Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 1 End to End Mobile Content Solution for Carriers and OEMs Investor Presentation NASDAQ: MNDL www.mandalaydigital.com

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 2 Safe Harbor Statement. Statements in this presentation concerning future results from operations, financial position, economic conditions, product r ele ases and any other statement that may be construed as a prediction of future performance or events are forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) . These statements involve known and unknown risks, uncertainties and other factors which may cause actual results to differ materially from those expressed o r i mplied by such statements. We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. Forward - looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “future,” “plan,” or “project” or the negat ive of these words or other variations on these words or comparable terminology. Forward - looking statements are based on assumptions that may be incorrect, and there can be no assurance that any projections or other expectations included in any forward - looking statements will come to pass. Our actual results could differ materially from those expressed or implied by the forward - looking statements as a result of various factors, including, but not limited to, a continued decline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; the ability to protec t o ur intellectual property rights; impact of any litigation or infringement actions brought against us; competition from other providers and products; risks in pro duct development; changes in government regulation; the ability to complete customer transactions and other factors. This presentation utilizes Pro forma Financial Results to provide a depiction of the revenues generated from the business acquired during April 2013 for the fiscal year ended March 31, 2013 combined with the Company’s revenues for such period and should not be utilized to make an investme nt decision. There are many uncertainties, including the ability to raise new capital on acceptable terms or at all, ability to manage international oper ati ons, ability to identify and consummate roll - up acquisitions targets, levels of orders, ability to record revenues, release schedules, finalization and market acceptanc e of new products, changes in economic conditions and market demand, pricing and other activities by competitors, and other risks including those described fr om time to time in Mandalay Digital Group's filings on Forms 10 - K and 10 - Q with the Securities and Exchange Commission (SEC), press releases and other commu nications. Except as required by applicable laws, we undertake no obligation to update publicly any forward - looking statements for any reas on, even if new information becomes available or other events occur in the future .

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 3 NASDAQ MNDL Share Price (6/26/13) $4.50 Fully Diluted Market Cap (6/26/13) $122 MM Fully Diluted Shares Outstanding* 27 MM Insider Ownership ~ 46% Avg. Volume (3 month) 27.5 K FYE 3/31/13 Pro Forma Revenue ~$20 MM California Headquarters plus domestic and international employees 120 Corporate Profile. *Fully Diluted Shares Per Treasury Method; Company completed 1 for 5 split on April 12th , 2013

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 4 The Company.

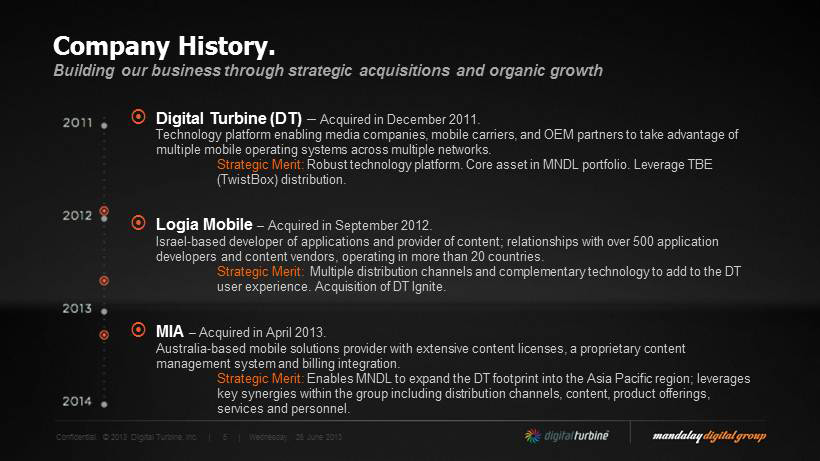

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 5 ; Digital Turbine ( DT ) – Acquired in December 2011. Technology platform enabling media companies, mobile carriers, and OEM partners to take advantage of multiple mobile operating systems across multiple networks . Strategic Merit: Robust technology platform. Core asset in MNDL portfolio. Leverage TBE ( TwistBox ) distribution. ; Logia Mobile – Acquired in September 2012. Israel - based developer of applications and provider of content; relationships with over 500 application developers and content vendors , operating in more than 20 countries . Strategic Merit: Multiple distribution channels and complementary technology to add to the DT user experience. Acquisition of DT Ignite. ; MIA – Acquired in April 2013. Australia - based mobile solutions provider with extensive content licenses , a proprietary content management system and billing integration. Strategic Merit: Enables MNDL to expand the DT footprint into the Asia Paci;c region; leverages key synergies within the group including distribution channels, content , product offerings, services and personnel. Company History. Building our business through strategic acquisitions and organic growth

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 6 Seasoned Management and World Class Board of Directors. Peter Adderton , CEO and Director - Peter Adderton founded Boost Mobile in Australia in 2000. Under his leadership, Boost expanded to New Zealand, Canada and the United States. Peter remains Director and the largest shareholder of Boost Mobile Australia. Boost Mo bil e USA is one of the fastest growing mobile brands in its category with annual revenues over $1 billion and over five million subscribers. Bo ost Mobile USA was purchased by Nextel in 2004, and remains a wholly - owned subsidiary of Sprint Nextel. Peter also founded Amp'd Mobile in 2004, creating the first integrated mobile entertainment company targeted for youth, young professionals and early adopters. Amp'd Mobile offered voice and 3G data services including wireless broadband, over 25 streaming linear TV channels and over 50 Video - on - Demand brand channels . Bill Stone, Chief Executive Officer, Digital Turbine - Bill Stone became CEO of Digital Turbine Group, Inc , a wholly - owned subsidiary of Mandalay Digital in September 2012. Stone was previously Senior Vice President of Qualcomm Inc. and President of its subsidiary FLO TV Inc. from 2009 to 2011. Prior to Qualcomm, Bill was the CEO and President of the smartphone application storefront provider, Handango , (acquired by Appia Inc.) from 2007 to 2009. Bill has also held a variety of global executive positions with operators including Vice President a t Verizon responsible for Mobile Content, Marketing, and Strategy, the Chief Marketing Officer for Vodafone in Australia, and Board Mem ber and Chief Marketing Officer for J – Phone Japan (now Softbank Mobile). Doron Cohen Head of EMEA. Former CEO of Volas &Head of Business Development at Emblaze Ralf Niebacker Technology EMEA. Former Vodafone Germany Jon Mooney Technology & Ops Asia/Pac. Former Telstra & T - Mobile, Co - Founder of MIA Kirstie Brown Finance & Content Asia/Pac . Former mBlox . Nick Montes Business Development & Content Americas. Former Verizon Vincent Vu Technology Americas. Former Clearwire & Amp'd Mobile Board of Directors Peter Guber Chairman Rob Ellin Director Paul Schaeffer Director Chris Rogers Director Jeff Karish Director Rob Deutschman Director

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 7 The Opportunity.

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 8 THE MARKET IMPLICATION Subscribers: • Over 6 Billion Global Subscribers / 4.5B in emerging markets. • ~300M in USA. Enormous Market Opportunity: • While optics do matter, US is only ~5% of market. Devices/Operating Systems: • Google ’ s Android operating system approaching 1B devices. • 1.2B devices to be sold in 2013; Apple is on only ~195M. • More than 3B to be sold in next 24 months. • Android ~75% of new Smartphone market share. • Crowded space of operating systems trying to compete with Apple and Google (e.g. Mozilla, Tizen , Microsoft, etc ). Android is where device OS growth is happening. While capturing attention and hype, Apple is a relatively small % of global devices. Common standards such as HTML5 best path to work ‘ horizontally ’ across all platforms vs. ‘ betting ’ on winners and losers. Mobile Content and Billing: • Mobile Content spending ~$60B in 2013 with YoY growth of 30%. • Average mobile customers spending $10/year on content. • Operator Billing to grow 500% from 2012 - 2017 ($2.3B to $13B). Mobile growing and mainstream way to buy content. Global Revenues: • Operators >$2T. • Samsung ~$250B ($70B mobile). • Apple ~$160B. • Google ~$50B. • Facebook ~$5B. Operators have the most to gain and lose. Mobile Market Opportunity. Sources: IDC, Strategy Analytics, Jupiter, Ovum

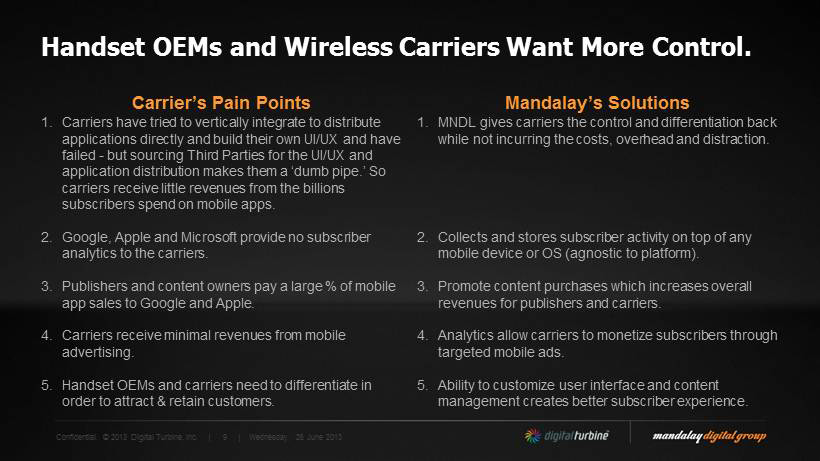

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 9 Handset OEMs and Wireless Carriers Want More Control. Carrier’s Pain Points 1. Carriers have tried to vertically integrate to distribute applications directly and build their own UI/UX and have failed - but sourcing Third Parties for the UI/UX and application distribution makes them a ‘ dumb pipe.’ So carriers receive little revenues from the billions subscribers spend on mobile apps. 2. Google, Apple and Microsoft provide no subscriber analytics to the carriers. 3. Publishers and content owners pay a large % of mobile app sales to Google and Apple. 4. Carriers receive minimal revenues from mobile advertising. 5. Handset OEMs and carriers need to differentiate in order to attract & retain customers. Mandalay’s Solutions 1. MNDL gives carriers the control and differentiation back while not incurring the costs, overhead and distraction. 2. Collects and stores subscriber activity on top of any mobile device or OS (agnostic to platform). 3. Promote content purchases which increases overall revenues for publishers and carriers. 4. Analytics allow carriers to monetize subscribers through targeted mobile ads. 5. Ability to customize user interface and content management creates better subscriber experience.

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 10 The Products.

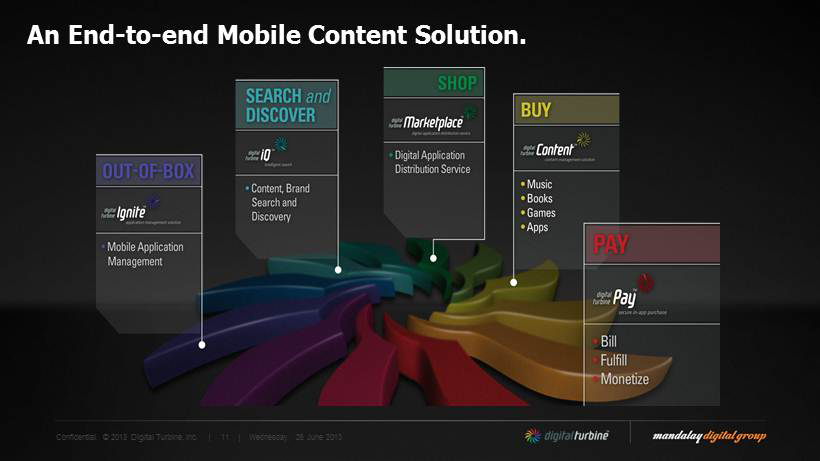

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 11 An End - to - end Mobile Content Solution.

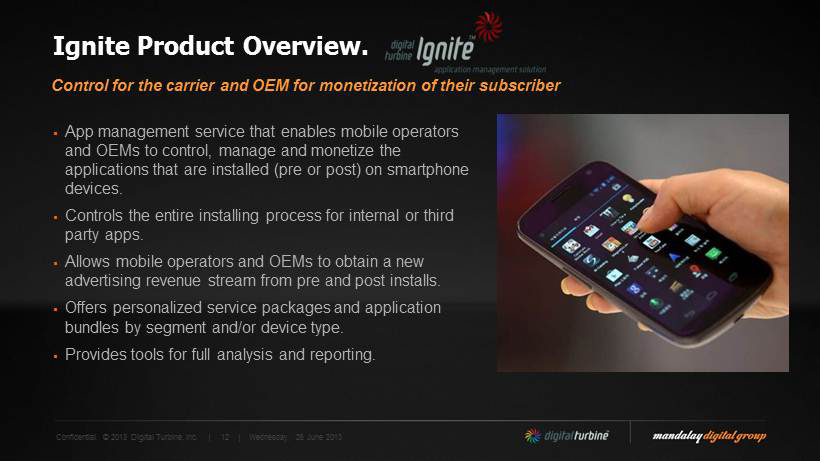

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 12 Ignite Product Overview. ▪ App management service that enables mobile operators and OEMs to control, manage and monetize the applications that are installed (pre or post) on smartphone devices. ▪ Controls the entire installing process for internal or third party apps. ▪ Allows mobile operators and OEMs to obtain a new advertising revenue stream from pre and post installs. ▪ Offers personalized service packages and application bundles by segment and/or device type. ▪ Provides tools for full analysis and reporting. Control for the carrier and OEM for monetization of their subscriber

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 13 Digital IQ Product Overview. ▪ Intelligently unscrambles the myriad of available content to deliver a redefined and personalized user experience (“ UX ”). ▪ Innovative cross - platform user experience and Content Management System (CMS) delivers the app to the user. ▪ Sits atop each of the various operating systems. ▪ Seamlessly integrated across complete mobile experience (web, device, carrier deck, apps, contacts). ▪ Intelligent recommendation engine featuring a global marketplace with carrier - branded capability. ▪ Brand pages that support merchandise and ticket purchases. ▪ Single sign - in, one - click purchasing that delivers more on - deck content purchases. Organizing apps through user - specific marketing and search

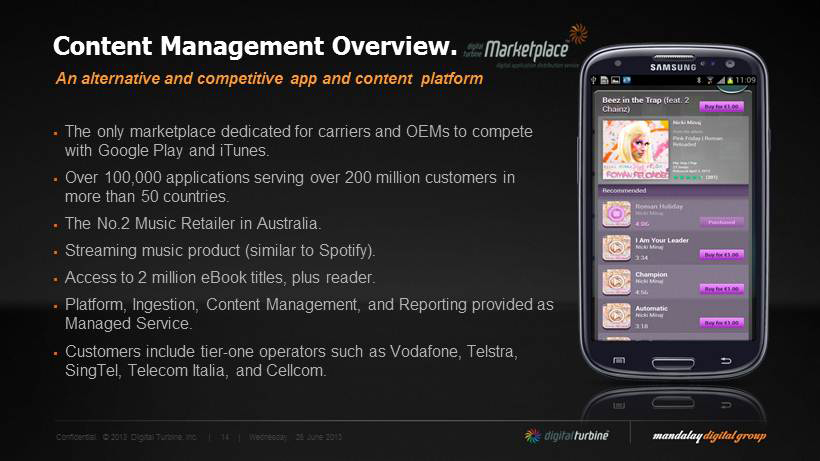

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 14 Content Management Overview. ▪ The only marketplace dedicated for carriers and OEMs to compete with Google Play and iTunes. ▪ Over 100,000 applications serving over 200 million customers in more than 50 countries. ▪ The No.2 Music Retailer in Australia. ▪ Streaming music product (similar to Spotify ). ▪ Access to 2 million eBook titles, plus reader. ▪ Platform, Ingestion, Content Management, and Reporting provided as Managed Service. ▪ Customers include tier - one operators such as Vodafone, Telstra, SingTel, Telecom Italia, and Cellcom . An alternative and competitive app and content platform

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 15 DT Pay Product Overview. ▪ Connectivity to Operators as the “Visa” for processing mobile content transactions. ▪ Enable content providers (e.g. Electronic Arts) to bill directly to customer’s mobile bill. Pre - paid service coming. ▪ Launched in Australia: » From zero revenue in October to a multi - million dollar run - rate. » Now launching product in new markets, including Italy (across 4 carriers). Closes the loop on content to billing

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 16 The Customers.

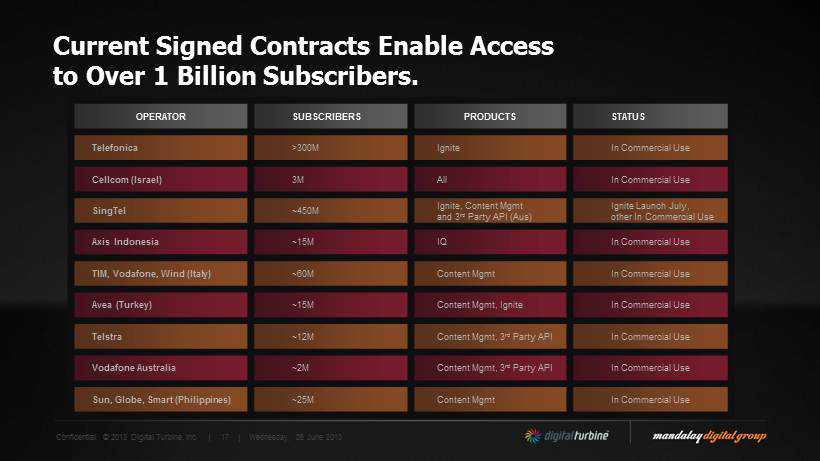

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 17 OPERATOR SUBSCRIBERS PRODUCTS STATUS Telefonica >300M Ignite In Commercial Use Cellcom (Israel) 3M All In Commercial Use SingTel ~450M Ignite, Content Mgmt and 3 rd Party API (Aus) Ignite Launch July, other In Commercial Use Axis Indonesia ~15M IQ In Commercial Use TIM , Vodafone, Wind (Italy) ~60M Content Mgmt In Commercial Use Avea (Turkey) ~15M Content Mgmt , Ignite In Commercial Use Telstra ~12M Content Mgmt , 3 rd Party API In Commercial Use Vodafone Australia ~2M Content Mgmt , 3 rd Party API In Commercial Use Sun, Globe, Smart (Philippines) ~ 25M Content Mgmt In Commercial Use Current Signed Contracts Enable Access to Over 1 Billion Subscribers.

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 18 The Models and Numbers.

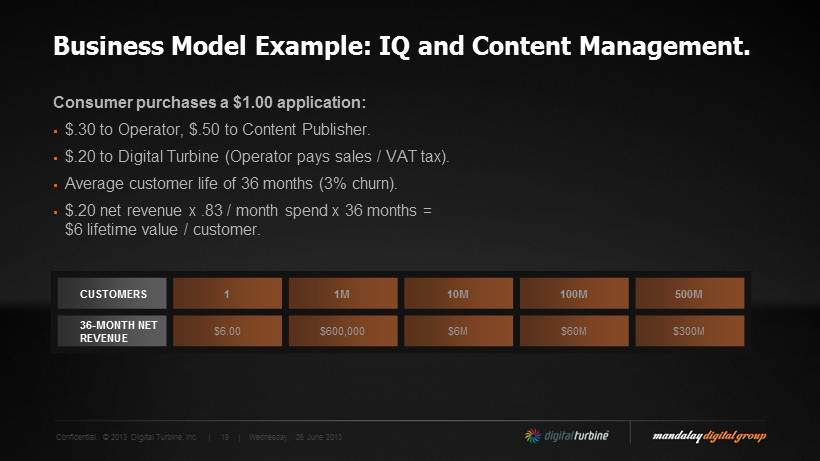

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 19 Business Model Example: IQ and Content Management. Consumer purchases a $1.00 application: ▪ $.30 to Operator, $.50 to Content Publisher. ▪ $.20 to Digital Turbine (Operator pays sales / VAT tax). ▪ Average customer life of 36 months (3% churn). ▪ $.20 net revenue x .83 / month spend x 36 months = $6 lifetime value / customer. CUSTOMERS 1 1M 10M 100M 500M 36 - MONTH NET REVENUE $ 6.00 $600,000 $6M $60M $300M

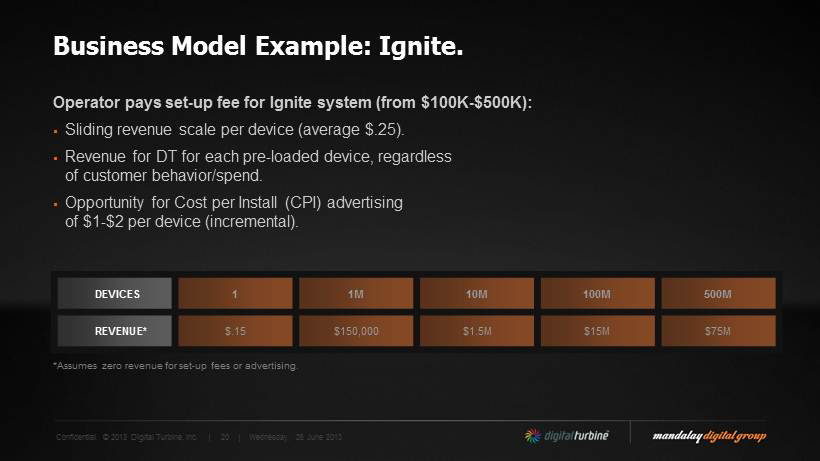

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 20 Business Model Example: Ignite. Operator pays set - up fee for Ignite system (from $ 100K - $ 500K ): ▪ Sliding revenue scale per device (average $.25). ▪ Revenue for DT for each pre - loaded device, regardless of customer behavior/spend. ▪ Opportunity for Cost per Install (CPI) advertising of $1 - $2 per device (incremental). *Assumes zero revenue for set - up fees or advertising. DEVICES 1 1M 10M 100M 500M REVENUE* $. 15 $150,000 $1.5M $15M $75M

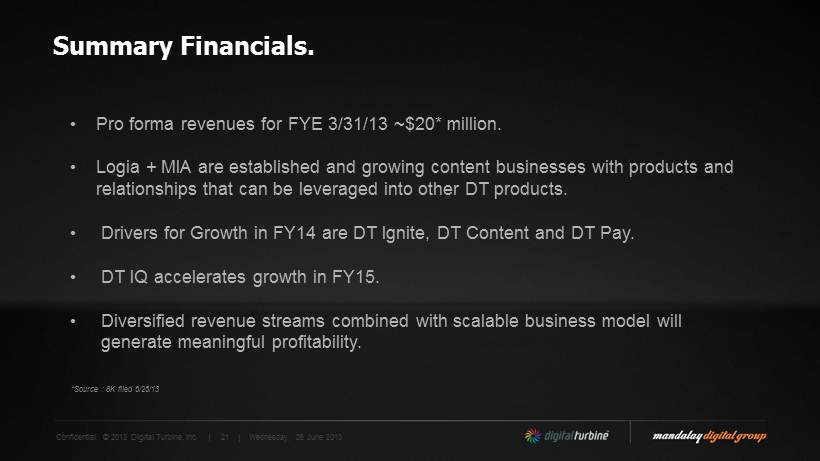

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 21 Summary Financials. *Source : 8K filed 6/26/13 • Pro forma revenues for FYE 3/31/13 ~$ 20* million. • Logia + MIA are established and growing content businesses with products and relationships that can be leveraged into other DT products. • Drivers for Growth in FY14 are DT Ignite, DT Content and DT Pay. • DT IQ accelerates growth in FY15. • Diversified revenue streams combined with scalable business model will generate meaningful profitability.

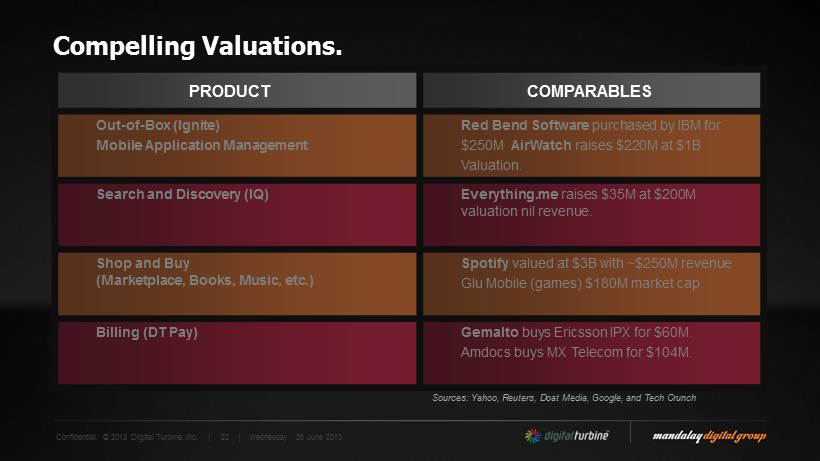

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 22 PRODUCT COMPARABLES Out - of - Box (Ignite) Mobile Application Management Red Bend Software purchased by IBM for $250M AirWatch raises $220M at $1B Valuation. Search and Discovery (IQ) Everything.me raises $35M at $200M valuation nil revenue. Shop and Buy (Marketplace, Books, Music, etc.) Spotify valued at $3B with ~$250M revenue Glu Mobile (games) $180M market cap. Billing (DT Pay) Gemalto buys Ericsson IPX for $60M. Amdocs buys MX Telecom for $104M. Compelling Valuations. Sources: Yahoo, Reuters, Doat Media, Google, and Tech Crunch

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 23 Key Opportunities. Strategic Opportunities: ▪ Continue acquisitions to accelerate distribution, technology, and revenue growth. ▪ Accelerate investment against strategic opportunities (e.g., IQ, books, music, video, etc.) Operational Opportunities: ▪ Cost - per - Install (CPI) deals for Ignite. ▪ Scale music streaming as entry point for other services. ▪ Emerging Markets (Africa, Latin America, Southeast Asia).

Confidential. © 2013 Digital Turbine, Inc. | | Wednesday, 26 June 2013 24 Contacts. Investor Relations John Mattio MZ Group Senior Vice President – MZ North America Main: 212 - 301 - 7130 Direct: 212 - 301 - 7131 Mobile: 203 - 297 - 3911 john.mattio@mzgroup.us www.mzgroup.us