Exhibit 99.1

Digital Turbine, Inc. Investor Presentation

Safe Harbor Statements. Statements in this presentation that are not statements of historical fact and that concern future results from operations, financial position, economic conditions, product releases, revenue and product synergies, cost savings, product or competitive enhancements and any other statement that may be construed as a prediction of future performance or events, including that Appia's technology will enhance Digital Turbine's existing products or foster new technology innovation, perceived benefits from the business combination, that the acquisition will result in increased revenue, cost savings and better competitive position, or that Digital Turbine will successfully integrate Appia’s technology, are forward - looking statements that speak only as of the date made and which involve known and unknown risks, uncertainties and other factors which may, should one or more of these risks uncertainties or other factors materialize, cause actual results to differ materially from those expressed or implied by such statements . These factors include the effect of the Appia acquisition on relationships with customers, operating results and business generally ; the ability to expand the combined company’s global reach, accelerate growth and enhance a scalable, low - capex business model that drives EBITDA ; failure to realize anticipated operational efficiencies, revenue (including projected revenue) and cost synergies and resulting revenue growth, EBITDA and free cash flow conversion ; inability to refinance the assumed debt or to refinance the debt on favorable terms ; unforeseen challenges related to relationships with operators, publishers and advertisers and expanding and maintaining those relationships ; the ability to execute upon, and realize any benefits from, potential value creation opportunities through strategic relationships in the future or at all, including the ability to leverage advertising opportunities effectively and increase revenue streams for carriers ; unforeseen difficulties preventing rapid integration of Appia’s app - install infrastructure into Digital Turbine’s existing platform ; the inherent and deal specific challenges in converting discussions with carriers into actual contractual relationships ; the Company’s ability as a smaller company to manage international, and as a result of the proposed merger, larger operations ; varying and often unpredictable levels of orders ; the challenges inherent in technology development necessary to maintain the Company’s competitive advantage ; the potential for unforeseen or underestimated cash requirements necessary to enable the transaction synergies to be realized, and other risks including those described from time to time in Digital Turbine’s filings on Forms 10 - K and 10 - Q with the SEC, press releases and other communications . You should not place undue reliance on these forward - looking statements . The Company does not undertake to update forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . Use of Non - GAAP Financial Measures . To supplement the Company’s condensed financial statements presented in accordance with U . S . Generally Accepted Accounting Principles (“ GAAP ”), Digital Turbine uses non - GAAP measures of certain components of financial performance, the exact amount of which are not currently determinable . These non - GAAP measures include non - GAAP adjusted gross profit and gross margin and non - GAAP adjusted EBITDA . Furthermore, the expected non - GAAP results are subject to completion of the Company’s year - end accounting processes, which include the finalization of several items that could affect these results . These items include, among others, estimation of certain contingent liabilities and the finalization of the Company’s provision for income taxes . Final results could also be affected by certain subsequent events in accordance with GAAP . Non - GAAP measures are provided to enhance investors’ overall understanding of the Company’s current financial performance, prospects for the future and as a means to evaluate period - to - period comparisons . The Company believes that these non - GAAP measures provide meaningful supplemental information regarding financial performance by excluding certain expenses and benefits that may not be indicative of recurring core business operating results . The Company believes the non - GAAP measures that exclude such items when viewed in conjunction with GAAP results and the accompanying reconciliations enhance the comparability of results against prior periods and allow for greater transparency of financial results . The Company believes non - GAAP measures facilitate management’s internal comparison of its financial performance to that of prior periods as well as trend analysis for budgeting and planning purposes . The presentation of non - GAAP measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP . Non - GAAP Adjusted gross margin is defined as GAAP gross margin adjusted to exclude the effect of intangible amortization expense . Readers are cautioned that non - GAAP Adjusted gross margin should not be construed as an alternative to gross margin determined in accordance with U . S . GAAP as an indicator of profitability or performance, which is the most comparable measure under GAAP . Non - GAAP Adjusted EBITDA is calculated as GAAP net loss excluding the following cash and non - cash expenses : interest expense, foreign transaction gains (losses), debt financing and non - cash related expenses, debt discount and non - cash debt settlement expense, gain or loss on extinguishment of debt, income taxes, asset impairment charges, depreciation and amortization, stock - based compensation expense, change in fair value of derivatives, fees and expenses related to acquisitions and discretionary bonus expenses . Because Adjusted EBITDA is a non - GAAP measure that does not have a standardized meaning, it may not be comparable to similar measures presented by other companies . Readers are cautioned that Non - GAAP Adjusted EBITDA should not be construed as an alternative to net income (loss) determined in accordance with U . S . GAAP as an indicator of performance, which is the most comparable measure under GAAP . Non - GAAP adjusted gross profit and gross margin and adjusted EBITDA are used by management as internal measures of profitability and performance . They have been included because the Company believes that the measures are used by certain investors to assess the Company’s financial performance before non - cash charges and certain costs that the Company does not believe are reflective of its underlying business . © 2015 Digital Turbine, Inc. 2

Agenda Market Opportunity Digital Turbine’s Solution Distribution & Customers Team & Investors Financial Overview © 2015 Digital Turbine, Inc. 3

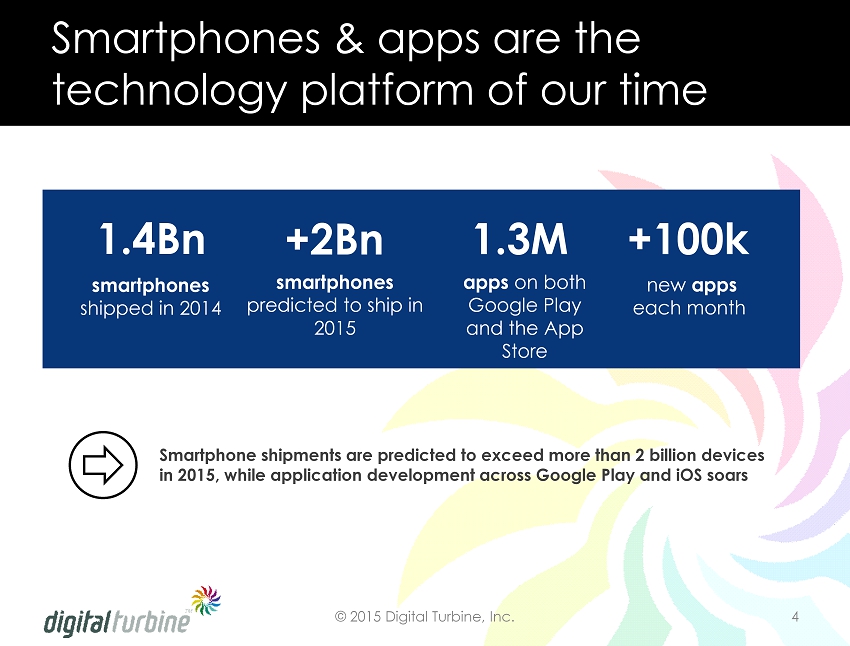

Smartphones & apps are the technology platform of our time 1.4Bn +2Bn 1.3M smartphones shipped in 2014 smartphones predicted to ship in 2015 apps on both Google Play and the App Store +100k new apps each month Smartphone shipments are predicted to exceed more than 2 billion devices in 2015, while application development across Google Play and iOS soars © 2015 Digital Turbine, Inc. 4

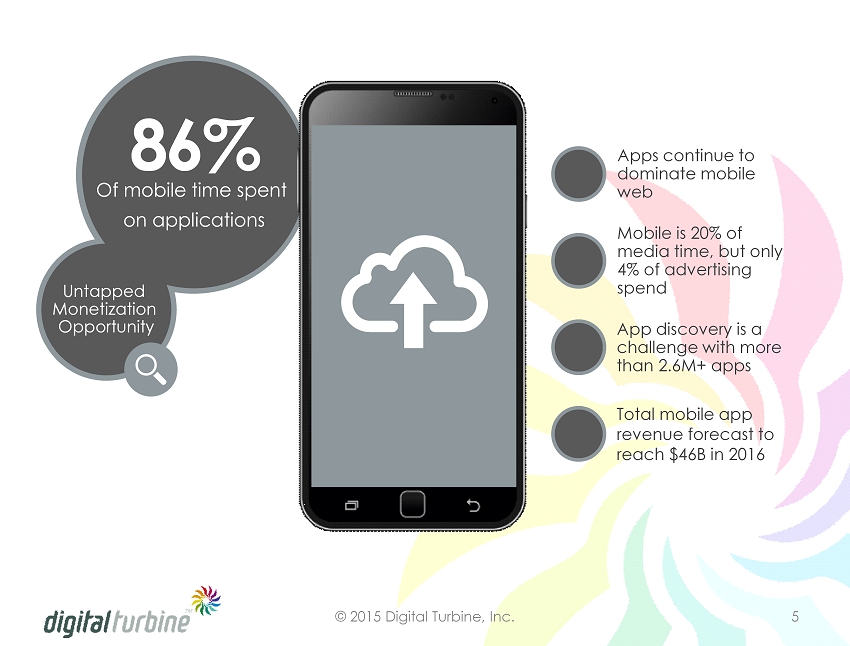

86% Of mobile time spent on applications Untapped Monetization Opportunity Apps continue to dominate mobile web App discovery is a challenge with more than 2.6M+ apps Total mobile app revenue forecast to reach $46B in 2016 Mobile is 20% of media time, but only 4% of advertising spend © 2015 Digital Turbine, Inc. 5

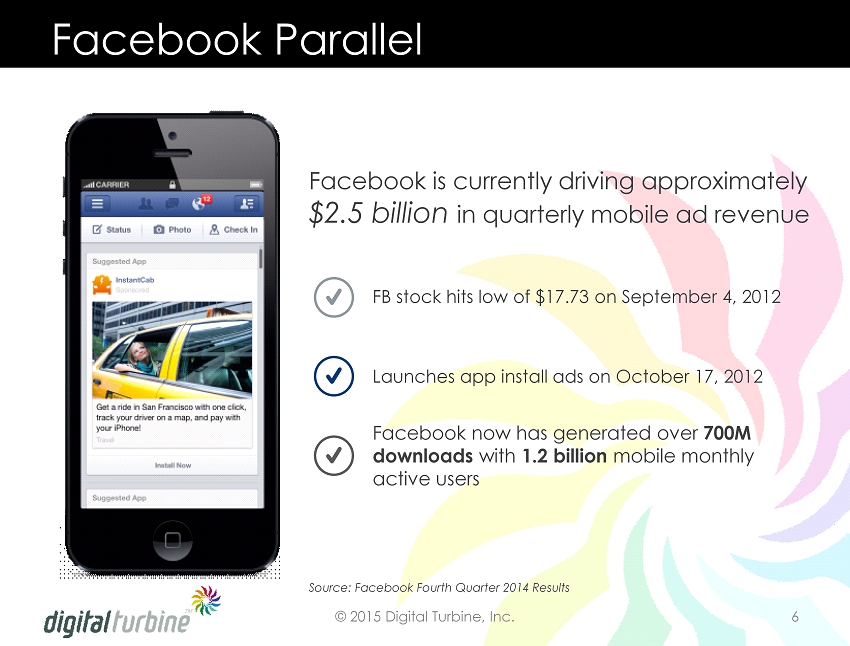

Facebook is currently driving approximately $2.5 billion in quarterly mobile ad revenue FB stock hits low of $17.73 on September 4, 2012 Launches app install ads on October 17, 2012 Facebook now has generated over 700M downloads with 1.2 billion mobile monthly active users Facebook Parallel Source: Facebook Fourth Quarter 2014 Results © 2015 Digital Turbine, Inc. 6

Our Mission The ‘App Economy’ is exploding and redefining both industries and human lives. Our mission is to deliver the right app to the right customer at the right time…anywhere on the planet.

Build the Google AdWords for Apps to allow any Third Party to monetize mobile while developing a cohesive product suite containing Advertising, Content (CMS), and Pay to provide an end - to - end ecosystem for any 3 rd Party to ‘plug - in’ and monetize. The Strategy © 2015 Digital Turbine, Inc. 8

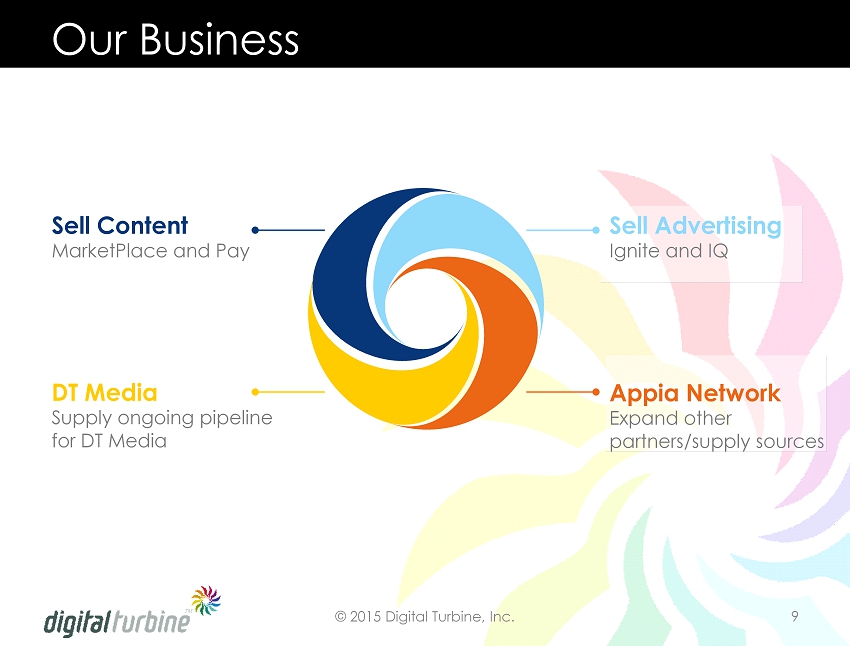

Appia Network Expand other partners/supply sources Sell Advertising Ignite and IQ Sell Content MarketPlace and Pay DT Media Supply ongoing pipeline for DT Media Our Business © 2015 Digital Turbine, Inc. 9

Agenda Market Opportunity Digital Turbine’s Solution Distribution & Customers Team & Investors Financial Overview © 2015 Digital Turbine, Inc. 10

Digital Turbine Media will focus as an advertiser solution for unique and exclusive carrier inventory. The primary products will be DT Ignite & DT IQ. Digital Turbine Media Appia , will continue to scale as a leading worldwide mobile user acquisition network, focused on multiple demand and supply solutions that have sustainability in the market. Appia Core Defining Appia Core vs. DT Media © 2015 Digital Turbine, Inc. 11

What will make our businesses have sustainable differentiation ? 1 2 Appia Core Appia Core – Able to run a profitable performance app - install business while building an APK managed DSP and leveraging DT Ad Units for Publishers Digital Turbine Media Digital Turbine Media – Unique Ad Units as the owner of the homescreen of the device Sustainable Differentiation © 2015 Digital Turbine, Inc. 12

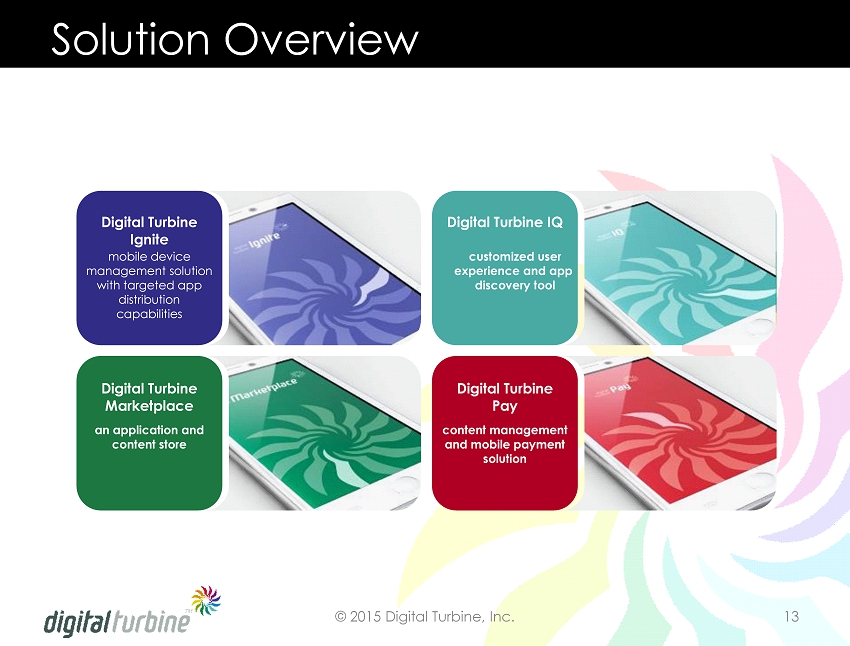

Solution Overview mobile device management solution with targeted app distribution capabilities Digital Turbine Ignite customized user experience and app discovery tool Digital Turbine IQ an application and content store Digital Turbine Marketplace Digital Turbine Pay content management and mobile payment solution © 2015 Digital Turbine, Inc. 13

DT Ignite App management service that enables mobile operators to control, manage and monetize the applications that are installed (pre or post) on smartphone devices Controls the entire install process for internal third party apps Allows mobile operators to obtain a new advertising revenue stream from pre and post installs Offers personalized service packages and application bundles by segment and/or device type Provides tools for full analysis and reporting © 2015 Digital Turbine, Inc. 14

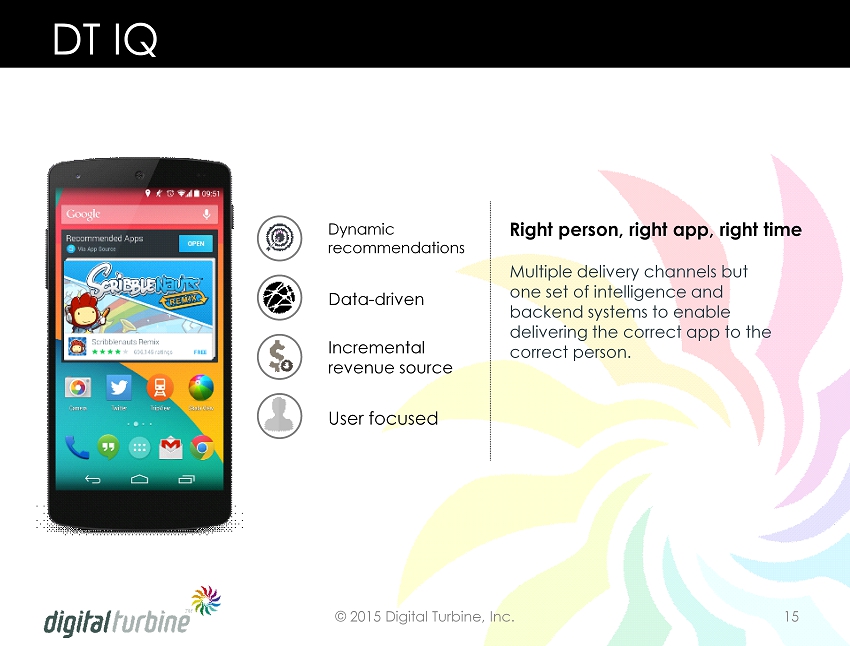

Dynamic recommendations User focused Incremental revenue source Data - driven Multiple delivery channels but one set of intelligence and backend systems to enable delivering the correct app to the correct person. Right person, right app, right time DT IQ © 2015 Digital Turbine, Inc. 15

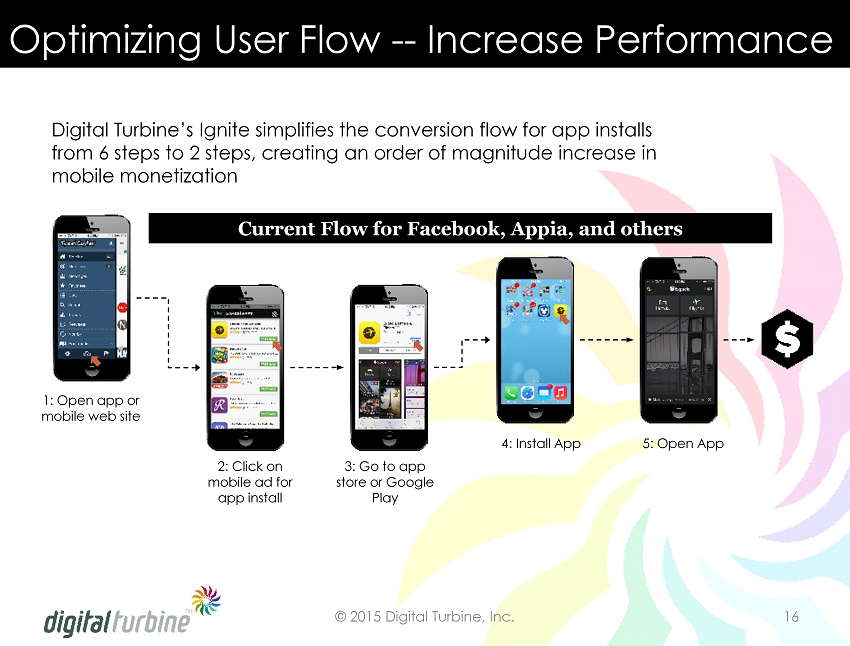

Digital Turbine’s Ignite simplifies the conversion flow for app installs from 6 steps to 2 steps, creating an order of magnitude increase in mobile monetization 1: Open app or mobile web site Current Flow for Facebook, Appia, and others 2: Click on mobile ad for app install 3: Go to app store or Google Play 4: Install App 5: Open App © 2015 Digital Turbine, Inc. 16 Optimizing User Flow -- Increase Performance

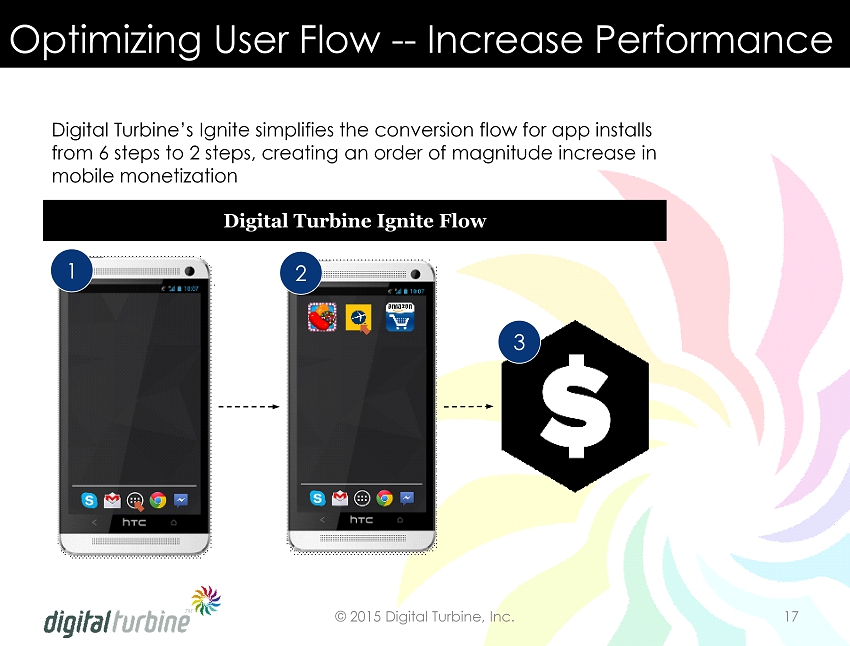

Digital Turbine Ignite Flow 1 2 3 Optimizing User Flow -- Increase Performance Digital Turbine’s Ignite simplifies the conversion flow for app installs from 6 steps to 2 steps, creating an order of magnitude increase in mobile monetization © 2015 Digital Turbine, Inc. 17

Agenda Market Opportunity Digital Turbine’s Solution Distribution & Customers Team & Investors Financial Overview © 2015 Digital Turbine, Inc. 18

Customers Leveraging the DT Media Platform © 2015 Digital Turbine, Inc. 19

Publishers Leveraging Appia Core Platform Appia partners with 250+ Publishers to monetize their mobile traffic © 2015 Digital Turbine, Inc. 20

App Install Advertisers Appia works with 150 + Advertisers & Agencies, including 60 of the top 100 grossing apps on the App Store and Google Play © 2015 Digital Turbine, Inc. 21

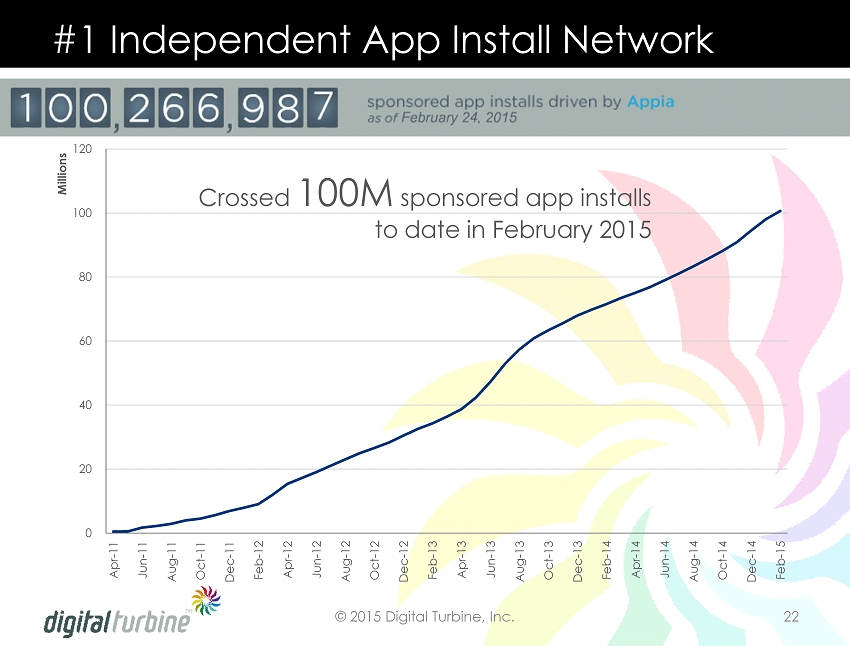

0 20 40 60 80 100 120 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12 Jun-12 Aug-12 Oct-12 Dec-12 Feb-13 Apr-13 Jun-13 Aug-13 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Oct-14 Dec-14 Feb-15 Millions #1 Independent App Install Network C rossed 100M sponsored app installs to date in February 2015 © 2015 Digital Turbine, Inc. 22

Agenda Market Opportunity Digital Turbine’s Solution Distribution & Customers Team & Investors Financial Overview © 2015 Digital Turbine, Inc. 23

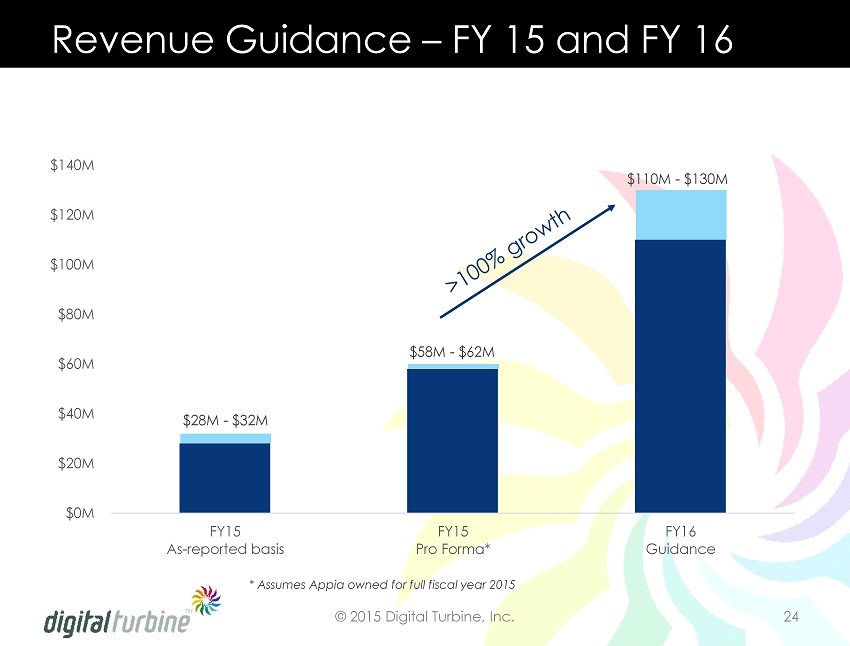

Revenue Guidance – FY 15 and FY 16 $28M - $32M $58M - $62M $110M - $130M $0M $20M $40M $60M $80M $100M $120M $140M FY15 As-reported basis FY15 Pro Forma* FY16 Guidance * Assumes Appia owned for full fiscal year 2015 © 2015 Digital Turbine, Inc. 24

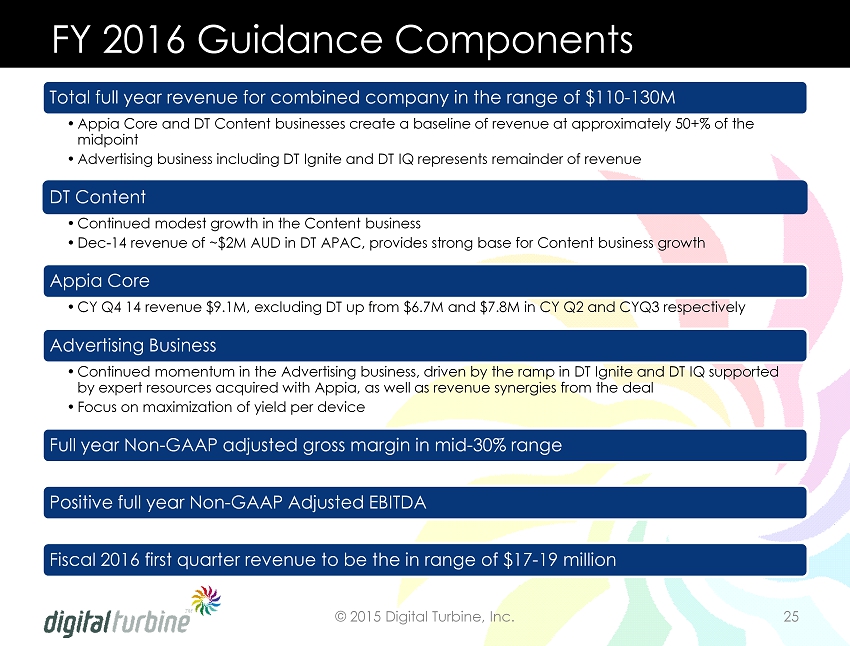

FY 2016 Guidance Components Total full year revenue for combined company in the range of $110 - 130M • Appia Core and DT Content businesses create a baseline of revenue at approximately 50+% of the midpoint • Advertising business including DT Ignite and DT IQ represents remainder of revenue DT Content • Continued modest growth in the Content business • Dec - 14 revenue of ~$2M AUD in DT APAC, provides strong base for Content business growth Appia Core • CY Q4 14 revenue $9.1M, excluding DT up from $6.7M and $7.8M in CY Q2 and CYQ3 respectively Advertising Business • Continued momentum in the Advertising business, driven by the ramp in DT Ignite and DT IQ supported by expert resources acquired with Appia, as well as revenue synergies from the deal • Focus on maximization of yield per device Full year Non - GAAP adjusted gross margin in mid - 30% range Positive full year Non - GAAP Adjusted EBITDA Fiscal 2016 first quarter revenue to be the in range of $17 - 19 million © 2015 Digital Turbine, Inc. 25

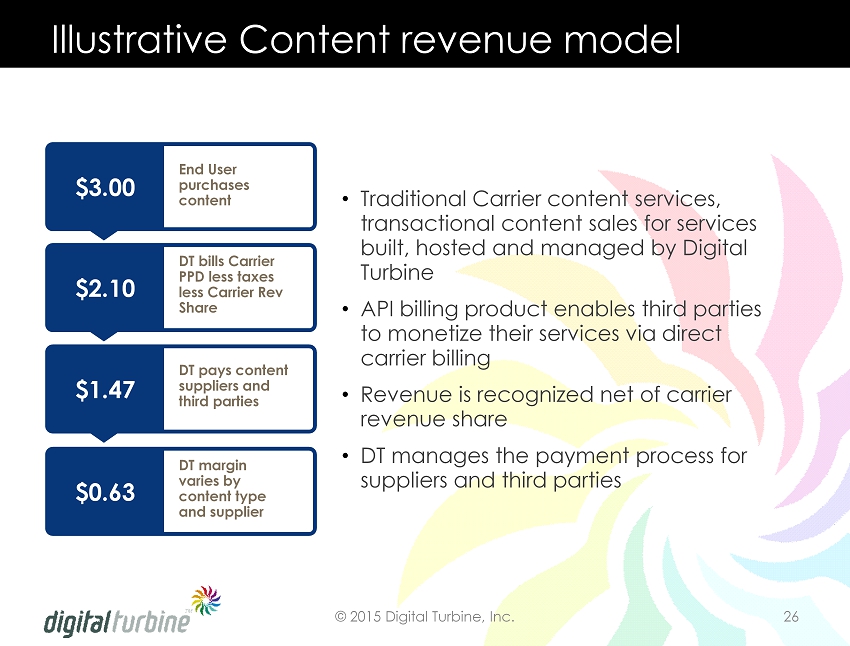

Illustrative Content revenue model End User purchases content • Traditional Carrier content services, transactional content sales for services built, hosted and managed by Digital Turbine • API billing product enables third parties to monetize their services via direct carrier billing • Revenue is recognized net of carrier revenue share • DT manages the payment process for suppliers and third parties $3.00 $2.10 DT bills Carrier PPD less t axes less C arrier R ev Share $1.47 DT pays content suppliers and third parties $0.63 DT margin varies by content type and supplier © 2015 Digital Turbine, Inc. 26

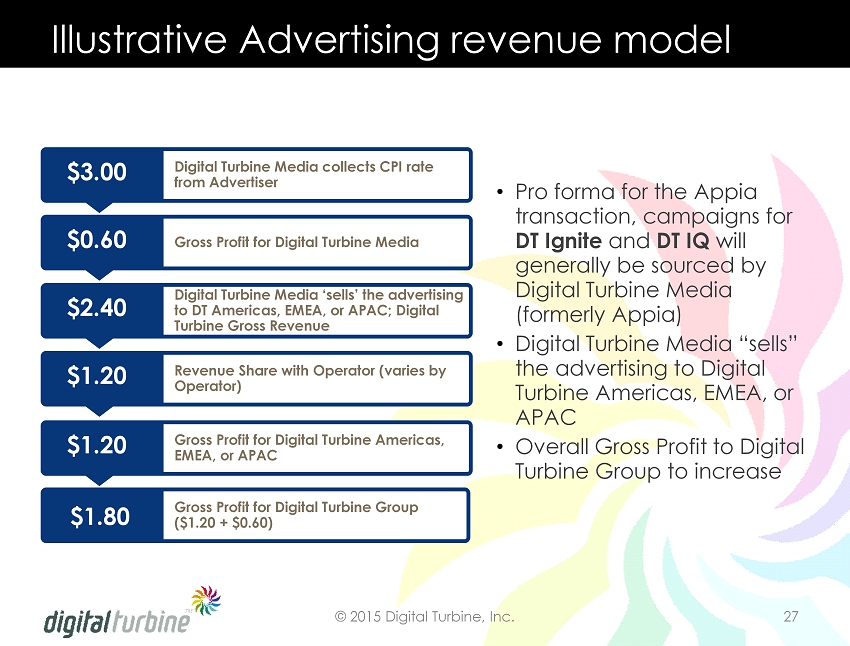

Illustrative Advertising revenue model Digital Turbine Media collects CPI rate from Advertiser $3.00 Gross Profit for Digital Turbine Media $0.60 Digital Turbine Media ‘sells ’ the advertising to DT Americas, EMEA, or APAC; Digital Turbine Gross Revenue $2.40 Revenue Share with Operator (varies by Operator) $1.20 Gross Profit for Digital Turbine Group ($1.20 + $0.60) $1.80 • Pro forma for the Appia transaction, campaigns for DT Ignite and DT IQ will generally be sourced by Digital Turbine Media (formerly Appia) • Digital Turbine Media “sells” the advertising to Digital Turbine Americas, EMEA, or APAC • Overall Gross Profit to Digital Turbine Group to increase Gross Profit for Digital Turbine Americas, EMEA, or APAC $1.20 © 2015 Digital Turbine, Inc. 27

Agenda Market Opportunity Digital Turbine’s Solution Distribution & Customers Team & Investors Financial Overview © 2015 Digital Turbine, Inc. 28

Experienced Executive Team Bill Stone – Chief Executive Officer • 20+ years experience in carrier relations, wireless, content, media, technology, marketing and distribution • Executive positions at Qualcomm, Verizon, and Vodafone © 2015 Digital Turbine, Inc. 29

Experienced Executive Team • Andrew Schleimer – Executive Vice President and Chief Financial Officer – President, Au Courant Capital Corp .; EVP of Strategic Development, Dick Clark Productions; EVP of Strategic Development, Six Flags; VP of M&A, UBS • James Alejandro – Chief Accounting Officer and Controller – Dell, Inc. – Director of Accounting, North America & Global S&P Revenu e • Nick Montes Americas and EVP Global Business Development – President, Logia Mobile USA; President and CEO, Viva Vision; Director of Multicultural Marketing, Verizon Wireless • Jon Mooney – EVP Group Product, Operations and Delivery – Chief Operating Officer, MIA; Content Acquisition & Strategy, Telstra; Product Manager, T - Mobile • Kirstie Brown – EVP Global Finance Operations – Chief Financial Officer, MIA; Controller, MBlox • Harris Thurmond – VP Product – Director of Mobile Software Development, Dell; Program Manager, Microsoft • Zoe Adamovicz – Head of EMEA and EVP Group Technology Development – CEO, Xyo ; Exec positions Deloitte, Jamster , Fox Mobile • Marcin Rudolf – Head of Group Technology – Chief Technical Officer and Cofounder, Xyo ; Chief Technical Officer, Vulevu © 2015 Digital Turbine, Inc. 30

Experienced Executive Team; cont . • Jamie Fellows - Chief Product Officer – SVP of Product, Millennial Media; VP of Product Management, AOL; Director of Product, Management Advertising.com • Jeff Henderson – VP Engineering and IT Operations – Director of Engineering, Novarra; Director of Engineering, Motricity • Jim Harvey – SVP Advertising Sales – VP of Client Strategy Brooks Bell, SVP of Consumer & Developer Services, Motricity • Matt Tubergen – VP of Business Development and Supply – SVP & GM of USA, Taptica; Product Manager, Recharge Studios W3i; Co - Founder, Azomob; Director, THQ Wireless © 2015 Digital Turbine, Inc. 31

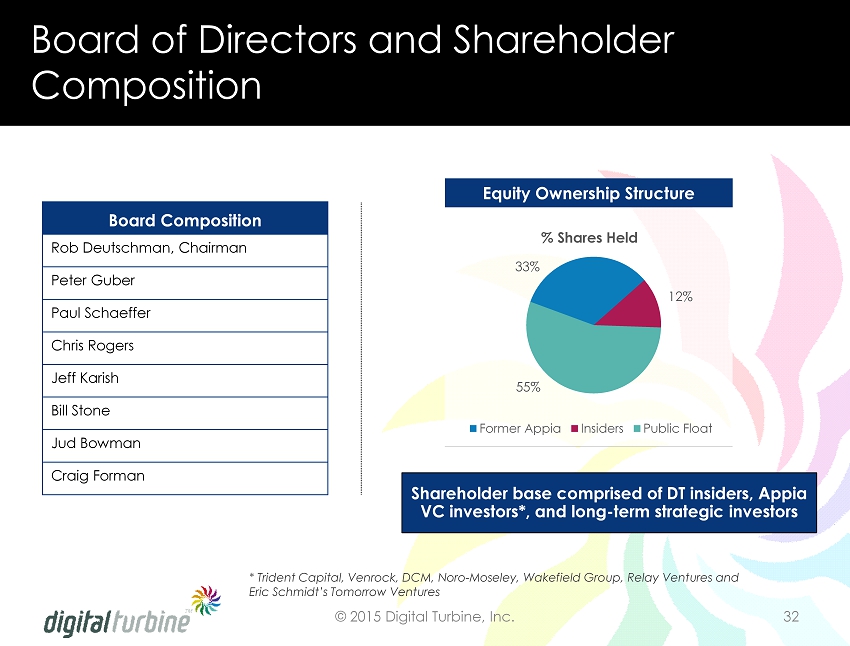

Board Composition Rob Deutschman , Chairman Peter Guber Paul Schaeffer Chris Rogers Jeff Karish Bill Stone Jud Bowman Craig Forman Board of Directors and Shareholder Composition 33% 12% 55% % Shares Held Former Appia Insiders Public Float Equity Ownership Structure Shareholder base comprised of DT insiders, Appia VC investors*, and long - term strategic investors © 2015 Digital Turbine, Inc. 32 * Trident Capital, Venrock, DCM, Noro - Moseley, Wakefield Group, Relay Ventures and Eric Schmidt’s Tomorrow Ventures