

Holder Sellers”

means

the Option Holders of AMV who have delivered their shares of capital stock

of

AMV to Buyer at Closing pursuant to the provisiosn of Sections 7.8, 7.9, 8.2(s)

and 8.2(t).

“Ordinary

Course of Business” means

an

action taken by a Person only if that action is consistent in the nature, scope

and magnitude with the past practices of such Person and is taken in the

ordinary course of the normal, day-to-day operations of such person.

“Other

Interests in Real Property”

has

the

meaning set forth in Section 4.14(a) hereof.

"Owned

Real Property"

has the

meaning set forth in Section 4.14(a) hereof.

"Patents"

has the

meaning set forth in Section 4.15(a) hereof.

“Permit”

means

any permit, licenses, registrations or other authorization by any Governmental

Entity.

"Person"

means

an individual, a corporation, a partnership, a limited liability company, a

trust, an unincorporated association, a Governmental Entity or any agency,

instrumentality or political subdivision of a Governmental Entity, or any other

entity or body.

"Policies"

has the

meaning set forth in Section 4.22(a) hereof.

"Products"

has the

meaning set forth in Section 4.23(a) hereof.

"Proprietary

Information

" has

the meaning set forth in Section 4.15(a) hereof.

"Purchase

Price"

has the

meaning set forth in Section 2.1 hereof.

"Real

Property"

has the

meaning set forth in Section 4.14(a) hereof.

"Relevant

Group"

means

any affiliated, combined, consolidated, unitary or similar group of which any

Seller Company is or was a member.

"Relief"

means

any loss, allowance, credit, relief, deduction, exemption or set-off from or

against or in respect of Tax or any right to a repayment of Tax.

"Representatives"

has the

meaning set forth in Section 6.3 hereof.

"Review

Period"

has the

meaning set forth in Section 2.6(b) hereof.

“SEC”

has

the

meaning set forth in Section 5.4(a) hereof.

“Second

Notice of Objection”

has

the

meaning set forth in Section 2.8(b) hereof.

“Second

Review Period”

has

the

meaning set forth in Section 2.8(b) hereof.

“Section

2.4(b) Accountants”

has

the

meaning set forth in Section 2.4(b) hereof.

“Section

2.4(b) Notice”

has

the

meaning set forth in Section 2.4(b) hereof.

“Securities

Act”

has

the

meaning set forth in Section 3.4 hereof.

"Seller

Company"

means

the Acquired Companies and each of the Subsidiaries of the Acquired Companies,

and "Seller

Companies"

means,

collectively, the Acquired Companies and all such Subsidiaries.

"Seller

Disclosure Schedule"

has the

meaning set forth in the preamble to Article IV hereof.

"Seller

Indemnitees"

has the

meaning set forth in Section 10.3(a) hereof.

“Sellers”

means,

collectively, the Founding Sellers, the Non-Founding Sellers and the Option

Holder Sellers.

“Sellers’

Representative”

has

the

meaning set forth in Section 2.5(a) hereof.

"Shares"

has the

meaning set forth in the recitals hereto.

“Stock

Consideration”

has

the

meaning set forth in Section 2.1(b) hereof.

“Stub

Period Adjustment”

has

the

meaning set forth in Section 2.6(a) hereof.

"Subsidiary"

or

"Subsidiaries"

means,

with respect to any party, any corporation or other organization, of which

(a)

such party or any other Subsidiary of such party is a general partner (excluding

partnerships, the general partnership interests of which held by such party

or

any Subsidiary of such party do not have a majority of the voting interest

in

such partnership), or (b) at least a majority of the securities or other

interests having by their terms ordinary voting power to elect a majority of

the

board of directors or others performing similar functions with respect to such

corporation or other organization is directly or indirectly owned or controlled

by such party and/or by any one or more of their Subsidiaries.

"Subsidiary

Shares"

has the

meaning set forth in Section 4.3(b) hereof.

"Tax"

or

"Taxes"

means

any and all local or foreign net or gross income, gross receipts, net proceeds,

sales, use, ad valorem, value added, franchise, bank shares, withholding,

payroll, employment, excise, property, deed, stamp, alternative or add-on

minimum, environmental, profits, windfall profits, transaction, license, lease,

service, service use, occupation, severance, energy, unemployment, social

security, worker's compensation, capital, premium, and other taxes, assessments,

customs, duties, fees, levies, or other governmental charges of any nature

whatever, whether disputed or not, together with any interest, penalties,

additions to tax, or additional amounts with respect thereto,

whether

of the United States of America, the United Kingdom or elsewhere.

"Taxes

Act"

means

the Income and Corporation Taxes Act 1988.

"Taxing

Authority"

means

HM

Revenue & Customs

and any

other Governmental Entity responsible for the administration

or

collection of any Tax.

"Tax

Claim"

means

any written claim with respect to Taxes made by any Taxing Authority or other

Person that, if pursued successfully, could serve as the basis for a claim

in

respect of Tax by the Buyer under this Agreement.

"Tax

Returns"

means

any return, computation, declaration, report, claim for refund, or information

return or statement relating to Taxes, including any schedule or attachment

thereto, and including any amendment thereof.

1.1 “Tax

Statute”

means

any primary or secondary statute, instrument, enactment, order, law, by-law,

or

regulation making any provision for or in relation to Tax whether of the United

States of America, the United Kingdom or elsewhere.

1.2 “Tax Withholding”

has

the

meaning set forth in Section 2.1(a) hereof.

"Third

Party Claim"

has the

meaning set forth in Section 10.4(a) hereof.

"Third

Party Defense"

has the

meaning set forth in Section 10.4(b) hereof.

"Transfer

Taxes"

means

sales, use, transfer, real property transfer, recording, documentary, stamp,

registration and stock transfer taxes and fees.

"TUPE"

means

the Transfer of Undertakings (Protection of Employment) Regulations

2006.

"UK

GAAP"

shall

mean generally accepted accounting practices, principles and standards in

compliance with all applicable laws in the United Kingdom including without

limitation the legal principles set out in the Companies Acts, rulings and

abstracts of the ASB and guidelines, conventions, rules and procedures of

accounting practice in the United Kingdom which are regarded as permissible

by

the ASB.

"US

GAAP"

shall

mean generally accepted accounting practices, principles and standards in

compliance with all applicable laws in the United States.

“ValueAct”

has

the

meaning set forth in Section 5.8 hereof.

“ValueAct

Note”

has

the

meaning set forth in Section 5.8 hereof.

“VAT”

means

value added tax.

“VATA”

means

the Value Added Tax Act 1994.

"Work

Product Agreements"

has the

meaning set forth in Section 4.15(j) hereof.

"Working

Capital"

shall

mean current assets (including any amounts received by AMV from Option Holder

Sellers in connection with the exercise of their options subsequent to September

30, 2008) less current liabilities as defined under UK GAAP, including without

limitation amounts to be paid in connection with corporation tax on the profit

for the period and unpaid amounts from prior periods, any bank borrowings and

any other liabilities which are payable within one year from the date of

Closing.

"$"

means

United States dollars.

“£”

means

English pounds.

1.2 Interpretation.

(a) The

meaning assigned to each term defined herein shall be equally applicable to

both

the singular and the plural forms of such term and vice versa, and words

denoting either gender shall include both genders as the context requires.

Where

a word or phrase is defined herein, each of its other grammatical forms shall

have a corresponding meaning.

(b) The

terms

"hereof", "herein" and "herewith" and words of similar import shall, unless

otherwise stated, be construed to refer to this Agreement as a whole and not

to

any particular provision of this Agreement.

(c) When

a

reference is made in this Agreement to an Article, Section, paragraph, Exhibit

or Schedule, such reference is to an Article, Section, paragraph, Exhibit or

Schedule to this Agreement unless otherwise specified.

(d) The

word

"include", "includes", and "including" when used in this Agreement shall be

deemed to by the words "without limitation", unless otherwise

specified.

(e) A

reference to any party to this Agreement or any other agreement or document

shall include such party's predecessors, successors and permitted

assigns.

(f) Reference

to any Law means such Law as amended, modified, codified, replaced or reenacted,

and all rules and regulations promulgated thereunder.

(g) The

parties have participated jointly in the negotiation and drafting of this

Agreement. Any rule of construction or interpretation otherwise requiring this

Agreement to be construed or interpreted against any party by virtue of the

authorship of this Agreement shall not apply to the construction and

interpretation hereof.

ARTICLE

II

PURCHASE

AND SALE

2.1 Purchase

and Sale of the Shares.

At the

Closing, upon the terms and subject to the conditions of this Agreement, each

of

the Sellers shall sell to Buyer in the amounts set forth opposite his name

on

Schedule

A,

which

Schedule shall be delivered to Buyer prior to Closing, and Buyer agrees to

purchase from Sellers, the Shares free and clear of all Liens. The aggregate

purchase price to be paid to the Sellers’ Representative on behalf of the

Sellers by Buyer hereunder (the "Purchase

Price"),

shall

consist of the following:

(a) $5,375,000

in cash, subject to adjustment as provided herein (the “Cash

Consideration”),

of

which (i) the exercise price of the AMV Options being exercised by the Option

Holder Sellers pursuant to Sections 7.8 and 8.2(s) shall be paid to AMV as

consideration for such Option Holder Seller’s exercise of such options, and

shall be deducted from the amount of Cash Consideration otherwise payable to

such Option Holder Seller, and be treated for all purposes under this Agreement

as having been paid to the person to whom such amounts would otherwise have

been

paid; and (ii) an amount equal to the maximum taxation liability that would

be

incurred with respect to the payment of the Cash Consideration to any Option

Holder Sellers under applicable Tax laws (the “Tax Withholding”)

(in

the amounts set forth next to such Option Holder Sellers’ names, as set forth on

Schedule

2.1(a)(ii)),

shall

be delivered to AMV and held by AMV in a separate account. The amount of the

Tax

Withholding shall be deducted from the amount of the Cash Consideration

otherwise payable to the applicable Seller, and treated for all purposes under

this Agreement as having been paid to the person to whom such amounts would

otherwise have been paid. Such amounts shall be held by AMV and subsequently

delivered by AMV to the applicable taxing authority or Seller, as applicable,

upon clarification or resolution of any potential tax liability or,

alternatively, upon receipt of a definitive opinion from a recognized United

Kingdom taxation expert that the time period during which the valuation of the

AMV EMI share option plan could be disputed has elapsed.

(b) 4,500,000

fully paid non-assessable shares of common stock of Buyer (the “Buyer

Common Stock”),

par

value $0.0001 per share (the “Stock

Consideration”);

(c) a

secured

promissory note in the aggregate original principal amount of $5,375,000,

substantially in the form attached hereto as Exhibit

A

and

issued to the Sellers’ Representative (the “Note”),

the

repayment of which with respect to the payments otherwise payable to Marcus

King

and Dan Boss shall be reduced by the amount of Tax Withholding to be withheld

with respect to each of Marcus King and Dan Boss (except to the extent already

so withheld), as required to satisfy the taxation liability of such persons

(as

set forth on Schedule

2.1(c)),

pursuant to Section 2.1(a)(ii). The Sellers’ Representative shall be responsible

for directing the distribution of the Note proceeds to the Sellers (pro-rata

in

proportion to each Seller’s interest after giving effect to the Tax Withholding)

and the Buyer shall be entitled to fully rely on such directions;

and

(d) subject

to the limitations set forth herein, the earn-out amounts, if any, as determined

in accordance with the provisions of Section 2.6.

The

Purchase Price shall be paid as provided in Section 2.3 and shall be

subject to adjustment as provided herein. The purchase and sale of the Shares

is

referred to in this Agreement as the "Acquisition".

2.2 Closing

Date.

The

closing of the Acquisition (the "Closing")

shall

take place at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo,

P.C., 666 Third Avenue, New York, New York 10017, as soon as possible, but

in no

event later than five Business Days after satisfaction (or waiver as provided

herein) of the conditions set forth in Article VIII (other than those

conditions that by their nature will be satisfied at the Closing), or such

other

place, time and date as Buyer and Sellers may agree. The date on which the

Closing occurs is referred to in this Agreement as the "Closing

Date."

2.3 Transactions

to be Effected at the Closing.

(a) At

the

Closing Buyer shall deliver:

(i) to

Sellers’ Representative on behalf of each Seller, the Cash Consideration (less

the sums set forth in Section 2.1(a)), in the amounts set forth on Schedule

A,

in

immediately available funds by wire transfer to an account of Sellers’

Representative designated in writing by Sellers’ Representative to Buyer no

later than three Business Days prior to the Closing Date;

(ii) to

each

Seller, duly executed stock certificates (or an irrevocable instruction letter

to the Buyer’s transfer agent) for the shares of Buyer Common Stock representing

each Seller’s proportionate share of the Stock Consideration, in the amounts set

forth on Schedule

A;

(iii) to

Sellers’ Representative, the Note; and

(iv) to

AMV,

an amount equal to the Tax Withholding; and

(v) all

other

documents, instruments or certificates required to be delivered by Buyer at

or

prior to the Closing pursuant to this Agreement.

(b) At

the

Closing Sellers shall deliver to Buyer:

(i) duly

completed and executed transfers of the Shares in favour of the Buyer or as

it

directs;

(ii) certificates

for the Shares

or an

indemnity in the form reasonably required by Buyer for any lost

certificates;

(iii) (A)

the

resignations of all persons, other than the Founding Sellers, as directors

of

the Acquired Companies and their Subsidiaries and the secretary of the Acquired

Companies and their Subsidiaries in the agreed form from their respective

offices and employment in the Acquired Companies and their Subsidiaries

containing a written acknowledgement under seal from each of them that he has

no

claim against the relevant Acquired Company or its Subsidiary on any grounds

whatsoever, and (B) the appointment of three of Buyer’s nominees to serve as

directors of AMV and each of its Subsidiaries;

(iv) Form

288a’s and 288b’s in respect of appointments and resignations of officers of

the

Acquired Companies or their Subsidiaries;

(v) the

certificate of incorporation, any certificate or certificates of incorporation

on change of name, any common seal, all statutory books duly completed up to

Closing, all share certificate books (with any unissued share certificates),

copies of the up to date memorandum and articles of association and all existing

Companies House electronic filing company authentication codes of the Acquired

Companies or any of their Subsidiaries;

(vi) all

title

deeds and documents (including plans and consents) relating to the Real Property

occupied by the Acquired Companies or any of their Subsidiaries;

(vii) the

appropriate forms to amend all existing bank mandates and authorities of the

Acquired Companies or any of their Subsidiaries;

(viii) bank

statements in respect of each account of the Acquired Companies as at the close

of business on the last Business Day prior to the Closing Date, together with

in

each case a reconciliation statement prepared by the Seller to show the position

at the Closing Date;

(ix) evidence

to the satisfaction of the Buyer that all debts and accounts between the Sellers

and any Affiliates of the Sellers (on the one hand) and the Acquired Companies

(on the other hand) have been fully paid and settled;

(x) all

other

documents and instruments reasonably necessary to vest in Buyer all of Sellers’

right, title and interest in and to the Shares, with full title guarantee under

English Law, free and clear of all Liens; and

(x) all

other

documents, instruments or certificates reasonably required to be delivered

by

Sellers at or prior to the Closing pursuant to this Agreement.

(c) At

the

Closing, a board meeting of each of the Acquired Companies and their

Subsidiaries shall be duly convened and held at which, with effect from

Closing:

(i) the

transfers referred to in Section 2.3(b)(i) shall (subject to stamping) be

approved and registered;

(ii) such

persons as the Buyer may nominate shall be appointed as directors and as the

secretary of the Acquired Companies and their Subsidiaries and the resignations

referred to in clause 2.3(b)(iii) shall be submitted and accepted;

(iii) all

authorities to the bankers of the Acquired Companies and their Subsidiaries

relating to bank accounts shall be revoked and new authorities to such persons

as the Buyer may nominate shall be given to operate the same;

(iv) the

registered office of the Acquired Companies and their Subsidiaries shall be

changed to such address as the Buyer shall specify; and

(v) the

accounting reference date of the Acquired Companies and their Subsidiaries

shall

be changed to such date as the Buyer shall specify.

2.4 Earn-Out

Payments. (a)

Delivery

of Financial Information.

Within

90 days after the last Business Day of each Earn-Out Period (as defined below),

Buyer shall deliver to Sellers’ Representative (at Buyer’s cost and expense) a

worksheet (the “Earn-Out

Worksheet”)

prepared by AMV’s accountants or Buyer’s accountants (or its designee), setting

forth Buyer’s determination of earnings before interest, tax, depreciation and

amortization (each measured in accordance with UK GAAP) as determined from

the

Seller Companies’ historical financial statements consistent with past practice

(“EBITDA”).

Notwithstanding the foregoing, the determination of EBITDA for any Earn-Out

Period shall be made using the following guidelines: (i) except as set forth

below, any profits, losses or other items relating to Fierce shall be excluded

from the EBITDA determination, (ii) any payments or management charges made

by

AMV at the written direction of Buyer or the board of directors of AMV, which

are outside of the normal course of operations of AMV shall be excluded from

the

EBITDA determination, and/or (iii) any revenue from any source, except as

contemplated by the parties, other than the existing business of the Acquired

Companies on the date hereof shall not be included in the EBITDA determination.

Subject to execution of a Non-Disclosure Agreement in customary form, Sellers

shall have the right, at Sellers’ expense, during each Earn-Out Period, at

reasonable times and upon reasonable notice, to examine, and to have the

Sellers’ Representative and their advisors examine, the books and records of the

Seller Companies to determine whether the calculation and payment of the

Earn-Out Payment are being conducted in accordance with the provisions of this

Agreement.

(b) Disputes

Regarding Earn-Out Worksheet.

In the

event that Sellers dispute any amounts reflected on any Earn-Out Worksheet,

Sellers’ Representative shall notify Buyer in writing (such notice, a

“Section

2.4(b) Notice”),

within 30 days after the delivery of the Earn-Out Worksheet, setting forth

the

amount, nature and basis of the dispute. Within the following 10 days, the

parties shall use their reasonable best efforts to resolve in good faith such

dispute. Upon their failure to do so, Sellers’ Representative and Buyer shall

within 10 days from the end of such 10 day period jointly engage an independent

accountant (the “Section

2.4(b) Accountants”),

or in

the absence of agreement, within seven days of the first disagreement being

expressed, such firm as the President of the Institute of Chartered Accountants

in England and Wales (or in his absence the next most senior officer) shall

determine to act as the Section 2.4(b) Accountants on the application of either

Buyer or the Sellers’ Representative. The Section 2.4(b) Accountants shall be

engaged jointly by Buyer and Sellers’ Representative to decide the dispute with

respect to the Earn-Out Worksheet within 30 days from its appointment, such

decision to be communicated to both parties in writing. The decision of the

Section 2.4(b) Accountants shall be final and binding upon the parties and

accordingly a declaratory judgment by a court of competent jurisdiction may

be

entered in accordance therewith. For greater certainty, the Section 2.4(b)

Accountants shall act in a capacity which under English Law would be deemed

to

be as expert and not as arbitrator. The fees and expenses of such accounting

firm shall be borne one-half by Buyer and one-half by Sellers.

(c) Calculation

of Earn-Out Payment.

The

Earn-Out Payment (the “Earn-Out

Payment”)

for

each of the periods from October 1, 2008 to March 31, 2009, from April 1, 2009

to March 31, 2010, and from April 1, 2010 to September 30, 2010 (each, an

“Earn-Out

Period,”

and

collectively, the “Earn-Out

Term”)

shall

be determined as follows:

(i) if

the

Acquired Companies’ EBITDA for the period of October 1, 2008 to March 31, 2009

exceeds £1,566,000, then the Sellers shall be entitled to an Earn-Out Payment

equal to 50% of the Acquired Companies’ EBITDA for such period, provided, that,

the calculation of the Acquired Companies’ EBITDA for such period shall be

reduced by 50% of the Stub Period Adjustment;

(ii) if

the

Acquired Companies’ EBITDA for the period of April 1, 2009 to March 31, 2010

exceeds £3,422,000, then the Sellers shall be entitled to an Earn-Out Payment

equal to 50% of the Acquired Companies’ EBITDA for such period; and

(iii) if

the

Acquired Companies’ EBITDA for the period of April 1, 2010 to September 30, 2010

exceeds £1,800,000, then the Sellers shall be entitled to an Earn-Out Payment

equal to 50% of the Acquired Companies’ EBITDA for such period.

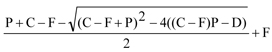

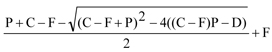

Notwithstanding

the foregoing, in no event shall the aggregate amount of the three potential

Earn-Out Payments made to the Sellers exceed the result of the following formula

in pounds sterling:

Where:

P

= C

plus the Acquired Companies’ EBITDA for the period of October 1, 2008 to March

31, 2009

C

=

£5,000,000

F

=

0.0005

D

=

0.1

(d) Payment.

Subject

to the provisions of Section 2.4(e), Buyer shall deliver any Earn-Out Payment

that may be due to Sellers to Sellers’ Representative on behalf of each Seller.

Any Earn-Out Payments that may be due will be paid not later than ten (10)

Business Days following the date that it is finally determined that such

Earn-Out Payment is payable in accordance with the provisions of this Section

2.4.

(e) Right

of Set-Off.

Buyer’s

obligation to make the Earn-Out Payments is subject to reduction or non-payment

(for each Sellers’ pro rata share of the Earn-Out Payment) due to any claim for

damages that a Buyer Indemnitee has against Sellers in accordance with Article

X. In the event that Buyer determines to exercise its right of set-off pursuant

to this Section 2.4, Buyer shall comply with the provisions of this Section

2.4

in determining the Earn-Out Payment and shall pay the amount, if any, by which

the Earn-Out Payment exceeds the amount set-off by Buyer.

(f) Conduct

During Earn-Out Term.

During

the Earn-Out Term, the Buyer will operate the Acquired Companies in the Ordinary

Course of Business, including, but not limited to, not making any material

changes in the nature of their businesses as they exist at the date of this

Agreement (except with respect to a potential sale or shutdown of Fierce),

not

incurring any major capital expenditures, not diverting customers or income

away

from the Acquired Companies and using its reasonable endeavours to promote

the

businesses of the Acquired Companies. The Founding Sellers shall manage the

day-to-day operations of AMV and its Subsidiaries, pursuant to and in accordance

with the terms of their employment agreements. During the Earn-Out Term,

dividends, loans or other similar payments may only be made by AMV to Buyer

to

the extent that AMV has cash surplus to the Working Capital requirements of

AMV

following Closing.

(g) Sale

of Fierce.

In the

event that Buyer determines, prior to September 30, 2010, to sell all or

substantially all of Fierce, whether by way of merger, stock sale, asset sale

or

otherwise, then, after taking into account any losses, charges or other

liabilities incurred by AMV, Buyer or Fierce in the ownership and operation

of

Fierce through the closing of any such transaction (including the costs and

expenses of such transaction), but excluding any amounts relating to Fierce

that

were used as an adjustment to the Purchase Price in determining Final Closing

Working Capital (as defined below), Sellers shall be entitled to receive, as

a

credit to the determination of EBITDA in the applicable Earn-Out Period (and

not

in cash), 12% of the gain of such transaction, determined in accordance with

the

principles set forth in this Section 2.4(g).

(h) Founding

Sellers’ Employment.

If,

during the Earn-Out Term, a Founding Seller resigns from employment with any

Acquired Company, then such Founding Seller shall not be entitled to receive

any

portion of any Earn-Out Payment that may become due to Sellers in the applicable

Earn-Out Period and any subsequent Earn-Out Periods and any aggregate Earn-Out

Payment that may otherwise be deliverable to the Sellers’ Representative shall

be reduced by the pro rata amount that such Founding Seller would otherwise

have

been entitled to if he had not resigned.

2.5 Sellers’

Representative.

(a) In

order

to administer efficiently (i) the implementation of the Agreement on behalf

of

the Sellers and (ii) the settlement of any dispute with respect to this

Agreement or the Note, the Sellers hereby designate Nathaniel MacLeitch as

the

Sellers’ representatives (the “Sellers’

Representative”).

Sellers’ Representative is also empowered to take all actions of an “authorized

person” pursuant to and under clause 6.5 of Article 6 of the Articles of

Association of AMV.

(b) From

and

after the Closing, the Sellers hereby authorize the Sellers’ Representative (i)

to take all action necessary in connection with the implementation of the

Agreement on behalf of the Sellers or the settlement of any dispute, including,

without limitation, with regard to matters pertaining to the indemnification

provisions of this Agreement and the Note, (ii) to give and receive all notices

required to be given under the Agreement and (iii) to take any and all

additional action as is contemplated to be taken by or on behalf of the Sellers

by the terms of this Agreement and the Note.

(c) In

the

event that the Sellers’ Representative dies, becomes legally incapacitated or

resigns from such position, another individual designated by the Sellers, who

shall be identified to Buyer as soon as practicable, shall fill such vacancy

and

shall be deemed to be the Sellers’ Representative for all purposes of this

Agreement; provided, however, that no change in the Sellers’ Representative

shall be effective until Buyer is given written notice of such change by the

Sellers.

(d) All

decisions and actions by the Sellers’ Representative as provided in this Section

2.5 or under the Note shall be binding upon all of the Sellers, and no Seller

shall have the right to object, dissent, protest or otherwise contest the

same.

(e) By

their

execution and/or approval of this Agreement and the Acquisition, the Sellers

agree that:

(i) Buyer

shall be able to rely conclusively on the instructions and decisions of the

Sellers’ Representative as to any actions required or permitted to be taken by

the Sellers or the Sellers’ Representative hereunder, and no party hereunder

shall have any cause of action against Buyer for any action taken by Buyer

in

reasonable reliance upon the instructions or decisions of the Sellers’

Representative;

(ii) all

actions, decisions and instructions of the Sellers’ Representative shall be

conclusive and binding upon all of the Sellers and no Seller shall have any

cause of action against the Sellers’ Representative for any action taken,

decision made or instruction given by the Sellers’ Representative under this

Agreement and under the Note, except for fraud or willful breach of this

Agreement or the Note by the Sellers’ Representative; and

(iii) the

provisions of this Section 2.5 are independent and severable, shall constitute

an irrevocable power of attorney, coupled with an interest and surviving death,

granted by the Sellers to the Sellers’ Representative and shall be binding upon

the executors, heirs, legal representatives and successors of the

Sellers.

(f) All

fees

and expenses incurred by the Sellers’ Representative shall be paid by the

Sellers severally to the extent of their pro rata interest in the aggregate

of

the Purchase Price.

(g) In

taking

any action hereunder and under the Note, the Sellers’ Representative shall be

protected in relying upon any notice, paper or other document reasonably

believed by it to be genuine, or upon any evidence reasonably deemed by it,

in

its good faith judgment, to be sufficient; provided,

however,

that

the Sellers’ Representative shall not waive any rights with respect to any

individual Seller’s interest(s) if such waiver would have the effect of

disproportionately and adversely affecting such individual Seller as compared

to

the interests of the other Sellers, without the prior consent of the affected

Sellers. The Sellers’ Representative shall not be liable to Buyer or the Sellers

for any act performed or omitted to be performed by it in the good faith

exercise of its duties and shall be liable only in the case of bad faith or

willful misconduct or gross negligence. The Sellers’ Representative may consult

with counsel in connection with its duties hereunder and shall be fully

protected in any act taken, suffered or permitted by it in good faith in

accordance with the advice of counsel. The Sellers’ Representative shall not be

responsible for determining or verifying the authority of any person acting

or

purporting to act on behalf of any party to this Agreement. The Sellers’

Representative may be replaced at any time by affirmative vote or written

consent of the Sellers.

2.6 Closing

Working Capital.

(a)Within

75

days after the Closing Date, Buyer will prepare, or cause to be prepared, and

deliver to Sellers’ Representative an audited Closing Working Capital Statement

(the "Closing

Working Capital Statement"),

which

shall set forth (i) Buyer's calculation of Working Capital as of September

30,

2008, (ii) which calculation shall also include (as an adjustment to the

Purchase Price) an amount equivalent to all other debt of AMV and its

Subsidiaries as at September 30, 2008 not included as part of the Working

Capital calculation, including debt that is payable longer than 12 months

relating to the acquisition of the Connection Makers business and (iii) which

calculation shall also include (as an adjustment to the Purchase Price) an

amount equivalent to a pro rata portion of the net profit after tax of AMV

and

its Subsidiaries for the period October 1, 2008 through the Closing Date, based

on the number of whole days elapsed from October 1, 2008 to the Closing Date

as

a proportion of the total net profit after tax of AMV and its Subsidiaries

for

the month of October 2008 (the “Stub

Period Adjustment”)

("Closing

Working Capital").

The

Closing Working Capital Statement and its components shall be prepared in

accordance with UK GAAP applied on a basis substantially consistent with those

used in the preparation of the Balance Sheet and the exchange rate used shall

be

the exchange rate as of the Closing Date as specified by the New York Federal

Reserve Bank.

(b)Upon

receipt from Buyer, Sellers’ Representative shall have 15 days to review the

Closing Working Capital Statement (the "Review

Period").

If

Sellers’ Representative disagrees with Buyer's computation of Closing Working

Capital, Sellers’ Representative may, on or prior to the last day of the Review

Period, deliver a notice to Buyer (the "Notice

of Objection"),

which

sets forth its objections to Buyer's calculation of Closing Working Capital;

provided that

the

Notice of Objection shall include only objections based on

(i) non-compliance with the standards set forth in Section 2.6(a) for the

preparation of the Closing Working Capital Statement and (ii) mathematical

errors in the computation of Closing Working Capital. Any Notice of Objection

shall specify those items or amounts with which Sellers’ Representative

disagrees, together with a detailed written explanation of the reasons for

disagreement with each such item or amount, and shall set forth Sellers’

Representative’s calculation of Closing Working Capital based on such

objections. To the extent not set forth in the Notice of Objection, Sellers’

Representative shall be deemed to have agreed with Buyer's calculation of all

other items and amounts contained in the Closing Working Capital Statement.

(c)Unless

Sellers’ Representative delivers the Notice of Objection to Buyer within the

Review Period, Sellers’ Representative shall be deemed to have accepted Buyer's

calculation of Closing Working Capital and the Closing Working Capital Statement

shall be final, conclusive and binding. If Sellers’ Representative delivers the

Notice of Objection to Buyer within the Review Period, Buyer and Sellers’

Representative shall, during the 30 days following such delivery or any mutually

agreed extension thereof, use their commercially reasonable efforts to reach

agreement on the disputed items and amounts in order to determine the amount

of

Closing Working Capital. If, at the end of such period or any mutually agreed

extension thereof, Buyer and Sellers’ Representative are unable to resolve their

disagreements, they shall jointly retain and refer their disagreements to an

independent accounting firm mutually acceptable to Buyer and Sellers’

Representative (the "Independent

Expert"),

or in

the absence of agreement, within seven days of the first disagreement being

expressed, such firm as the President of the Institute of Chartered Accountants

in England and Wales (or in his absence the next most senior officer) shall

determine to act as the Independent Expert on the application of either Buyer

or

the Sellers’ Representative. The parties shall instruct the Independent Expert

promptly to review this Section 2.6 and to determine solely with respect to

the

disputed items and amounts so submitted whether and to what extent, if any,

the

Closing Working Capital set forth in the Closing Working Capital Statement

requires adjustment. The Independent Expert shall base its determination solely

on written submissions by Buyer and Sellers’ Representative and not on an

independent review. Buyer and Sellers’ Representative shall make available to

the Independent Expert all relevant books and records and other items reasonably

requested by the Independent Expert. As promptly as practicable but in no event

later than 45 days after its retention, the Independent Expert shall deliver

to

Buyer and Sellers’ Representative a report which sets forth its resolution of

the disputed items and amounts and its calculation of Closing Working Capital;

provided that

in no

event shall Closing Working Capital as determined by the Independent Expert

be

less than Buyer's calculation of Closing Working Capital set forth in the

Closing Working Capital Statement nor more than Sellers’ Representative’s

calculation of Closing Working Capital set forth in the Notice of Objection.

The

decision of the Independent Expert shall be final, conclusive and binding on

the

parties. The costs and expenses of the Independent Expert shall be borne

one-half by Buyer and one-half by Sellers.

2.7 Adjustment

of Purchase Price.

(a) "Final

Closing Working Capital"

means

the Closing Working Capital (i) as shown in the Closing Working Capital

Statement delivered by Buyer to Sellers’ Representative pursuant to Section

2.6(a), if no Notice of Objection with respect thereto is timely delivered

by

Sellers’ Representative to Buyer pursuant to Section 2.6(b); or (ii) if a

Notice of Objection is so delivered, (A) as agreed by Buyer and Sellers’

Representative pursuant to Section 2.6(c) or (B) in the absence of such

agreement, as shown in the Independent Expert's calculation delivered pursuant

to Section 2.6(c). If the deficit amount of Final Closing Working Capital

exceeds $1,500,000, Sellers shall pay to Buyer, as an adjustment to the Purchase

Price, in the manner as provided in Section 2.7(b), an amount equal to the

difference between $1,500,000 and Final Closing Working Capital (the

“Excess

Amount”).

If

the deficit amount of Final Closing Working Capital is less than $1,500,000,

Buyer shall pay to Sellers, in the manner as provided in Section 2.7(b), an

amount equal to the difference between Final Working Capital and $1,500,000

(the

“Deficit

Amount”).

(b) Within

three Business Days after Final Working Capital has been finally determined

pursuant to Section 2.6, (i) if there is an Excess Amount, Sellers shall pay

to

Buyer by means of a downward adjustment in the principal sum due under the

Note,

an amount equal to such Excess Amount, and (ii) if there is a Deficit Amount,

the aggregate amount outstanding under the Note shall be increased by such

Deficit Amount.

(c) Any

rights accruing to a party under this Section 2.7 shall be in addition to and

independent of the rights to indemnification under Article X and any payments

made to any party under this Section 2.7 shall not be subject to the terms

of

Article X; provided,

that,

Buyer

shall not be entitled to indemnification for any breach of any representation,

warranty or covenant of Sellers of this Agreement to the extent that amounts

paid to Buyer under this Section 2.7 may be attributed solely to such breach.

Nothing herein shall preclude Buyer from seeking indemnification to the extent

that payments to Buyer under this Section 2.7 do not satisfy all Losses arising

from such breach.

2.8 Working

Capital Following Closing.

(a) Within

60

days after June 30, 2009, Buyer will prepare, or cause to be prepared, and

deliver to Sellers an audited Working Capital Statement (the "Nine-Month

Closing Working Capital Statement"),

which

shall set forth Buyer's calculation of Working Capital as of the nine-month

anniversary of September 30, 2008, which calculation shall exclude any

particular remaining debt of AMV and its Subsidiaries which were included as

part of the calculation of Final Closing Working Capital and shall exclude

any

costs and liabilities relating to Fierce ("Nine-Month

Working Capital").

The

Nine-Month Working Capital Statement shall be prepared in accordance with UK

GAAP applied on a basis substantially consistent with those used in the

preparation of the Balance Sheet and the exchange rate used shall be the

exchange rate as of the Closing Date as specified by the New York Federal

Reserve Bank.

(b) Upon

receipt from Buyer, Sellers’ Representative shall have 15 days to review the

Nine-Month Working Capital Statement (the "Second Review

Period").

If

Sellers’ Representative disagrees with Buyer's computation of Nine-Month Working

Capital, Sellers’ Representative may, on or prior to the last day of the Second

Review Period, deliver a notice to Buyer (the "Second Notice

of Objection"),

which

sets forth its objections to Buyer's calculation of Nine-Month Working Capital;

provided that

the

Second Notice of Objection shall include only objections based on

(i) non-compliance with the standards set forth in Section 2.8(a) for the

preparation of the Nine-Month Working Capital Statement and

(ii) mathematical errors in the computation of Nine-Month Working Capital.

Any Second Notice of Objection shall specify those items or amounts with which

Sellers’ Representative disagrees, together with a detailed written explanation

of the reasons for disagreement with each such item or amount, and shall set

forth Sellers’ Representative’s calculation of Nine-Month Working Capital based

on such objections. To the extent not set forth in the Second Notice of

Objection, Sellers’ shall be deemed to have agreed with Buyer's calculation of

all other items and amounts contained in the Nine-Month Working Capital

Statement.

(c) Unless

Sellers’ Representative delivers the Second Notice of Objection to Buyer within

the Second Review Period, Sellers shall be deemed to have accepted Buyer's

calculation of Nine-Month Working Capital and the Nine-Month Working Capital

Statement shall be final, conclusive and binding. If Sellers’ Representative

delivers the Notice of Objection to Buyer within the Second Review Period,

Buyer

and Sellers’ Representative shall, during the 30 days following such delivery or

any mutually agreed extension thereof, use their commercially reasonable efforts

to reach agreement on the disputed items and amounts in order to determine

the

amount of Nine-Month Working Capital. If, at the end of such period or any

mutually agreed extension thereof, Buyer and Sellers’ Representative are unable

to resolve their disagreements, they shall jointly retain and refer their

disagreements to an Independent Expert mutually acceptable to Buyer and Sellers’

Representative, or in the absence of agreement, within seven days of the first

disagreement being expressed, such firm as the President of the Institute of

Chartered Accountants in England and Wales (or in his absence the next most

senior officer) shall determine to act as the Independent Expert on the

application of either Buyer or the Sellers’ Representative. The parties shall

instruct the Independent Expert promptly to review this Section 2.8 and to

determine solely with respect to the disputed items and amounts so submitted

whether and to what extent, if any, the Nine-Month Working Capital set forth

in

the Nine-Month Working Capital Statement requires adjustment. The Independent

Expert shall base its determination solely on written submissions by Buyer

and

Sellers’ Representative and not on an independent review. Buyer and Sellers’

Representative shall make available to the Independent Expert all relevant

books

and records and other items reasonably requested by the Independent Expert.

As

promptly as practicable but in no event later than 45 days after its retention,

the Independent Expert shall deliver to Buyer and Sellers’ Representative a

report which sets forth its resolution of the disputed items and amounts and

its

calculation of Nine-Month Working Capital; provided that

in no

event shall Nine-Month Working Capital as determined by the Independent Expert

be less than Buyer's calculation of Nine-Month Working Capital set forth in

the

Nine-Month Working Capital Statement nor more than Sellers’ Representative’s

calculation of Closing Working Capital set forth in the Second Notice of

Objection. The decision of the Independent Expert shall be final, conclusive

and

binding on the parties. The costs and expenses of the Independent Expert shall

be borne one-half by Buyer and one-half by Sellers.

2.9 Working