Confidential. © 2014 Mandalay Digital Group, Inc. Page 1 End to End Mobile Content Solution for Carriers and OEMs Investor Presentation February 2014 NASDAQ: MNDL www.mandalaydigital.com

Confidential. © 2014 Mandalay Digital Group, Inc. Page 2 Safe Harbor Statements. Statements in this presentation concerning future results from operations, financial position, economic conditions, product r ele ases and any other statement that may be construed as a prediction of future performance or events, including without limitation state men ts regarding future profitability and expected fiscal 2014 reven

ues, carrier (including Tier 1 carrier) relationships and produc t r amp up are “forward - looking statements” (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of th e Securities Exchange Act of 1934, as amended), which involve known and unknown risks, uncertainties and other factors which ma y cause actual results to differ materially from those expressed or implied by such statements. We claim the protection of the saf e harbor contained in the Private Securities Litigation Reform Act of 1995 related to these forward looking statements. These factors in clude the inherent and deal specific challenges in converting discussions with carriers into actual contractual relationships, product acc eptance of new products in a competitive marketplace, the potential for unforeseen or underestimated cash requirements or liabilities, r isk s intrinsic to dispositions (like the Twistbox disposition) such as successor liability claims, the impact of currency exchange rate fluc tua tions on our reported GAAP financial statements, the Company’s ability as a smaller company to manage international operations, its abilit y g iven the Company’s limited resources to identify and consummate acquisitions, varying and often unpredictable levels of orders, th e challenges inherent in technology development necessary to maintain the Company’s competitive advantage such as adherence to release schedules and the costs and time required for finalization and gaining market acceptance of new products, changes in economic conditions and market demand, rapid and complex changes occurring in the mobile marketplace, pricing and other activ iti es by competitors, and other risks including those described from time to time in Mandalay Digital Group's filings on Forms 10 - K an d 10 - Q with the Securities and Exchange Commission (SEC), press releases and other communications.

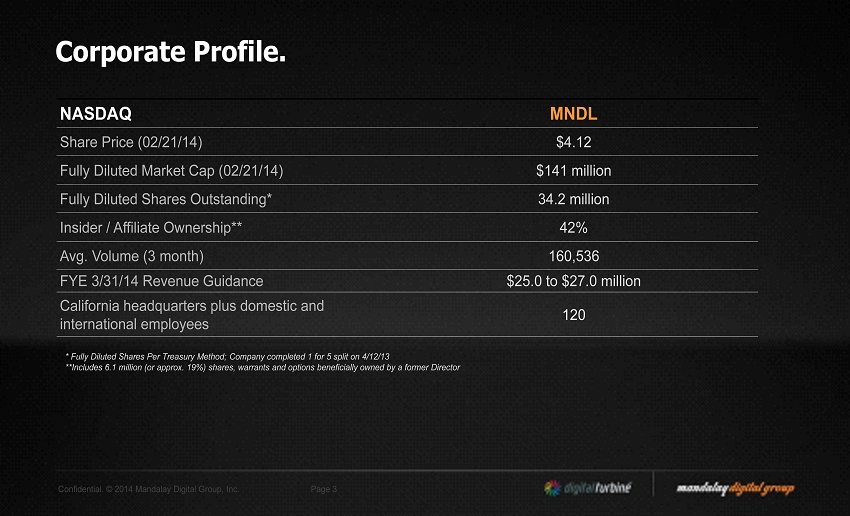

Confidential. © 2014 Mandalay Digital Group, Inc. Page 3 NASDAQ MNDL Share Price (02/21/14) $4.12 Fully Diluted Market Cap (02/21/14) $ 141 million Fully Diluted Shares Outstanding* 34.2 million Insider / Affiliate Ownership** 42 % Avg. Volume (3 month) 160,536 FYE 3/31/14 Revenue Guidance $25.0 to $27.0 million California h eadquarters plus domestic and international employees 120 Corporate Profile. * Fully D

iluted Shares Per Treasury Method; Company completed 1 for 5 split on 4/12/13 **Includes 6.1 million (or approx. 19%) shares, warrants and options beneficially owned by a former Director

Confidential. © 2014 Mandalay Digital Group, Inc. Page 4 The Company.

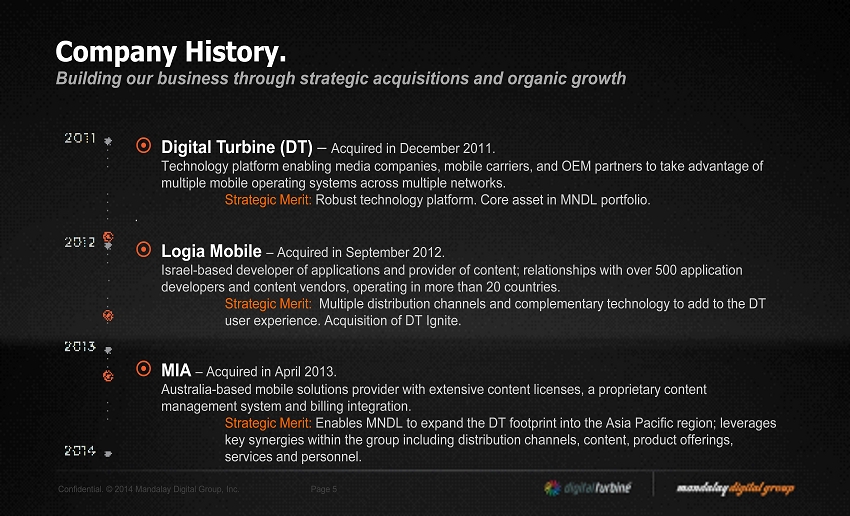

Confidential. © 2014 Mandalay Digital Group, Inc. Page 5 Digital Turbine ( DT ) – Acquired in December 2011. Technology platform enabling media companies, mobile carriers, and OEM partners to take advantage of multiple mobile operating systems across multiple networks . Strategic Merit: Robust technology platform. Core asset in MNDL portfolio . . Logia Mobile – Acquired in September 2012. Israel - b

ased developer of applications and provider of content; relationships with over 500 application developers and content vendors , operating in more than 20 countries . Strategic Merit: Multiple distribution channels and complementary technology to add to the DT user experience. Acquisition of DT Ignite. MIA – Acquired in April 2013. Australia - based mobile solutions provider with extensive content licenses , a proprietary content management system and billing integration. Strategic Merit: Enables MNDL to expand the DT footprint into the Asia Pacific region; leverages key synergies within the group including distribution channels, content , product offerings, services and personnel. Company History. Building our business through strategic acquisitions and organic growth

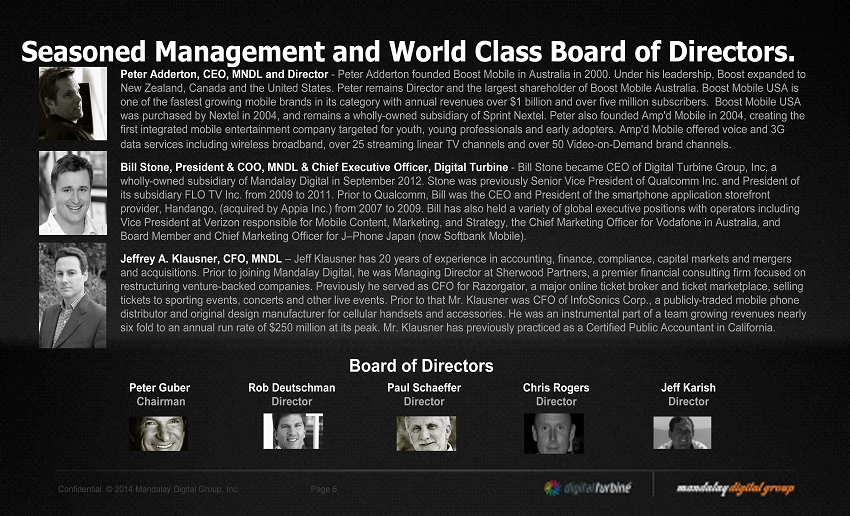

Confidential. © 2014 Mandalay Digital Group, Inc. Page 6 Seasoned Management and World Class Board of Directors. Peter Adderton , CEO, MNDL and Director - Peter Adderton founded Boost Mobile in Australia in 2000. Under his leadership, Boost expanded to New Zealand, Canada and the United States. Peter remains Director and the largest shareholder of Boost Mobile Australia. Boos t M obile USA is one of the fastest

growing mobile brands in its category with annual revenues over $1 billion and over five million subscribe rs. Boost Mobile USA was purchased by Nextel in 2004, and remains a wholly - owned subsidiary of Sprint Nextel. Peter also founded Amp'd Mobile in 2004, creating the first integrated mobile entertainment company targeted for youth, young professionals and early adopters. Amp'd Mobile offered voice and 3G data services including wireless broadband, over 25 streaming linear TV channels and over 50 Video - on - Demand brand channels . Bill Stone, President & COO, MNDL & Chief Executive Officer, Digital Turbine - Bill Stone became CEO of Digital Turbine Group, Inc , a wholly - owned subsidiary of Mandalay Digital in September 2012. Stone was previously Senior Vice President of Qualcomm Inc. and P resident of its subsidiary FLO TV Inc. from 2009 to 2011. Prior to Qualcomm, Bill was the CEO and President of the smartphone application st orefront provider, Handango , (acquired by Appia Inc.) from 2007 to 2009. Bill has also held a variety of global executive positions with operators including Vice President at Verizon responsible for Mobile Content, Marketing, and Strategy, the Chief Marketing Officer for Vodafone i n A ustralia, and Board Member and Chief Marketing Officer for J – Phone Japan (now Softbank Mobile). Jeffrey A. Klausner , CFO, MNDL – Jeff Klausner has 20 years of experience in accounting, finance, compliance, capital markets and mergers and acquisitions. Prior to joining Mandalay Digital, he was Managing Director at Sherwood Partners, a premier financial consu lti ng firm focused on restructuring venture - backed companies. Previously he served as CFO for Razorgator , a major online ticket broker and ticket marketplace, selling tickets to sporting events, concerts and other live events. Prior to that Mr. Klausner was CFO of InfoSonics Corp., a publicly - traded mobile phone distributor and original design manufacturer for cellular handsets and accessories. He was an instrumental part of a team gro win g revenues nearly six fold to an annual run rate of $250 million at its peak. Mr. Klausner has previously practiced as a Certified Public Accountant in California. Board of Directors Peter Guber Chairman Rob Deutschman Director Paul Schaeffer Director Chris Rogers Director Jeff Karish Director

Confidential. © 2014 Mandalay Digital Group, Inc. Page 7 The Opportunity.

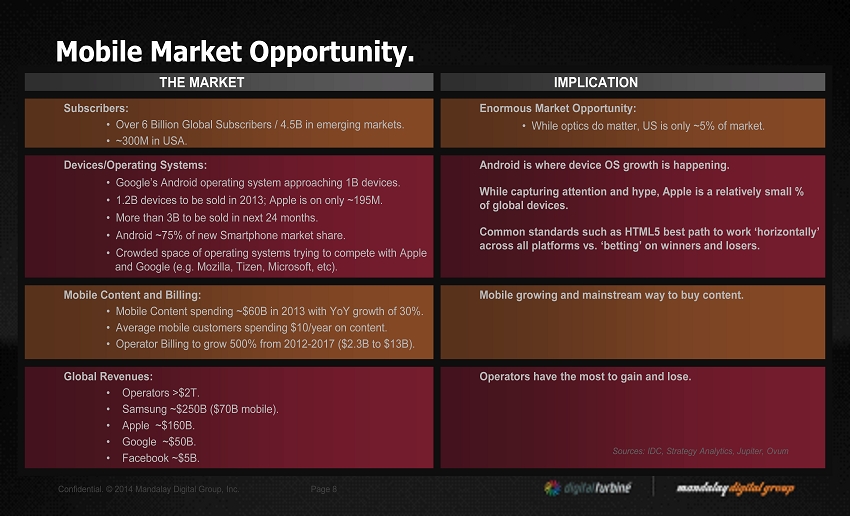

Confidential. © 2014 Mandalay Digital Group, Inc. Page 8 THE MARKET IMPLICATION Subscribers: • Over 6 Billion Global Subscribers / 4.5B in emerging markets. • ~300M in USA. Enormous Market Opportunity: • While optics do matter, US is only ~5% of market. Devices/Operating Systems: • Google ’ s Android operating system approaching 1B devices. • 1.2B devices to be sold in 2013; Apple is on only ~195M. • More

than 3B to be sold in next 24 months. • Android ~75% of new Smartphone market share. • Crowded space of operating systems trying to compete with Apple and Google (e.g. Mozilla, Tizen , Microsoft, etc ). Android is where device OS growth is happening. While capturing attention and hype, Apple is a relatively small % of global devices. Common standards such as HTML5 best path to work ‘ horizontally ’ across all platforms vs. ‘ betting ’ on winners and losers. Mobile Content and Billing: • Mobile Content spending ~$60B in 2013 with YoY growth of 30%. • Average mobile customers spending $10/year on content. • Operator Billing to grow 500% from 2012 - 2017 ($2.3B to $13B). Mobile growing and mainstream way to buy content. Global Revenues: • Operators >$2T. • Samsung ~$250B ($70B mobile). • Apple ~$160B. • Google ~$50B. • Facebook ~$5B. Operators have the most to gain and lose. Mobile Market Opportunity. Sources: IDC, Strategy Analytics, Jupiter, Ovum

Confidential. © 2014 Mandalay Digital Group, Inc. Page 9 MNDL Ripe to Capitalize From Recent Market Trends. Macro Trend 1. Google launch of KitKat version of Android, Google Play removed from Vodafone 2. 40% of Facebook’s mobile revenues came from CPI relationships in last quarter 3. Considerable M&A activity, including recent acquisition of Whatsapp by Facebook for $19BN 4. Carriers have tried to verticall

y integrate to distribute applications directly and build their own UI/UX and have failed – rendering them a ‘dumb pipe’ with little content monetization opportunity 5. Google, Apple and Microsoft provide no subscriber analytics to the carriers. Mandalay Opportunity 1. Carriers, OEMs and application developers must increase their competitive positioning against Google – exactly what DT’s suite of products enables 2. Operators currently NOT participating in this revenue stream – DT Ignite and Marketplace allow operators to take share in mobile application installs 3. Validation of the DT strategy and focus helping to drive increased customer momentum 4. DT product suite gives carriers the control and differentiation back while not incurring the costs, overhead and distraction 5. DT product suite Collects and stores subscriber activity on top of any mobile device or OS (agnostic to platform).

Confidential. © 2014 Mandalay Digital Group, Inc. Page 10 The Products.

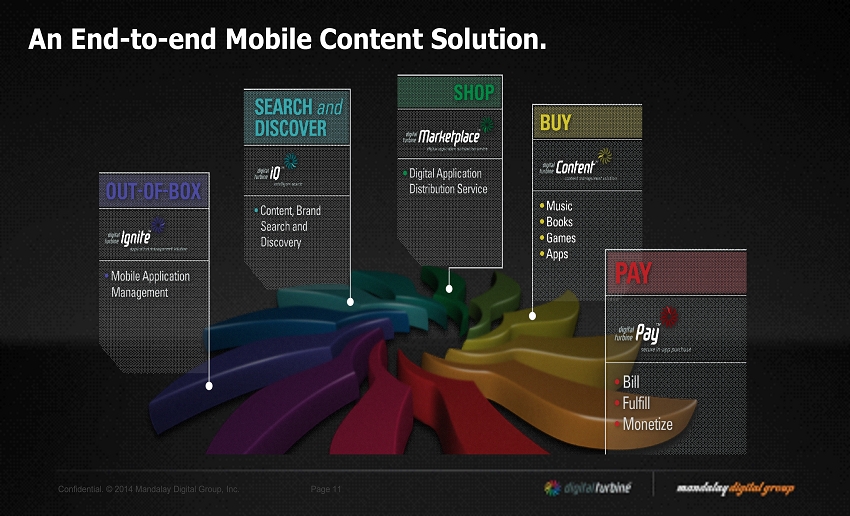

Confidential. © 2014 Mandalay Digital Group, Inc. Page 11 An End - to - end Mobile Content Solution.

Confidential. © 2014 Mandalay Digital Group, Inc. Page 12 Ignite Product Overview. ▪ App management service that enables mobile operators and OEMs to control, manage and monetize the applications that are installed (pre or post) on smartphone devices. ▪ Controls the entire installing process for internal or third party apps. ▪ Allows mobile operators and OEMs to obtain a new advertising revenue stream from pr

e and post installs. ▪ Offers personalized service packages and application bundles by segment and/or device type. ▪ Provides tools for full analysis and reporting. Control for the carrier and OEM for monetization of their subscriber

Confidential. © 2014 Mandalay Digital Group, Inc. Page 13 Digital IQ Product Overview. ▪ Intelligently unscrambles the myriad of available content to deliver a redefined and personalized user experience (“ UX ”). ▪ Innovative cross - platform user experience and Content Management System (CMS) delivers the app to the user. ▪ Sits atop each of the various operating systems. ▪ Seamlessly integrated across comple

te mobile experience (web, device, carrier deck, apps, contacts). ▪ Intelligent recommendation engine featuring a global marketplace with carrier - branded capability. ▪ Brand pages that support merchandise and ticket purchases. ▪ Single sign - in, one - click purchasing that delivers more on - deck content purchases. Organizing apps through user - specific marketing and search

Confidential. © 2014 Mandalay Digital Group, Inc. Page 14 Content Management Overview. ▪ The only marketplace dedicated for carriers and OEMs to compete with Google Play and iTunes. ▪ Over 100,000 applications serving over 200 million customers in more than 50 countries. ▪ The No.2 Music Retailer in Australia. ▪ Streaming music product (similar to Spotify ). ▪ Access to 2 million eBook titles, plus reader.

▪ Platform, Ingestion, Content Management, and Reporting provided as Managed Service. ▪ Customers include tier - one operators such as Vodafone, Telstra, SingTel, Telecom Italia, and Cellcom . An alternative and competitive app and content platform

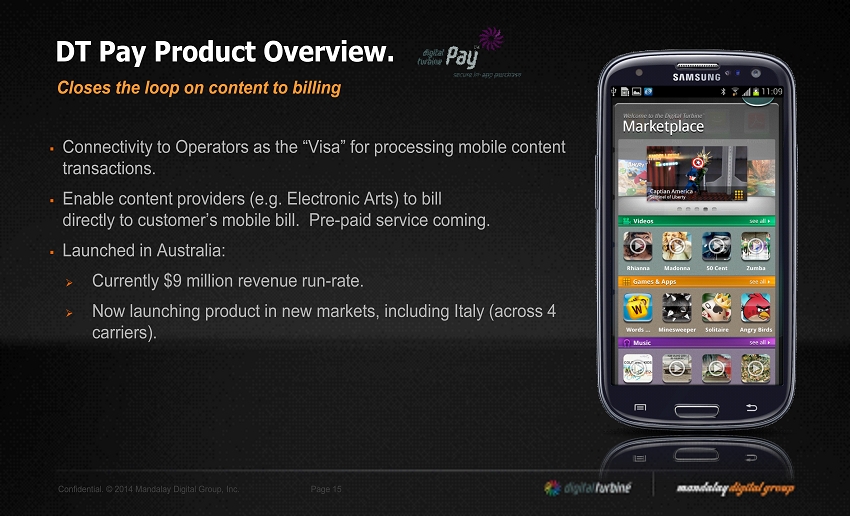

Confidential. © 2014 Mandalay Digital Group, Inc. Page 15 DT Pay Product Overview. ▪ Connectivity to Operators as the “Visa” for processing mobile content transactions. ▪ Enable content providers (e.g. Electronic Arts) to bill directly to customer’s mobile bill. Pre - paid service coming. ▪ Launched in Australia: » Currently $9 million revenue run - rate . » Now launching product in new markets, including Italy (a

cross 4 carriers). Closes the loop on content to billing

Confidential. © 2014 Mandalay Digital Group, Inc. Page 16 The Customers.

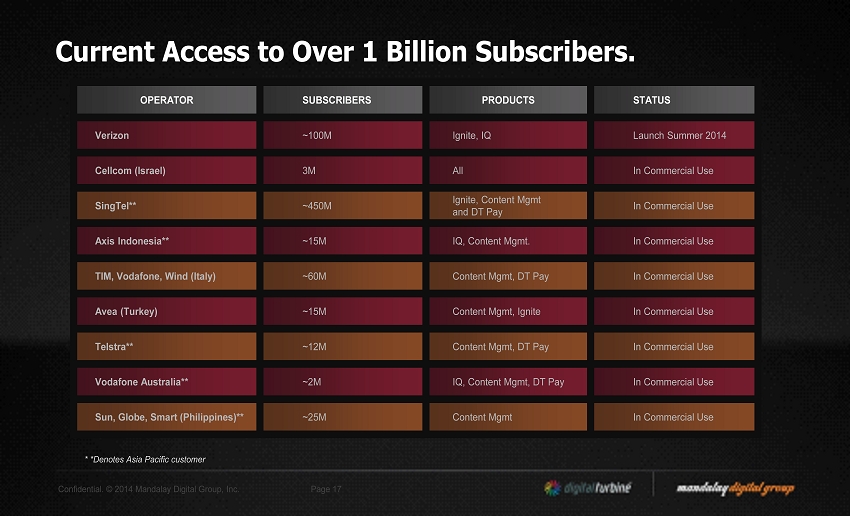

Confidential. © 2014 Mandalay Digital Group, Inc. Page 17 OPERATOR SUBSCRIBERS PRODUCTS STATUS Verizon ~100M Ignite, IQ Launch Summer 2014 Cellcom (Israel) 3M All In Commercial Use SingTel** ~450M Ignite, Content Mgmt and DT Pay In Commercial Use Axis Indonesia** ~15M IQ, Content Mgmt. In Commercial Use TIM , Vodafone, Wind (Italy) ~60M Content Mgmt , DT Pay In Commercial Use Avea (Turkey) ~15M

Content Mgmt , Ignite In Commercial Use Telstra** ~12M Content Mgmt , DT Pay In Commercial Use Vodafone Australia** ~2M IQ, Content Mgmt , DT Pay In Commercial Use Sun, Globe, Smart (Philippines)** ~ 25M Content Mgmt In Commercial Use Current Access to Over 1 Billion Subscribers. * *Denotes Asia Pacific customer

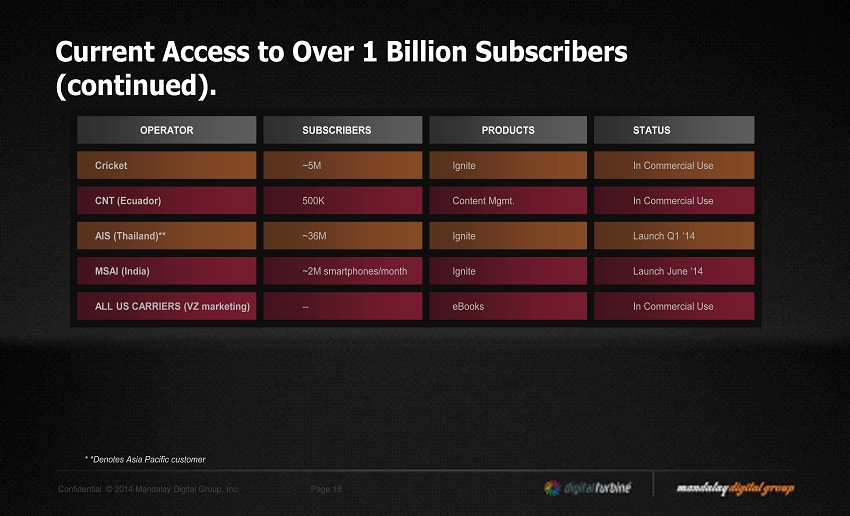

Confidential. © 2014 Mandalay Digital Group, Inc. Page 18 OPERATOR SUBSCRIBERS PRODUCTS STATUS Cricket ~5M Ignite In Commercial Use CNT (Ecuador) 500K Content Mgmt. In Commercial Use AIS (Thailand)** ~36M Ignite Launch Q1 ‘14 MSAI (India) ~2M smartphones/month Ignite Launch June ‘14 ALL US CARRIERS (VZ marketing) -- eBooks In Commercial Use Current Access to Over 1 Billion Subscribers (continued). * *Deno

tes Asia Pacific customer

Confidential. © 2014 Mandalay Digital Group, Inc. Page 19 The Models and Numbers.

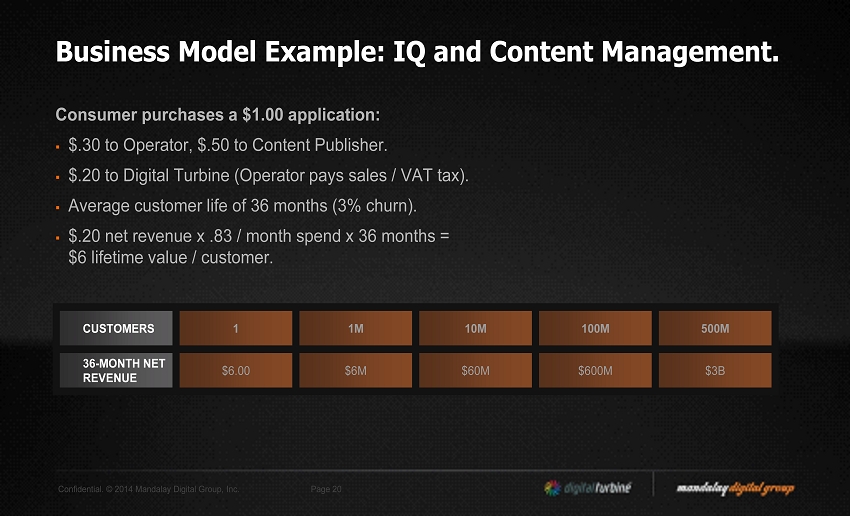

Confidential. © 2014 Mandalay Digital Group, Inc. Page 20 Business Model Example: IQ and Content Management. Consumer purchases a $1.00 application: ▪ $.30 to Operator, $.50 to Content Publisher. ▪ $.20 to Digital Turbine (Operator pays sales / VAT tax). ▪ Average customer life of 36 months (3% churn). ▪ $.20 net revenue x .83 / month spend x 36 months = $6 lifetime value / customer. CUSTOMERS 1 1M 10M 10

0M 500M 36 - MONTH NET REVENUE $ 6.00 $6M $ 60M $ 600M $ 3B

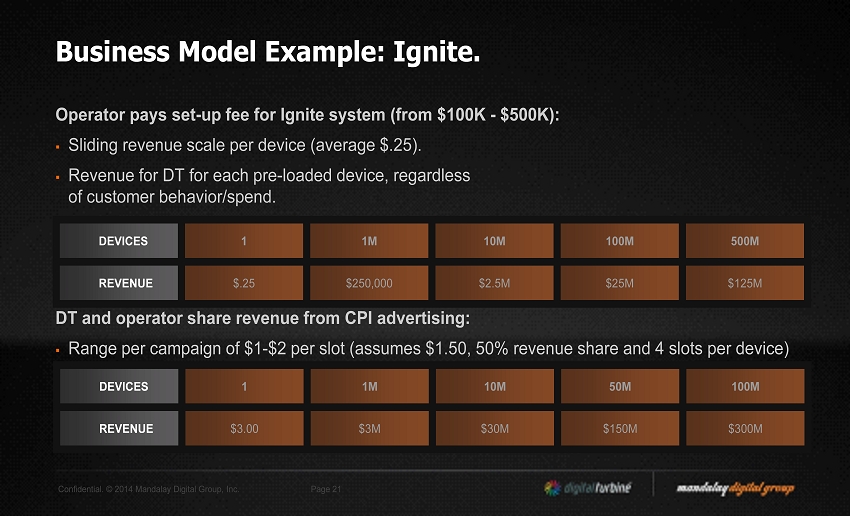

Confidential. © 2014 Mandalay Digital Group, Inc. Page 21 Business Model Example: Ignite. Operator pays set - up fee for Ignite system (from $100K - $500K): ▪ Sliding revenue scale per device (average $.25). ▪ Revenue for DT for each pre - loaded device, regardless of customer behavior/spend. DT and operator share revenue from CPI advertising: ▪ Range per campaign of $1 - $2 per slot (assumes $1.50, 50% revenue

share and 4 slots per device) DEVICES 1 1M 10M 100M 500M REVENUE $.25 $250,000 $2.5M $25M $125M DEVICES 1 1M 10M 50M 100M REVENUE $3.00 $3M $30M $150M $300M

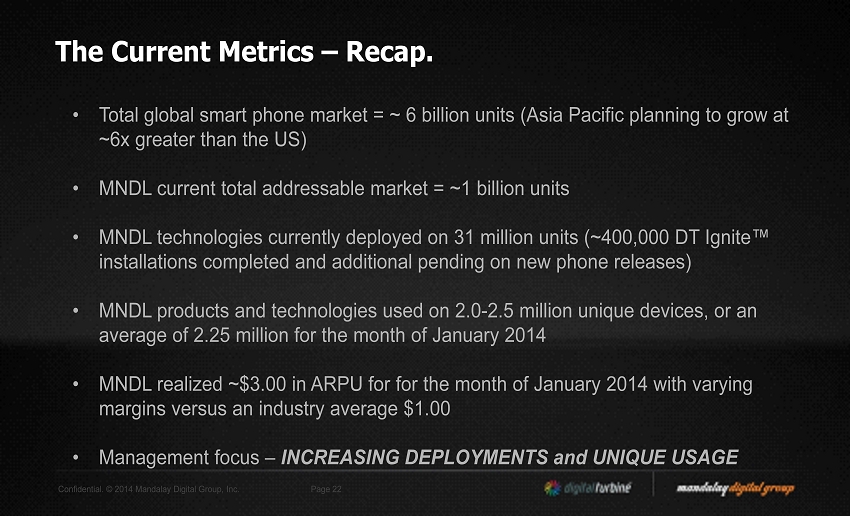

Confidential. © 2014 Mandalay Digital Group, Inc. Page 22 The Current Metrics – Recap. • Total global smart phone market = ~ 6 billion units (Asia Pacific planning to grow at ~6x greater than the US) • MNDL current total addressable market = ~1 billion units • MNDL technologies currently deployed on 31 million units (~400,000 DT Ignite™ installations completed and additional pending on new phone releases) • MN

DL products and technologies used on 2.0 - 2.5 million unique devices, or an average of 2.25 million for the month of January 2014 • MNDL realized ~ $3.00 in ARPU for for the month of January 2014 with varying margins versus an industry average $ 1.00 • Management focus – INCREASING DEPLOYMENTS and UNIQUE USAGE

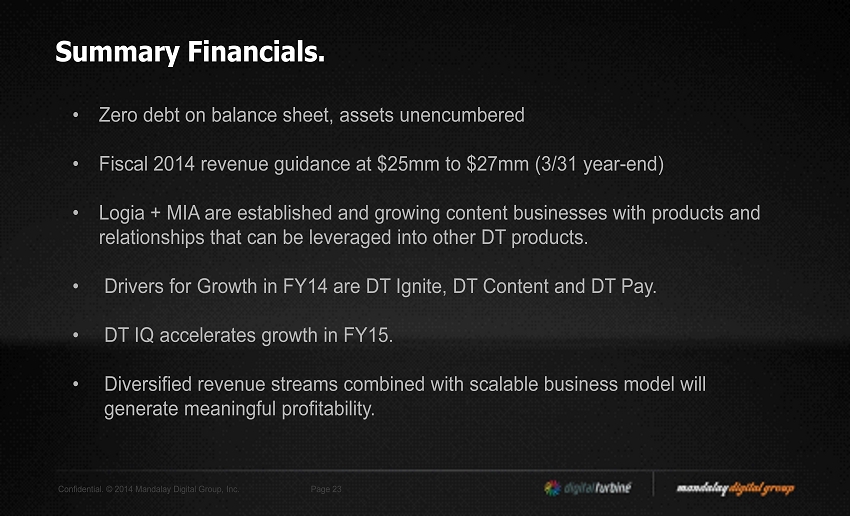

Confidential. © 2014 Mandalay Digital Group, Inc. Page 23 Summary Financials. • Zero debt on balance sheet, assets unencumbered • Fiscal 2014 revenue guidance at $25mm to $27mm (3/31 year - end) • Logia + MIA are established and growing content businesses with products and relationships that can be leveraged into other DT products. • Drivers for Growth in FY14 are DT Ignite, DT Content and DT Pay. • DT IQ accele

rates growth in FY15. • Diversified revenue streams combined with scalable business model will generate meaningful profitability.

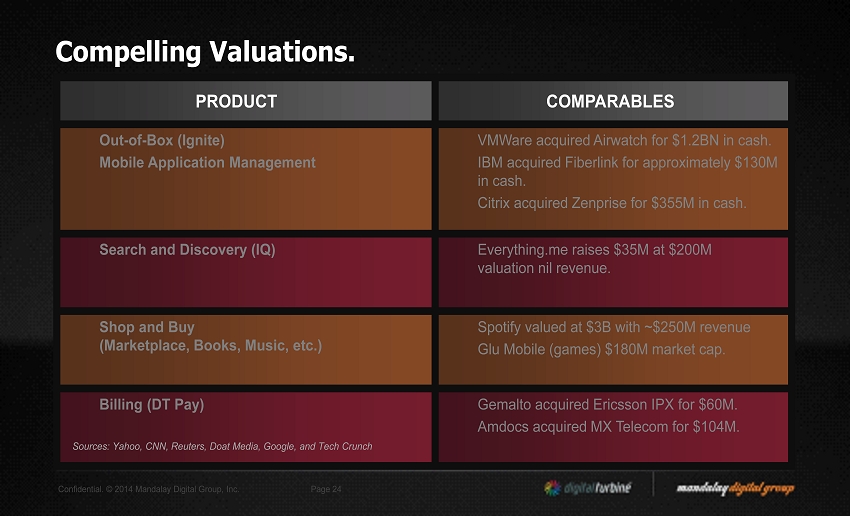

Confidential. © 2014 Mandalay Digital Group, Inc. Page 24 PRODUCT COMPARABLES Out - of - Box (Ignite) Mobile Application Management VMWare acquired Airwatch for $1.2BN in cash. IBM acquired Fiberlink for approximately $130M in cash. Citrix acquired Zenprise for $355M in cash. Search and Discovery (IQ) Everything.me raises $35M at $200M valuation nil revenue. Shop and Buy (Marketplace, Books, Music, etc.)

Spotify valued at $3B with ~$250M revenue Glu Mobile (games) $180M market cap. Billing (DT Pay) Gemalto acquired Ericsson IPX for $60M. Amdocs acquired MX Telecom for $104M. Compelling Valuations. Sources: Yahoo, CNN, Reuters , Doat Media, Google, and Tech Crunch

Confidential. © 2014 Mandalay Digital Group, Inc. Page 25 Other Key Opportunities. Strategic Opportunities: ▪ Continue acquisitions to accelerate distribution, technology, and revenue growth. ▪ Accelerate investment against strategic opportunities (e.g., IQ, books, music, video, etc.) Operational Opportunities: ▪ Cost - per - Install (CPI) deals for Ignite. ▪ Scale music streaming as entry point for other services.

▪ Emerging Markets (Africa, Latin America, Southeast Asia).

Confidential. © 2014 Mandalay Digital Group, Inc. Page 26 Contacts. Investor Relations Andrew Schleimer Mandalay Digital Group Direct: 646 - 845 - 7335 Mobile: 646 - 584 - 4021 a.schleimer@mandalaydigital.com Laurie Berman PondelWilkinson Inc. Direct: 310 - 279 - 5962 Mobile: 310 - 867 - 4365 lberman @pondel.com |