Exhibit 99.1

Craig - Hallum Alpha Select Conference September 17, 2015

2 Safe Harbor Statements . Statements in this presentation that are not statements of historical fact and that concern future results from operations, financial position, economic conditions, product releases, and any other statement that may be construed as a prediction of future performance or events, including fiscal year 2016 revenue and non - GAAP adjusted gross margin ranges, are forward - looking statements that speak only as of the date made and which involve known and unknown risks, uncertainties and other factors which may, should one or more of these risks uncertainties or other factors materialize, cause actual results to differ materially from those expressed or implied by such statements . These factors include the occurrence of any event, change or other circumstances that could give rise to risks related to disruption of management's attention from the ongoing business operations due to the Appia merger integration effort ; the ability to expand the combined company’s global reach, accelerate growth and enhance a scalable, low - capex business model that drives EBITDA ; failure to realize anticipated operational efficiencies, revenue (including projected revenue) and cost synergies and resulting revenue growth, EBITDA and free cash flow conversion from the Appia merger ; inability to refinance the assumed debt or to refinance the debt on favorable terms ; unforeseen challenges related to relationships with operators, publishers and advertisers and expanding and maintaining those relationships ; the ability to execute upon, and realize any benefits from, potential value creation opportunities through strategic relationships in the future or at all, including the ability to leverage advertising opportunities effectively and increase revenue streams for carriers ; the inherent and deal specific challenges in converting discussions with carriers into actual contractual relationships ; product acceptance of a new product such as DT Ignite™ or DT IQ™ in a competitive marketplace ; device sell through for any specific device or series of devices ; the potential for unforeseen or underestimated cash requirements or liabilities ; the impact of currency exchange rate fluctuations on our reported GAAP financial statements ; the Company’s ability as a smaller company to manage international operations ; its ability given the company's limited resources to identify and consummate acquisitions ; varying and often unpredictable levels of orders ; the challenges inherent in technology development necessary to maintain the Company’s competitive advantage ; such as adherence to release schedules and the costs and time required for finalization and gaining market acceptance of new products ; changes in economic conditions and market demand ; rapid and complex changes occurring in the mobile marketplace ; pricing and other activities by competitors ; pricing risks associated with potential commoditization of the Appia Core as competition increases and new technologies add pricing pressure ; technology management risk as the company needs to adapt to complex specifications of different carriers and the management of a complex technology platform given the company's relatively limited resources, and other risks including those described from time to time in Digital Turbine’s filings on Forms 10 - K and 10 - Q with the SEC, press releases and other communications . You should not place undue reliance on these forward - looking statements . The Company does not undertake to update forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . Use of Non - GAAP Financial Measures . To supplement the Company’s condensed historical financial statements and/or forward looking financials presented in accordance with U . S . Generally Accepted Accounting Principles (“GAAP”), Digital Turbine uses non - GAAP measures of certain components of financial performance, the exact amount of which are not currently determinable . These non - GAAP measures include non - GAAP adjusted gross profit and gross margin and non - GAAP adjusted EBITDA . Furthermore, the expected GAAP and non - GAAP results for the twelve month period ended March 31 , 2016 presented, if any, are subject to completion of the Company’s year - end accounting processes, which include the finalization of the Company’s provision for income taxes . Final results could also be affected by certain subsequent events . Non - GAAP measures are provided to enhance investors’ overall understanding of the Company’s current financial performance, prospects for the future and as a means to evaluate period - to - period comparisons . The Company believes that these non - GAAP measures provide meaningful supplemental information regarding financial performance by excluding certain expenses and benefits that may not be indicative of core business operating results . The Company believes the non - GAAP measures that exclude such items when viewed in conjunction with GAAP results and the accompanying reconciliations, if any, enhance the comparability of results against prior periods and allow for greater transparency of financial results . To the extent the Company is unable to provide a quantitative reconciliation for forward looking non - GAAP financial measures, the Company has provided a qualitative description of the anticipated differences between such non - GAAP financial measure and the most comparable financial measure . The Company believes non - GAAP measures facilitate management’s internal comparison of its financial performance to that of prior periods as well as trend analysis for budgeting and planning purposes . The presentation of non - GAAP measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP . Non - GAAP Adjusted gross margin is defined as GAAP gross margin adjusted to exclude the effect of intangible amortization expense . Readers are cautioned that non - GAAP Adjusted gross margin should not be construed as an alternative to gross margin determined in accordance with U . S . GAAP as an indicator of profitability or performance, which is the most comparable measure under GAAP . Non - GAAP Adjusted EBITDA is calculated as GAAP net loss excluding the following cash and non - cash expenses : interest expense, foreign transaction gains (losses), debt financing and non - cash related expenses, debt discount and non - cash debt settlement expense, gain or loss on extinguishment of debt, income taxes, asset impairment charges, depreciation and amortization, stock - based compensation expense, change in fair value of derivatives, and fees and expenses related to acquisitions . Because Adjusted EBITDA is a non - GAAP measure that does not have a standardized meaning, it may not be comparable to similar measures presented by other companies . Readers are cautioned that Non - GAAP Adjusted EBITDA should not be construed as an alternative to net income (loss) determined in accordance with U . S . GAAP as an indicator of performance, which is the most comparable measure under GAAP . Non - GAAP adjusted gross profit and gross margin and adjusted EBITDA are used by management as internal measures of profitability and performance . They have been included because the Company believes that the measures are used by certain investors to assess the Company’s financial performance before certain cash and non - cash charges and other costs that the Company does not believe are reflective of its core operating underlying business . © Digital Turbine. All rights reserved.

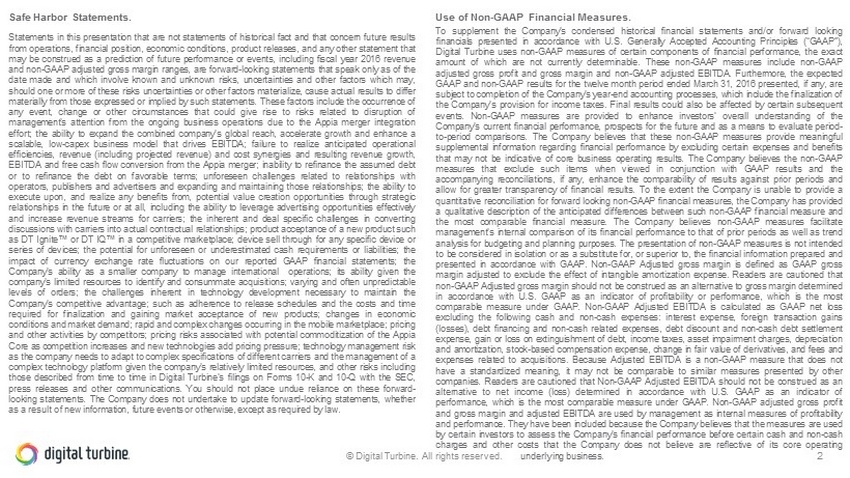

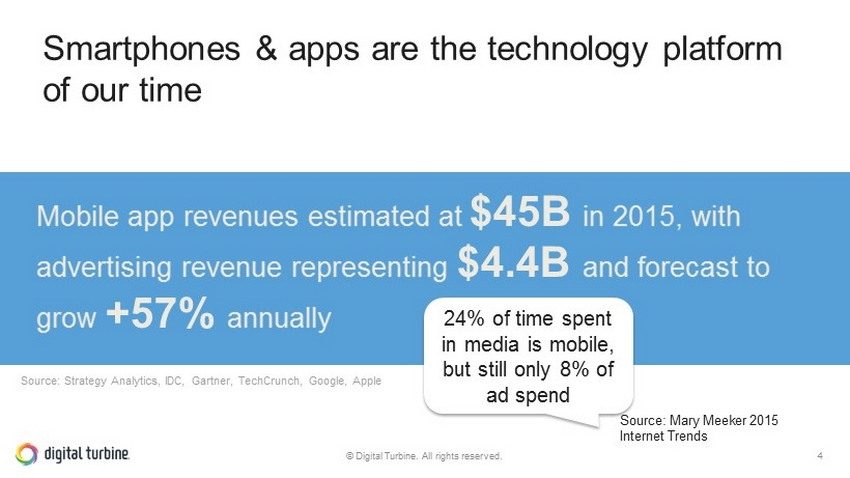

3 1.3B smartphones shipped in 2014 1.4M apps on both Google Play and the App Store $45B mobile app revenue forecast in 2015 $4.4B mobile advertising revenue in 2015 Source: Strategy Analytics, IDC, Gartner, TechCrunch, Google, Apple Smartphones & apps are the technology platform of our time © Digital Turbine. All rights reserved.

Smartphones & apps are the technology platform of our time 4 Mobile app revenues estimated at $45B in 2015, with advertising revenue representing $4.4B and forecast to grow +57% annually Source: Strategy Analytics, IDC, Gartner, TechCrunch, Google, Apple © Digital Turbine. All rights reserved. 24 % of time spent in media is mobile, but still only 8% of ad spend Source: Mary Meeker 2015 Internet Trends

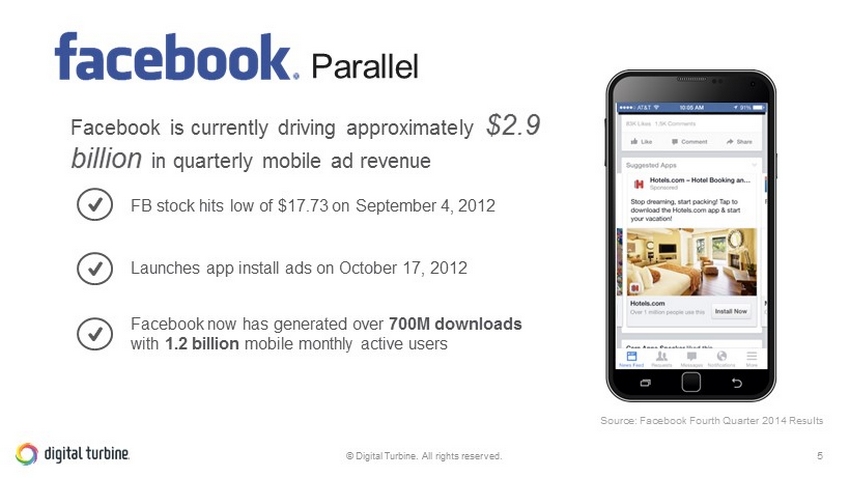

Facebook is currently driving approximately $ 2.9 billion in quarterly mobile ad revenue FB stock hits low of $17.73 on September 4, 2012 Launches app install ads on October 17, 2012 Facebook now has generated over 700M downloads with 1.2 billion mobile monthly active users Source: Facebook Fourth Quarter 2014 Results 5 Parallel © Digital Turbine. All rights reserved.

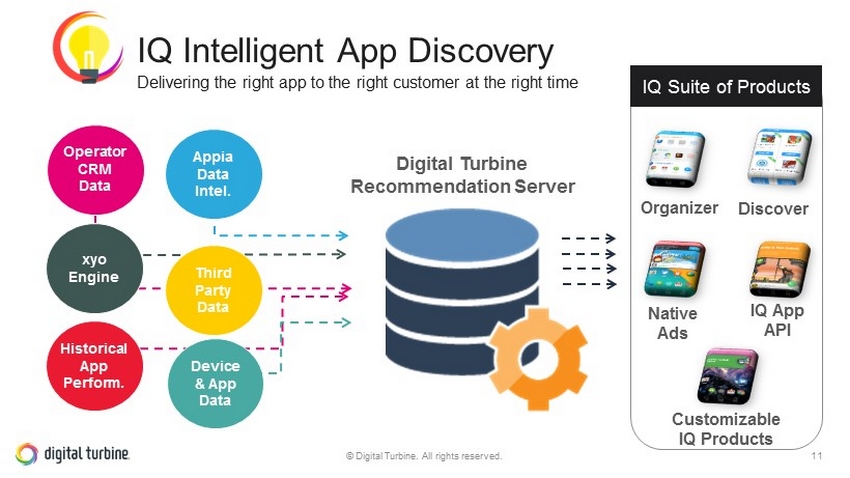

Our Mission The ‘App Economy’ is exploding and redefining both industries and human lives. Our mission is to deliver the right app to the right customer at the right time…anywhere on the planet.

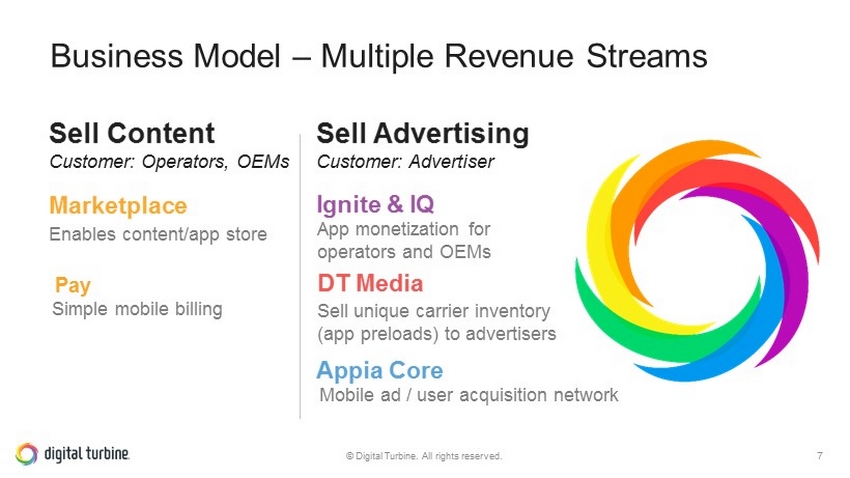

Appia Core M obile ad / user acquisition network Ignite & IQ App monetization for operators and OEMs Marketplace Enables content/app store DT Media Sell unique carrier inventory (app preloads) to advertisers Business Model – Multiple Revenue Streams Sell Advertising Customer: Advertiser Sell Content Customer: Operators, OEMs 7 © Digital Turbine. All rights reserved. Pay Simple mobile billing

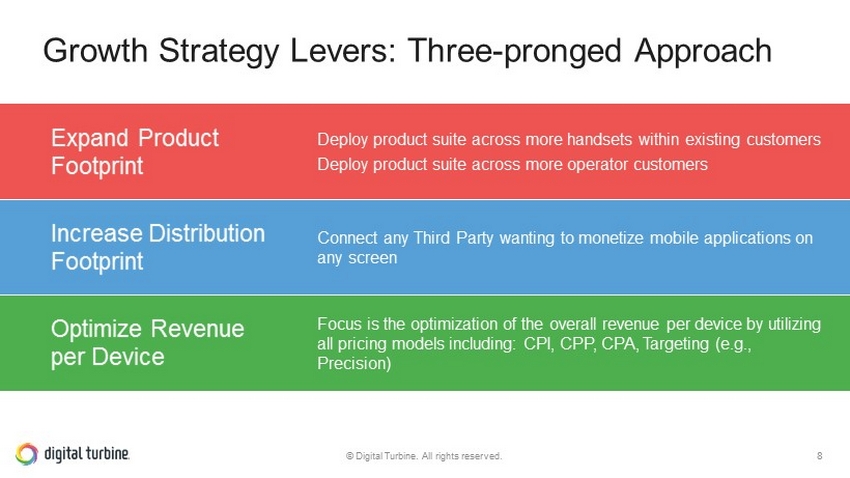

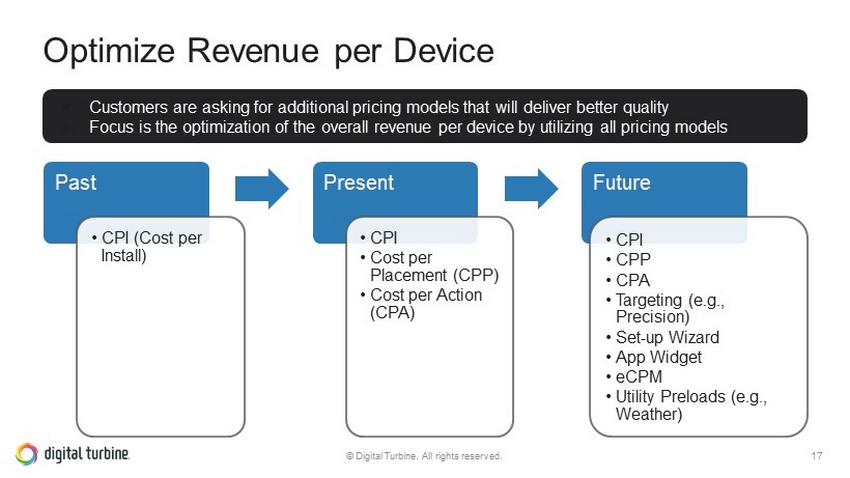

Growth Strategy Levers: Three - pronged Approach Increase Distribution Footprint Expand Product Footprint Optimize Revenue per Device Connect any Third Party wanting to monetize mobile applications on any screen Deploy product suite across more handsets within existing customers Deploy product suite across more operator customers Focus is the optimization of the overall revenue per device by utilizing all pricing models including: CPI, CPP, CPA, Targeting (e.g., Precision) 8 © Digital Turbine. All rights reserved.

End to End Mobile Solutions – Comprehensive product portfolio 9 © Digital Turbine. All rights reserved.

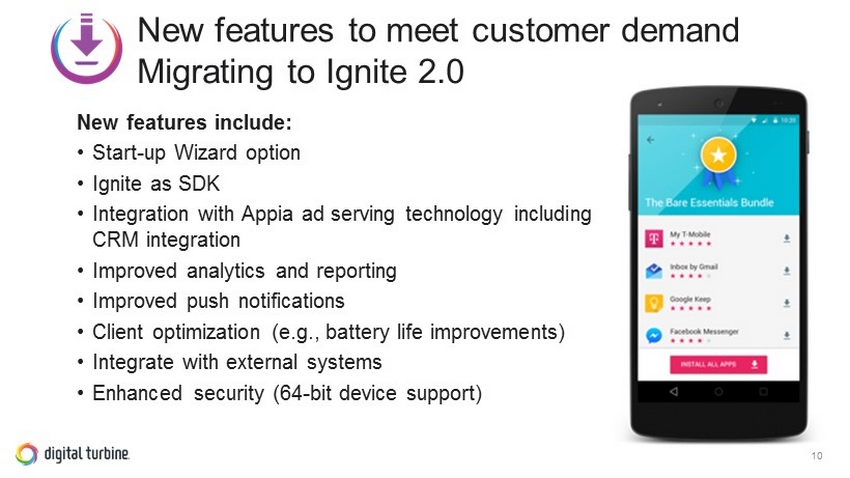

New features to meet customer demand Migrating to Ignite 2.0 New features include: • Start - up Wizard option • Ignite as SDK • Integration with Appia ad serving technology including CRM integration • Improved analytics and reporting • Improved push notifications • Client optimization (e.g., battery life improvements) • Integrate with external systems • Enhanced security (64 - bit device support) 10

Delivering the right app to the right customer at the right time Digital Turbine Recommendation Server Device & App Data Historical App Perform. Appia Data Intel. xyo Engine Third Party Data IQ Suite of Products Organizer Discover Native Ads IQ App API Customizable IQ Products Operator CRM Data © Digital Turbine. All rights reserved. IQ Intelligent App Discovery 11

Appia Diversifies Revenues Appia will continue to scale as a leading worldwide mobile user acquisition network 12 • Partnering with 150+ app install advertisers – Drives both Appia Core and DT Media ads – Exposure to Apple Ecosystem, with ~20% of revenue from iOS advertisers • Solid foundation of 250+ Global Publishers partners utilizing the Appia platform – Expanding international supply base in China and other geographies – Planning continued growth through APK managed DSP and leveraging DT Ad Units for Publishers © Digital Turbine. All rights reserved.

Increase Distribution Footprint Operators OEMs Other Third Parties (Distributors, Chipset suppliers, Retailers, etc.) 13 Strategy: Connect any Third Party wanting to monetize mobile applications on any Screen © Digital Turbine. All rights reserved.

Current Digital Turbine Partners – Mobile Operator and OEM Partners 14 © Digital Turbine. All rights reserved.

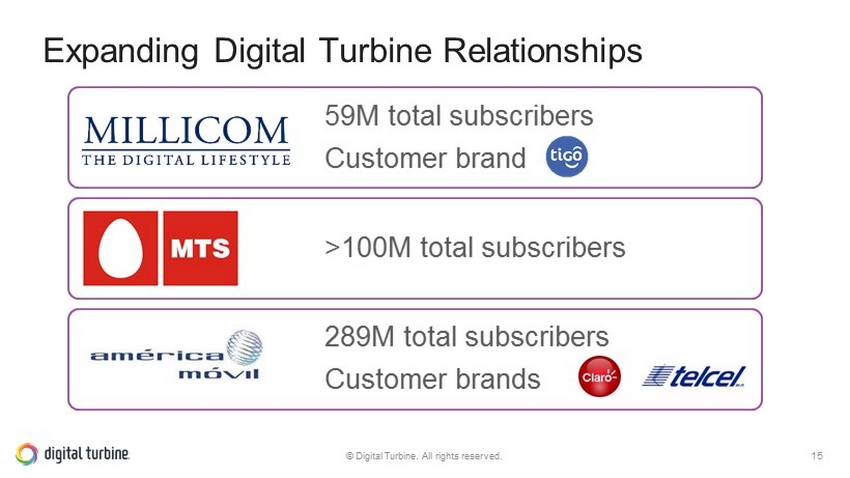

Expanding Digital Turbine R elationships 59M total subscribers Customer brand >100M total subscribers 289M total subscribers Customer brands © Digital Turbine. All rights reserved. 15

© Digital Turbine. All rights reserved. 16 Strong Demand for DT Media Inventory

Optimize Revenue per Device Past • CPI (Cost per Install) Present • CPI • Cost per Placement (CPP) • Cost per Action (CPA) Future • CPI • CPP • CPA • Targeting (e.g., Precision) • Set - up Wizard • App Widget • eCPM • Utility Preloads (e.g., Weather) 17 ▪ Customers are asking for additional pricing models that will deliver better quality ▪ Focus is the optimization of the overall revenue per device by utilizing all pricing models © Digital Turbine. All rights reserved.

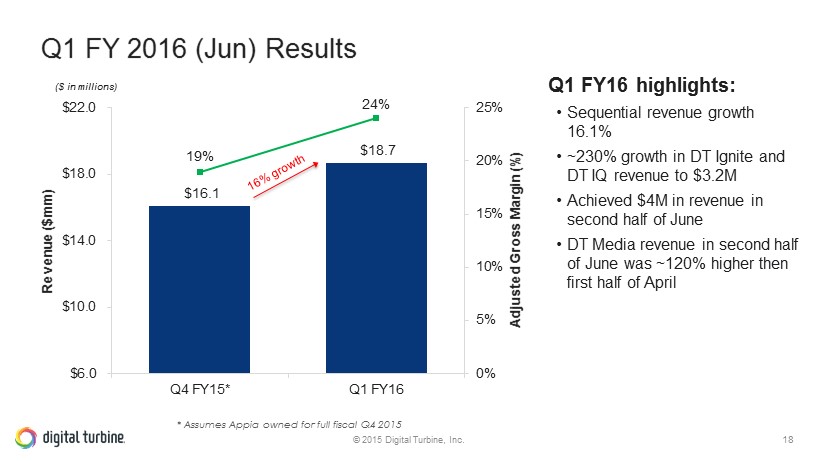

Q1 FY 2016 (Jun) Results $16.1 $18.7 19% 24% 0% 5% 10% 15% 20% 25% $6.0 $10.0 $14.0 $18.0 $22.0 Q4 FY15* Q1 FY16 Adjusted Gross Margin (%) Revenue ($mm) * Assumes Appia owned for full fiscal Q4 2015 © 2015 Digital Turbine, Inc. 18 Q1 FY16 highlights: • Sequential revenue growth 16.1% • ~230% growth in DT Ignite and DT IQ revenue to $3.2M • Achieved $4M in revenue in second half of June • DT Media revenue in second half of June was ~120% higher then first half of April • Appia Core revenue up 26% year - over - year • Content revenue up 28% year - over - year ($ in millions)

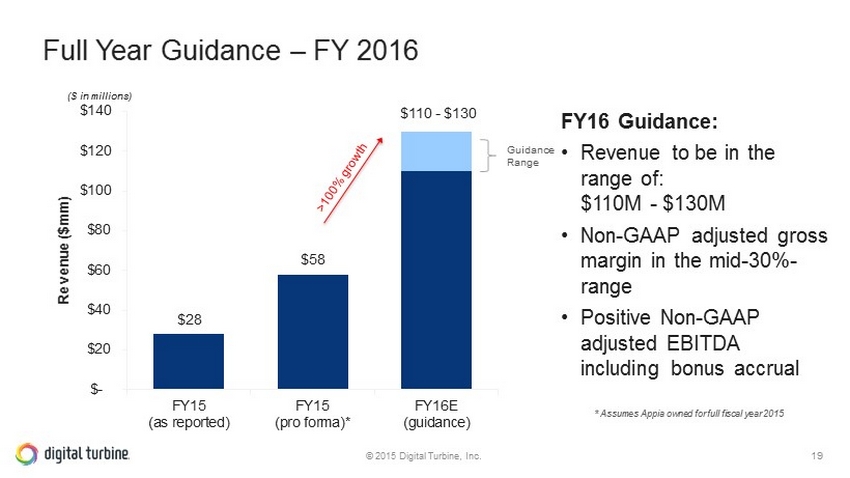

$28 $58 $110 - $130 $- $20 $40 $60 $80 $100 $120 $140 FY15 (as reported) FY15 (pro forma)* FY16E (guidance) Revenue ($mm) Full Year Guidance – FY 2016 * Assumes Appia owned for full fiscal year 2015 © 2015 Digital Turbine, Inc. 19 FY16 Guidance: • Revenue to be in the range of: $110M - $130M • Non - GAAP adjusted gross margin in the mid - 30% - range • Positive Non - GAAP adjusted EBITDA including bonus accrual Guidance Range ($ in millions)

© 2015 Digital Turbine, Inc. 20 • FY Revenue Guidance driven by ramp of DT Media in back half of the fiscal year – Major retail selling quarter in Q3 FY16 – Continued organic growth in Q4 FY16 • Acceleration of DT Media driven by: – More units through enhanced distribution profile • Penetration with existing customers • Launch of announced new customers • Pipeline of unannounced new customers – Higher yield per device through pricing optimization • Increased stable of campaigns • Competitive environment from limited inventory • Targeting with data science • Revenue supported by a stable, predictable base from Appia Core and Content • Biggest opportunities and risks – Holiday device sales – Carrier launches and ramp Business Outlook – Key Drivers

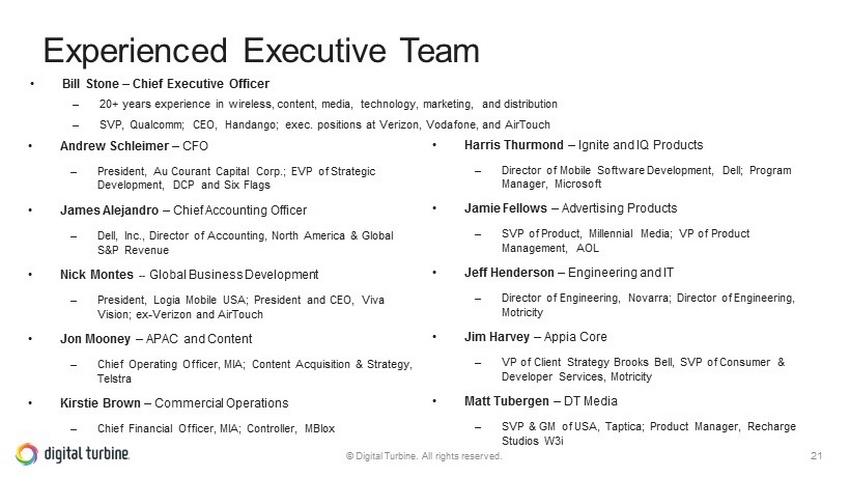

Experienced Executive Team • Bill Stone – Chief Executive Officer – 20+ years experience in wireless, content, media, technology, marketing, and distribution – SVP, Qualcomm; CEO, Handango; exec. positions at Verizon, Vodafone, and AirTouch 21 • Andrew Schleimer – CFO – President, Au Courant Capital Corp.; EVP of Strategic Development, DCP and Six Flags • James Alejandro – Chief Accounting Officer – Dell, Inc., Director of Accounting, North America & Global S&P Revenue • Nick Montes -- Global Business Development – President, Logia Mobile USA; President and CEO, Viva Vision; ex - Verizon and AirTouch • Jon Mooney – APAC and Content – Chief Operating Officer, MIA; Content Acquisition & Strategy, Telstra • Kirstie Brown – Commercial Operations – Chief Financial Officer, MIA; Controller, MBlox • Harris Thurmond – Ignite and IQ Products – Director of Mobile Software Development, Dell; Program Manager, Microsoft • Jamie Fellows – Advertising Products – SVP of Product, Millennial Media; VP of Product Management, AOL • Jeff Henderson – Engineering and IT – Director of Engineering, Novarra; Director of Engineering, Motricity • Jim Harvey – Appia Core – VP of Client Strategy Brooks Bell, SVP of Consumer & Developer Services, Motricity • Matt Tubergen – DT Media – SVP & GM of USA, Taptica; Product Manager, Recharge Studios W3i © Digital Turbine. All rights reserved.

x At the center of exponential growth in marketing and app - install advertising spend on mobile x Strong secular tail winds of global mobile, app, and install advertising growth x Recent acquisitions create single, large scale ecosystem x Uniquely positioned to deliver apps and ads to a device’s home screen x Growing global customer base of carriers, OEMs, mobile sites, and apps x Accelerating revenue ramp x Driven by distribution, products, and optimization/device x Supported by a stable, predictable base x Scalable business model x Experienced management team x Market timing 22 Investment Thesis © Digital Turbine. All rights reserved.

Thank you