Needham & Company Annual Growth Conference January 12, 2016 Exhibit 99.1

2 © 2015 Digital Turbine, Inc. Safe Harbor Statements . This presentation includes “forward - looking statements” within the meanings of the U . S . federal securities laws . Statements in this presentation that are not statements of historical fact and that concern future results from operations, financial position, economic conditions, product releases, and any other statement that may be construed as a prediction of future performance or events, including financial projections, new customers and growth in various products, are forward - looking statements that speak only as of the date made and which involve known and unknown risks, uncertainties and other factors which may, should one or more of these risks uncertainties or other factors materialize, cause actual results to differ materially from those expressed or implied by such statements . These factors include risks associated with DT Ignite adoption among existing customers (including the impact of possible delays with major carriers and OEM partners in the roll out for mobile phones deploying DT Ignite) ; actual mobile device sales and sell - through where DT Ignite is deployed is out of our control ; new customer adoption and time to revenue with new carrier and OEM partners is subject to delays and factors out of our control ; risks associated with fluctuations in the number of DT Ignite slots across US carrier partners ; required customization and technical integration which may slow down time to revenue notwithstanding the existence of a distribution agreement ; the challenges, given the Company's comparatively small size, to expand the combined Company's global reach, accelerate growth and create a scalable, low capex business model that drives EBITDA ; challenges to realize anticipated operational efficiencies, revenue (including projected revenue) and cost synergies and resulting revenue growth, EBITDA and free cash flow conversion from the Appia merger ; the impact of currency exchange rate fluctuations on our reported GAAP financial statements, particularly in regard to the Australian dollar ; ability as a smaller company to manage international operations ; varying and often unpredictable levels of orders ; the challenges inherent in technology development necessary to maintain the Company’s competitive advantage ; such as adherence to release schedules and the costs and time required for finalization and gaining market acceptance of new products ; changes in economic conditions and market demand ; rapid and complex changes occurring in the mobile marketplace ; pricing and other activities by competitors ; pricing risks associated with potential commoditization of the Appia Core as competition increases and new technologies add pricing pressure ; technology management risk as the company needs to adapt to complex specifications of different carriers and the management of a complex technology platform given the company's relatively limited resources, and other risks including those described from time to time in Digital Turbine’s filings on Forms 10 - K and 10 - Q with the SEC, press releases and other communications . You should not place undue reliance on these forward - looking statements . The Company does not undertake to update forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . Use of Non - GAAP Financial Measures . To supplement the Company’s condensed historical financial statements and/or forward looking financials presented in accordance with U . S . Generally Accepted Accounting Principles (“GAAP”), Digital Turbine uses non - GAAP measures of certain components of financial performance . These non - GAAP measures include non - GAAP adjusted EBITDA . Furthermore, the expected GAAP and non - GAAP results for the twelve month period ended March 31 , 2016 presented, if any, are subject to completion of the Company’s year - end accounting processes, which include the finalization of the Company’s provision for income taxes . Final results could also be affected by certain subsequent events . Non - GAAP measures are provided to enhance investors’ overall understanding of the Company’s current financial performance, prospects for the future and as a means to evaluate period - to - period comparisons . The Company believes that these non - GAAP measures provide meaningful supplemental information regarding financial performance by excluding certain expenses and benefits that may not be indicative of core business operating results . The Company believes the non - GAAP measures that exclude such items when viewed in conjunction with GAAP results and the accompanying reconciliations, if any, enhance the comparability of results against prior periods and allow for greater transparency of financial results . The Company believes non - GAAP measures facilitate management’s internal comparison of its financial performance to that of prior periods as well as trend analysis for budgeting and planning purposes . The presentation of non - GAAP measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP . Non - GAAP Adjusted EBITDA is calculated as GAAP net loss excluding the following cash and non - cash expenses : interest expense, foreign transaction gains (losses), debt financing and non - cash related expenses, debt discount and non - cash debt settlement expense, gain or loss on extinguishment of debt, income taxes, asset impairment charges, depreciation and amortization, stock - based compensation expense, change in fair value of derivatives, and fees and expenses related to acquisitions . Because Adjusted EBITDA is a non - GAAP measure that does not have a standardized meaning, it may not be comparable to similar measures presented by other companies . Readers are cautioned that Non - GAAP Adjusted EBITDA should not be construed as an alternative to net income (loss) determined in accordance with U . S . GAAP as an indicator of performance, which is the most comparable measure under GAAP .

3 © 2015 Digital Turbine, Inc. Agenda 1 Market Trends 2 Our Products 3 Distribution & Footprint 4 Financial Highlights

Carriers and OEM’s look for new sources of revenue from both advertising and data Current market trends driving opportunity Carriers search for relevance from a subscriber perspective (avoid the dumb pipe) App economy is here to stay – 80%+ of content consumed on smartphones through apps App discovery continues to be an issue for the ecosystem Content is king but distribution is the emperor Mobile advertising is in it’s infancy Media spend over - indexed on traditional formats and significantly under - indexed on mobile

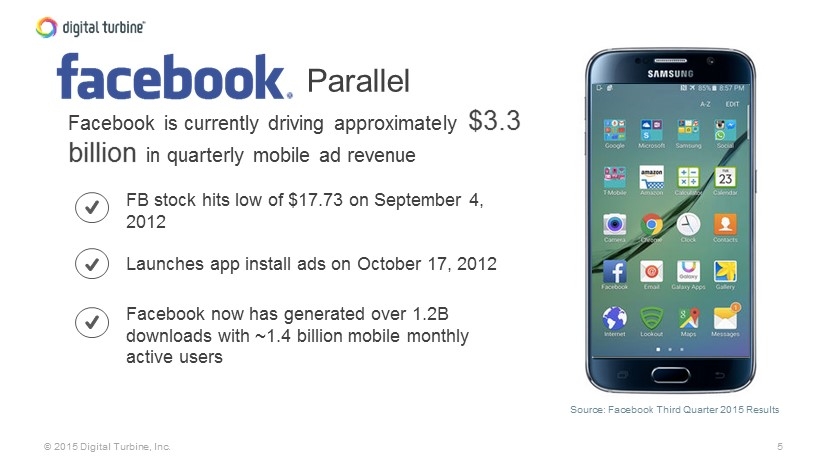

5 © 2015 Digital Turbine, Inc. Facebook is currently driving approximately $3.3 billion in quarterly mobile ad revenue FB stock hits low of $17.73 on September 4, 2012 Launches app install ads on October 17, 2012 Facebook now has generated over 1.2B downloads with ~1.4 billion mobile monthly active users Source: Facebook Third Quarter 2015 Results Parallel

6 Our Mission: Right App. Right Person. Right Time. Every day millions of android devices activate. Digital Turbine helps developers, advertisers, mobile operators and OEMs make the most of these new opportunities.

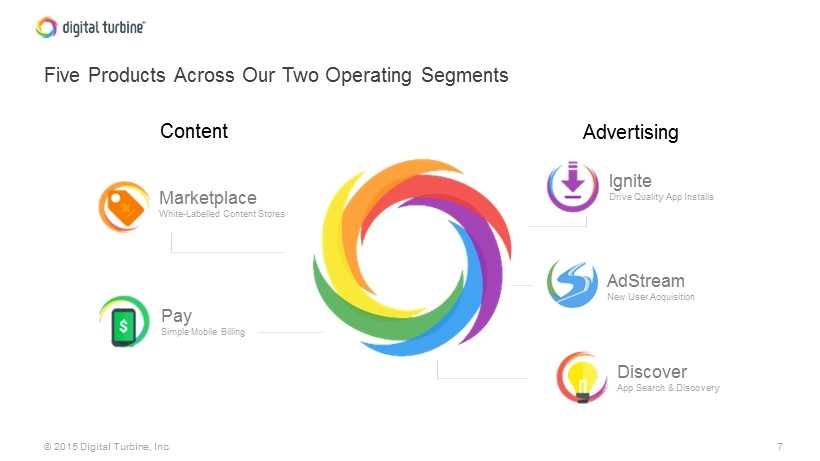

7 © 2015 Digital Turbine, Inc. Five Products Across Our T wo Operating Segments Marketplace White - Labelled Content Stores Pay Simple Mobile Billing Ignite Drive Quality App Installs AdStream New User Acquisition Content Discover App Search & Discovery Advertising

8 © 2015 Digital Turbine, Inc. AppSource is the engine and data science that enables app install recommendations, tracking, and optimization AppSource RTB Collaborative Filtering Content Filtering Advertiser • App install ads • App preloads • Push notifications • App install retargeting Publisher • Carriers & OEMs • Mobile publishers • Utilizing Ignite, AdStream and Discover

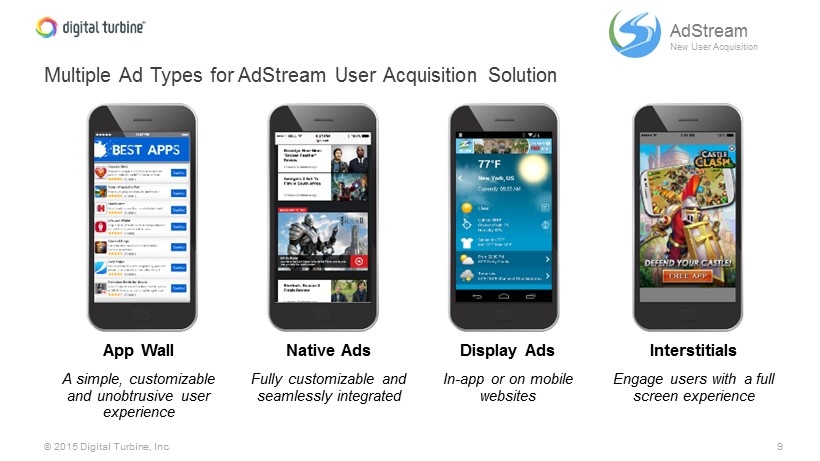

9 © 2015 Digital Turbine, Inc. Multiple Ad Types for AdStream User Acquisition Solution App Wall A simple, customizable and unobtrusive user experience Native Ads Fully customizable and seamlessly integrated Display Ads In - app or on mobile websites Interstitials Engage users with a full screen experience AdStream New User Acquisition

10 © 2015 Digital Turbine, Inc. Evolution of Ignite App Delivery – Multiple Go to Market Approaches Silent Wizard SDK Ignite Drive Quality App Installs

11 © 2015 Digital Turbine, Inc. Additional demand beyond traditional carrier partners While capitalizing on current opportunities we are working to leverage our products to meet marketplace trends • Continued deployment with OEMs • BYOD Ignite development for SIM cards • Other connected devices including wearables, automobiles, and television

12 © 2015 Digital Turbine, Inc. Signed contracts with major global players Partnered with 25+ mobile operators and OEM’s Major anchor tenants in key geographies

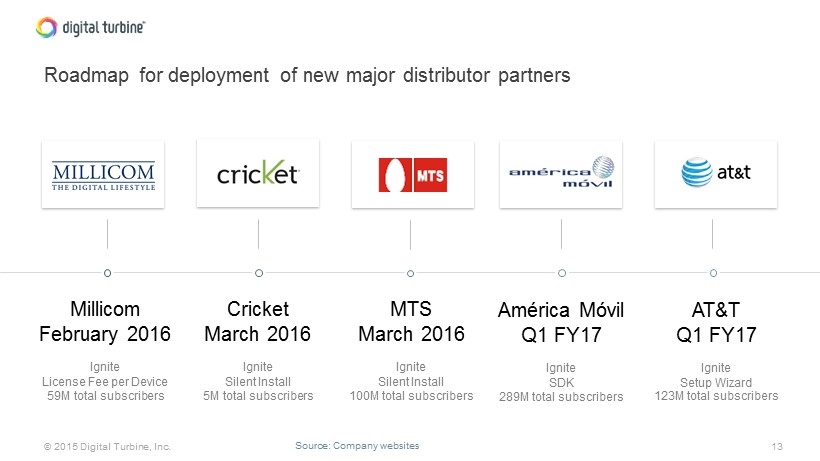

13 © 2015 Digital Turbine, Inc. Roadmap for deployment of new major distributor partners Millicom February 2016 Ignite License Fee per Device 59M total subscribers Cricket March 2016 Ignite Silent Install 5M total subscribers MTS March 2016 Ignite Silent Install 100M total subscribers América Móvil Q1 FY17 Ignite SDK 289M total subscribers AT&T Q1 FY17 Ignite Setup Wizard 123M total subscribers Source: Company websites

14 © 2015 Digital Turbine, Inc. Travel Social Real Estate Finance Strong Demand for DT Media Advertising Inventory Digital Turbine works with top tier Advertisers & Advertising Agencies including the top grossing apps on the App Store and Google Play Retail Music Entertainment Gaming Shopping Agency

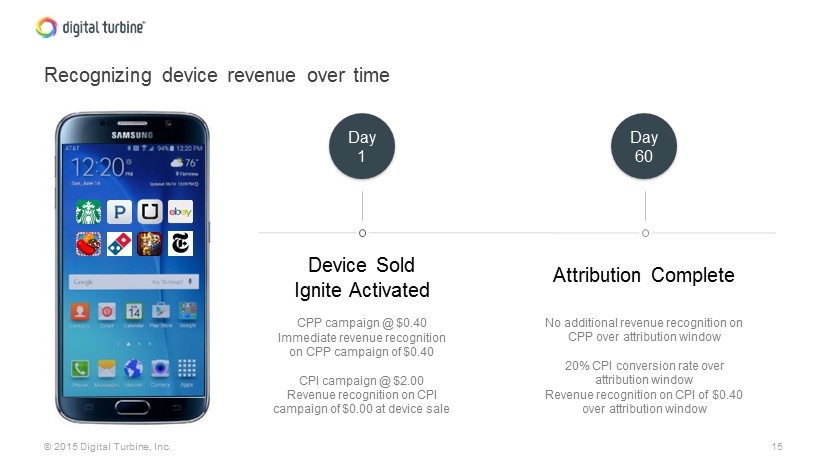

15 © 2015 Digital Turbine, Inc. Recognizing device revenue over time Device Sold Ignite Activated CPP campaign @ $0.40 Immediate revenue recognition on CPP campaign of $0.40 CPI campaign @ $2.00 Revenue recognition on CPI campaign of $ 0.00 at device sale Attribution Complete No additional revenue recognition on CPP over attribution window 20% CPI conversion rate over attribution window Revenue recognition on CPI of $ 0.40 over attribution window Day 1 Day 60

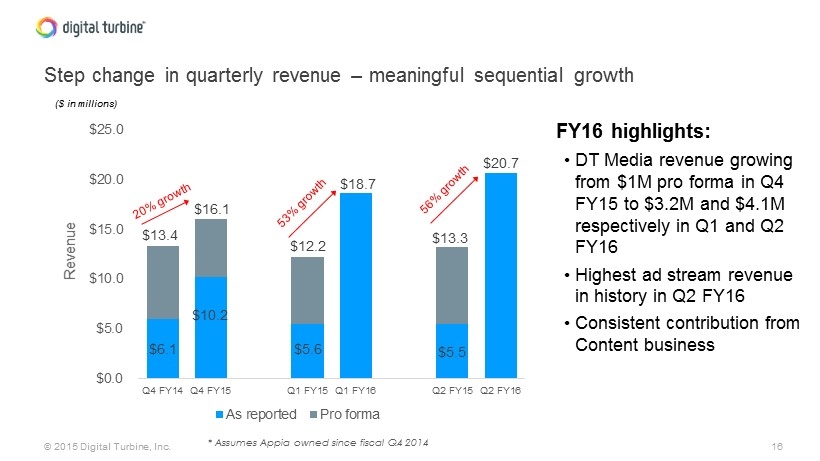

16 © 2015 Digital Turbine, Inc. $6.1 $10.2 $5.6 $18.7 $5.5 $20.7 $13.4 $16.1 $12.2 $13.3 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 Q4 FY14 Q4 FY15 Q1 FY15 Q1 FY16 Q2 FY15 Q2 FY16 Revenue As reported Pro forma Step change in quarterly revenue – meaningful sequential growth * Assumes Appia owned since fiscal Q4 2014 FY16 highlights: • DT Media revenue growing from $1M pro forma in Q4 FY15 to $3.2M and $4.1M respectively in Q1 and Q2 FY16 • Highest ad stream revenue in history in Q2 FY16 • Consistent contribution from Content business ($ in millions)

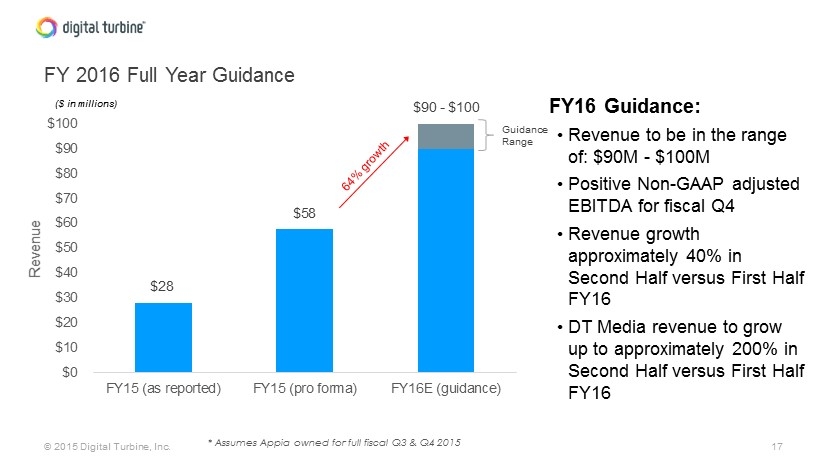

17 © 2015 Digital Turbine, Inc. FY 2016 Full Year Guidance * Assumes Appia owned for full fiscal Q3 & Q4 2015 FY16 Guidance: • Revenue to be in the range of : $90M - $ 100M • Positive Non - GAAP adjusted EBITDA for fiscal Q4 • Revenue growth approximately 40 % in Second Half versus First Half FY16 • DT Media revenue to grow up to approximately 200% in Second Half versus First Half FY16 ($ in millions) $28 $58 $90 - $100 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 FY15 (as reported) FY15 (pro forma) FY16E (guidance) Revenue Guidance Range

18 © 2015 Digital Turbine, Inc. Fiscal 2016 outlook over the remainder of Q4 • Continued organic DT Media growth in Q4 FY16 driven by: • Full quarter of 8 slots on US Carrier partners • Continued accretion in yield per device to over $2 per device • Launch of announced new customers • Potential launch of new material devices on existing distribution partners • Revenue supported by a stable, predictable base from AdStream and Content • Stable cash operating expenses driving profitability on an Adjusted EBITDA basis for Q4 FY16 Business Outlook – Q4 FY16

19 © 2015 Digital Turbine, Inc. Looking to FY 2017 • Positive quarter over prior year quarter results from large US distribution partners through higher device penetration • Onboarding of new distribution partners including América Móvil , AT&T and a more meaningful contribution from MTS, Millicom and Cricket • Growth in Appia Core driven by increased focus and effort internationally as well as RTB • Growth in DT Content driven by continued penetration of DT Pay customers in the pacific rim and Australia and new Content business opportunities in SE Asia Business Outlook – FY 2017

Thank You Digital Turbine @digitalTurbine digitalTurbine