Exhibit 99.2

June 201 8 Analyst Day

2 Confidential. © 2018 Digital Turbine, Inc. Schedule of Events Welcome – Brian Bartholomew, SVP Capital Markets Digital Turbine Today & In The Future – Bill Stone, CEO The Digital Turbine Mobile Delivery Platform Product Demonstrations – Brandon Ayers, Dir. of Product Strategy The Supply Side – Bill Stone, CEO Carrier/OEM Value Proposition Presentation by Roberto López Diaz, América Móvil The Demand Side – Matt Tubergen, EVP Media Perspective on Mobile Media Market Fireside Chat Panel - David McKie , Yelp and Alexander Matthews, Oath Financial Overview – Barrett Garrison, CFO Closing Remarks and Q&A Digital Turbine Analyst Day New York City

3 Confidential. © 2018 Digital Turbine, Inc. Safe Harbor Statement This presentation includes "forward-looking statements" within the meaning of the U.S. federal securities laws. Statements in this news release that are not statements of historical fact and that concern future results from operations, financial position, economic conditions, product releases and any other statement that may be construed as a prediction of future performance or events, including financial projections and growth in various products are forward-looking statements that speak only as of the date made and which involve known and unknown risks, uncertainties and other factors which may, should one or more of these risks uncertainties or other factors materialize, cause actual results to differ materially from those expressed or implied by such statements. These factors and risks include risks associated with Ignite adoption among existing customers (including the impact of possible delays with major carrier and OEM partners in the roll out for mobile phones deploying Ignite); actual mobile device sales and sell-through where Ignite is deployed is out of our control; new customer adoption and time to revenue with new carrier and OEM partners is subject to delays and factors out of our control; risks associated with fluctuations in the number of Ignite slots across US carrier partners; the challenges, given the Company’s comparatively small size, to expand the combined Company's global reach, accelerate growth and create a scalable, low-capex business model that drives EBITDA (as well as Adjusted EBITDA); varying and often unpredictable levels of orders; the challenges inherent in technology development necessary to maintain the Company's competitive advantage such as adherence to release schedules and the costs and time required for finalization and gaining market acceptance of new products; changes in economic conditions and market demand; rapid and complex changes occurring in the mobile marketplace; pricing and other activities by competitors; derivative and warrant liabilities on our balance sheet will fluctuate as our stock price moves and will also produce changes in our income statement; these fluctuations and changes might materially impact our reported GAAP financials in an adverse manner, particularly if our stock price were to rise; technology management risk as the Company needs to adapt to complex specifications of different carriers and the management of a complex technology platform given the Company's relatively limited resources; and other risks including those described from time to time in Digital Turbine's filings on Forms 10-K and 10-Q with the Securities and Exchange Commission (SEC), press releases and other communications. You should not place undue reliance on these forward-looking statements. The Company does not undertake to update forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Digital Turbine Platform Today & In The Future Bill Stone, CEO

5 Confidential. © 2018 Digital Turbine, Inc. Building Blocks of Value • Demand/Customers • Operating Leverage/ Biz Model • Competitive Landscape/ Moat • Timing (esp. in Tech)

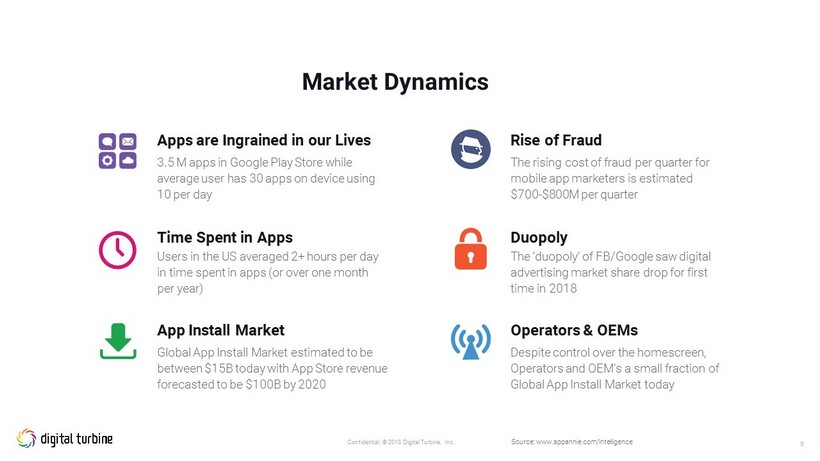

6 Confidential. © 2018 Digital Turbine, Inc. 3.5 M apps in Google Play Store while average user has 30 apps on device using 10 per day Rise of Fraud Apps are Ingrained in our Lives The rising cost of fraud per quarter for mobile app marketers is estimated $700 - $800M per quarter Time Spent in Apps Users in the US averaged 2+ hours per day in time spent in apps (or over one month per year) Source: www.appannie.com /intelligence The ‘duopoly’ of FB/Google saw digital advertising market share drop for first time in 2018 Duopoly Market Dynamics Despite control over the homescreen , Operators and OEM’s a small fraction of Global App Install Market today Operators & OEMs Global App Install Market estimated to be between $15B today with App Store revenue forecasted to be $100B by 2020 App Install Market

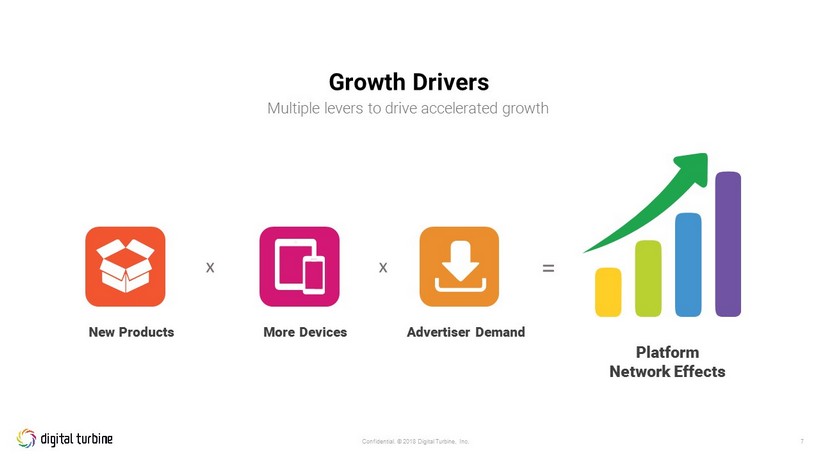

7 Confidential. © 2018 Digital Turbine, Inc. Advertiser Demand New Products More Devices x = Platform Network Effects Growth Drivers Multiple levers to drive accelerated growth x

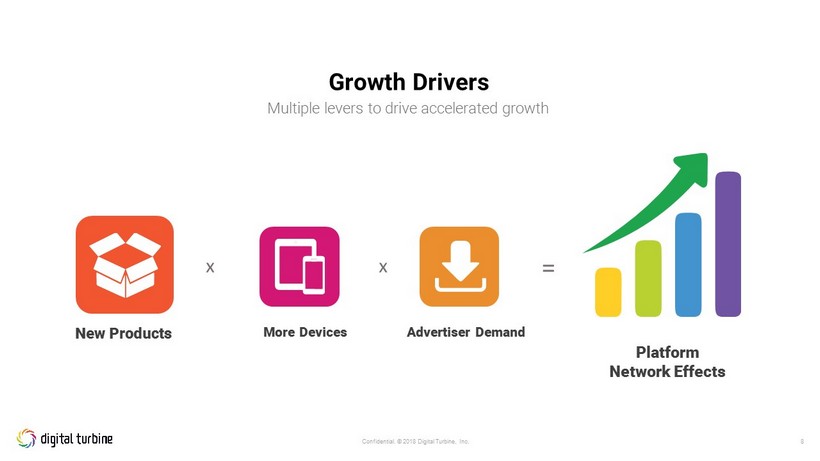

8 Confidential. © 2018 Digital Turbine, Inc. x = Platform Network Effects Growth Drivers Multiple levers to drive accelerated growth x Advertiser Demand New Products More Devices

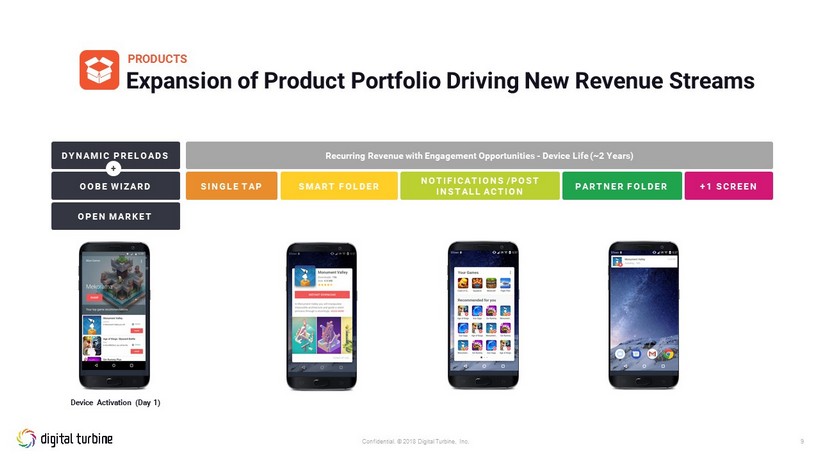

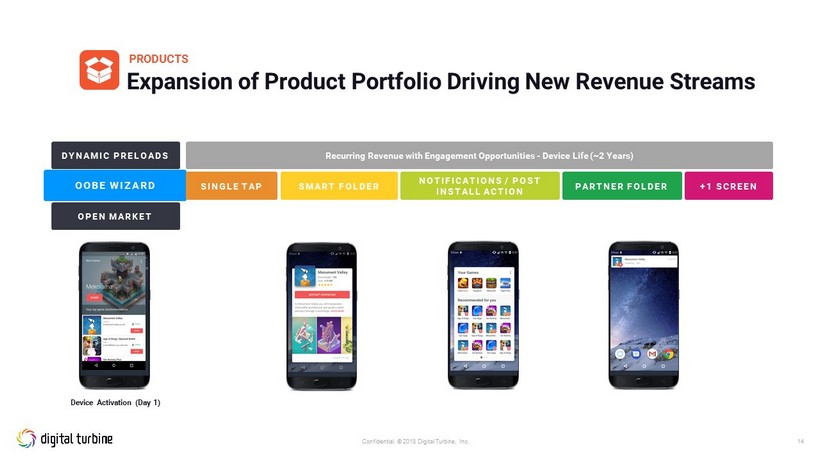

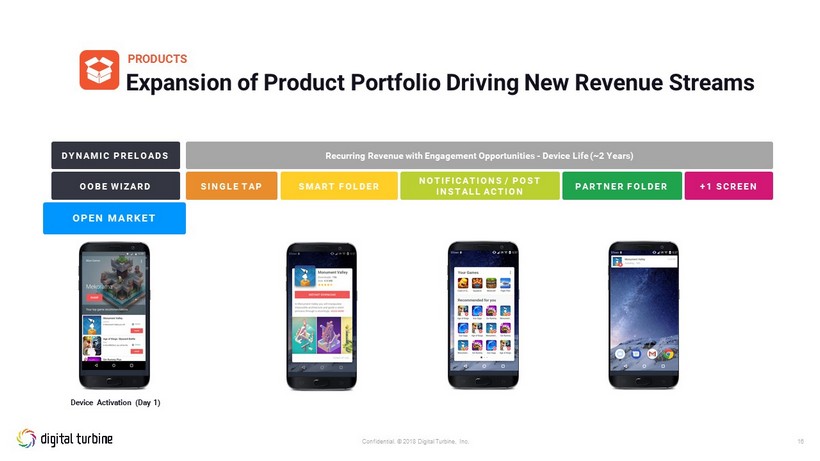

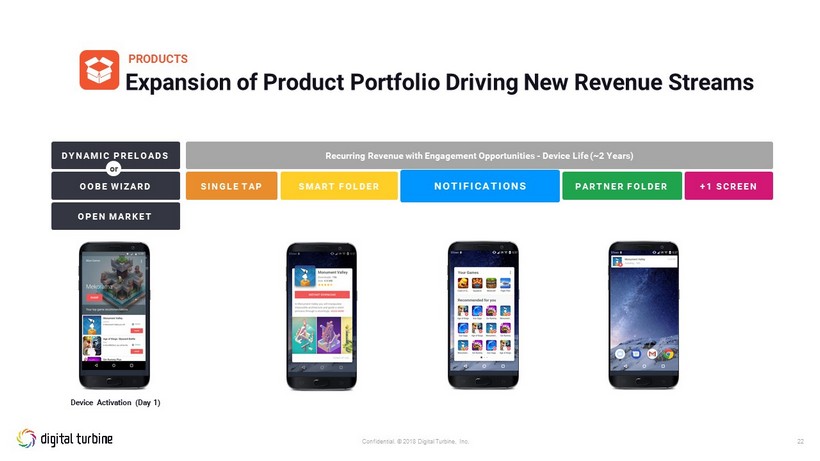

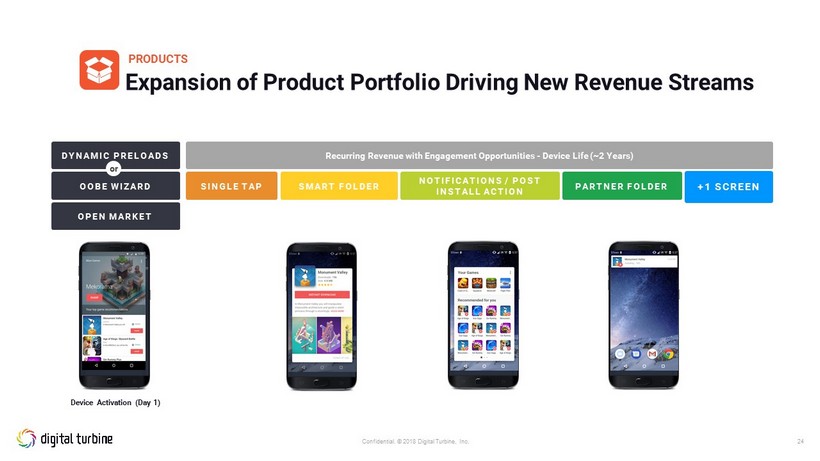

9 Confidential. © 2018 Digital Turbine, Inc. OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams DYNAMIC PRELOADS Device Activation (Day 1) SINGLE TAP SMART FOLDER NOTIFICATIONS /POST INSTALL ACTION +1 SCREEN PARTNER FOLDER + OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS

Product Demonstrations Brandon Ayers, Director of Product Strategy

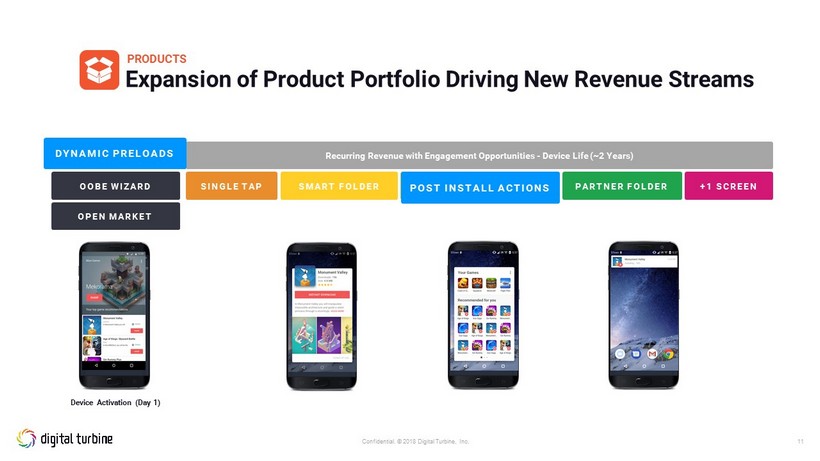

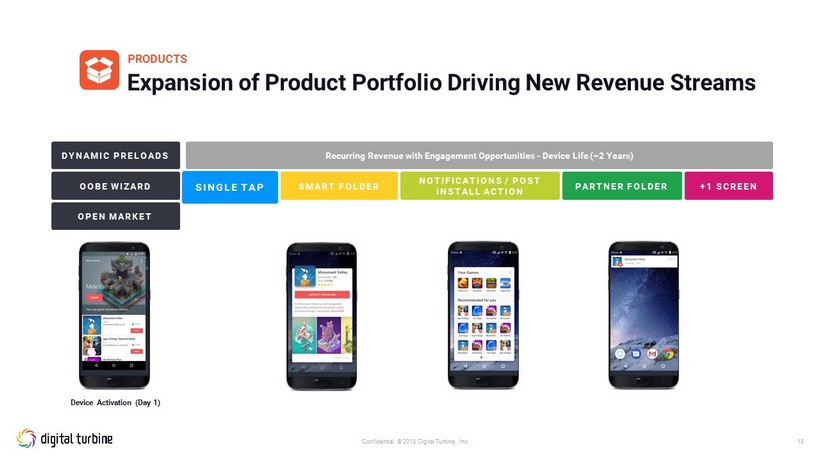

11 Confidential. © 2018 Digital Turbine, Inc. OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams Device Activation (Day 1) SINGLE TAP SMART FOLDER NOTIFICATIONS / POST INSTALL ACTION +1 SCREEN PARTNER FOLDER OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS DYNAMIC PRELOADS POST INSTALL ACTIONS

12 Confidential. © 2018 Digital Turbine, Inc. Dynamic Preloads • Designed to mimic the traditional factory preload experience • Frictionless user - experience, requiring no user interaction • Sponsored and partner applications installed seamlessly • Revenue maximized by real - time ad - serving technology • Dynamic OOBE may be paired with OOBE Wizard for a ’Blended’ flow PRODUCTS

Confidential. © 2018 Digital Turbine, Inc. • Rich media notifications and precise targeting drive increased conversion and revenue. • Shown to increase conversions by more than 100%. • Actions are configured on a per app basis. • Post Install Actions may be instant or delayed – e.g. 48 hours or 30 days. • Multiple apps can be configured with PIA, using staggered timing. Post Install Actions PRODUCTS

14 Confidential. © 2018 Digital Turbine, Inc. OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams DYNAMIC PRELOADS Device Activation (Day 1) SINGLE TAP SMART FOLDER NOTIFICATIONS / POST INSTALL ACTION +1 SCREEN PARTNER FOLDER OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS

15 Confidential. © 2018 Digital Turbine, Inc. Curated app list is presented to the user during new device set up. Enables users to opt - in and self - select which apps to install from a recommended selection. • Get discovered - capture users’ attention when they are focused on setting up their device for the first time. • Post install notifications available to prompt further user engagement. Out Of The Box Experience (OOBE) Wizard PRODUCTS

16 Confidential. © 2018 Digital Turbine, Inc. OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams DYNAMIC PRELOADS Device Activation (Day 1) SINGLE TAP SMART FOLDER NOTIFICATIONS / POST INSTALL ACTION +1 SCREEN PARTNER FOLDER OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS

17 Confidential. © 2018 Digital Turbine, Inc. When a customer using a Digital Turbine Platform enabled device registers on a carrier network, a custom experience can be delivered to that device – including but not limited to targeted notifications and application delivery without requiring user interaction. The operator may outline custom experiences on a per - device basis that are triggered when the user inserts a valid SIM card. Seamlessly deliver a signature experience to BYOD devices Open Market / BYOD PRODUCTS

18 Confidential. © 2018 Digital Turbine, Inc. OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams DYNAMIC PRELOADS Device Activation (Day 1) SMART FOLDER NOTIFICATIONS / POST INSTALL ACTION +1 SCREEN PARTNER FOLDER OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS SINGLE TAP

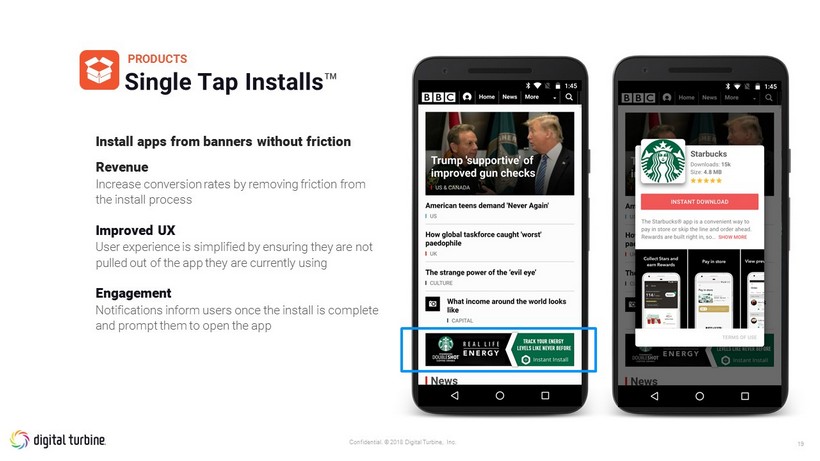

19 Confidential. © 2018 Digital Turbine, Inc. Revenue Increase conversion rates by removing friction from the install process Improved UX User experience is simplified by ensuring they are not pulled out of the app they are currently using Engagement N otifications inform user s once the install is complete and prompt them to open the app Install apps from banners without friction One Click Install removes friction and improves conversion expnentially Single Tap Installs ™ PRODUCTS

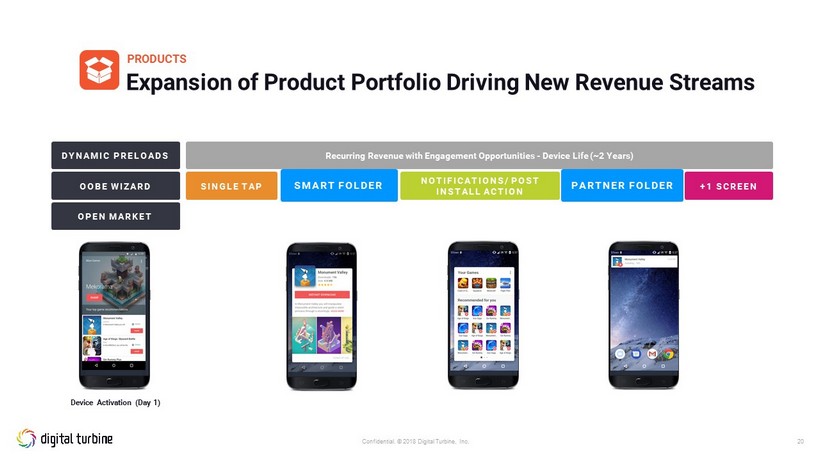

20 Confidential. © 2018 Digital Turbine, Inc. OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams DYNAMIC PRELOADS Device Activation (Day 1) SINGLE TAP SMART FOLDER NOTIFICATIONS/ POST INSTALL ACTION +1 SCREEN PARTNER FOLDER OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS PARTNER FOLDER

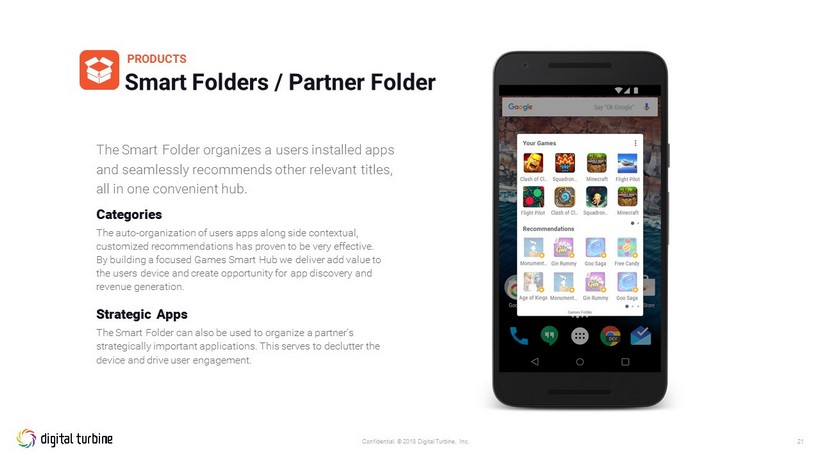

21 Confidential. © 2018 Digital Turbine, Inc. Categories The auto - organization of users apps along side contextual, customized recommendations has proven to be very effective. By building a focused Games Smart Hub we deliver add value to the users device and create opportunity for app discovery and revenue generation. Strategic Apps The Smart Folder can also be used to organize a partner’s strategically important applications. This serves to declutter the device and drive user engagement. The Smart Folder organizes a users installed apps and seamlessly recommends other relevant titles, all in one convenient hub. Smart Folders / Partner Folder PRODUCTS

22 Confidential. © 2018 Digital Turbine, Inc. PARTNER FOLDER OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams DYNAMIC PRELOADS Device Activation (Day 1) SINGLE TAP SMART FOLDER NOTIFICATIONS / POST INSTALL ACTION +1 SCREEN NOTIFICATIONS or OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS

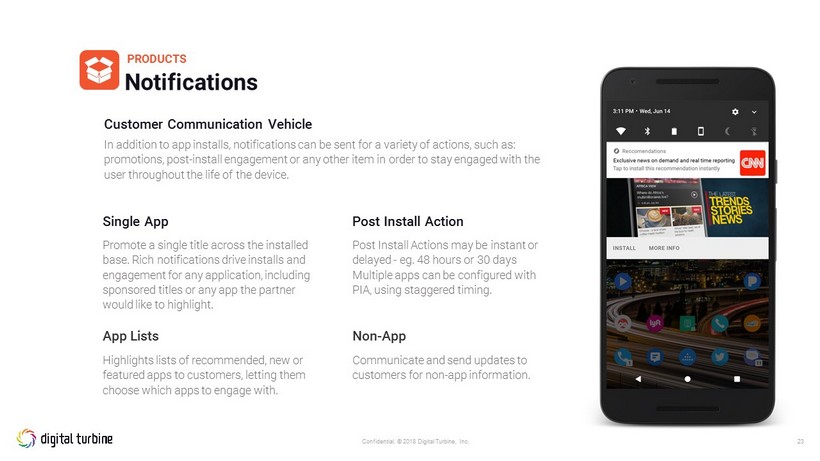

23 Confidential. © 2018 Digital Turbine, Inc. Single App Promote a single title across the installed base. Rich notifications drive installs and engagement for any application, including sponsored titles or any app the partner would like to highlight. Post Install Action Post Install Actions may be instant or delayed - eg . 48 hours or 30 days Multiple apps can be configured with PIA, using staggered timing . App Lists Highlights lists of recommended, new or featured apps to customers, letting them choose which apps to engage with. Non - App Communicate and send updates to customers for non - app information. In addition to app installs, notifications can be sent for a variety of actions, such as: promotions, post - install engagement or any other item in order to stay engaged with the user throughout the life of the device. Customer Communication Vehicle Notifications PRODUCTS

24 Confidential. © 2018 Digital Turbine, Inc. PARTNER FOLDER OOBE WIZARD Expansion of Product Portfolio Driving New Revenue Streams DYNAMIC PRELOADS Device Activation (Day 1) SINGLE TAP SMART FOLDER NOTIFICATIONS / POST INSTALL ACTION +1 SCREEN +1 SCREEN or OPEN MARKET Recurring Revenue with Engagement Opportunities - Device Life (~2 Years) PRODUCTS

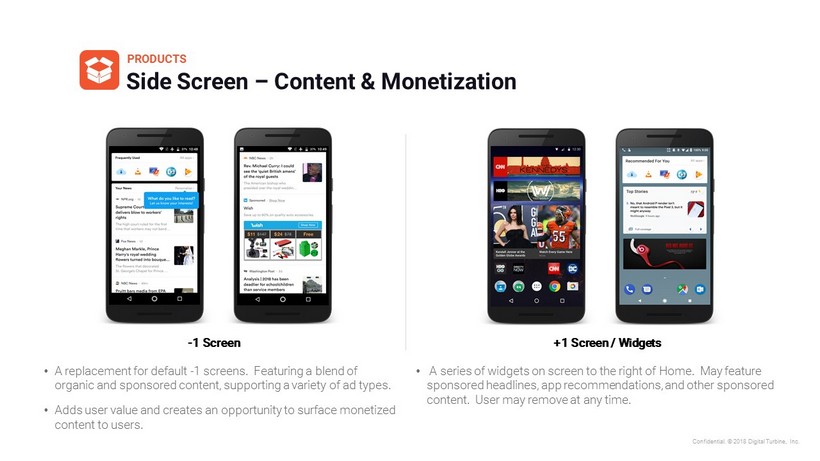

Confidential. © 2018 Digital Turbine, Inc. +1 Screen / Widgets • A series of widgets on screen to the right of Home. May feature sponsored headlines, app recommendations, and other sponsored content. User may remove at any time. - 1 Screen • A replacement for default - 1 screens. Featuring a blend of organic and sponsored content, supporting a variety of ad types. • Adds user value and creates an opportunity to surface monetized content to users. PRODUCTS Side Screen – Content & Monetization

The Supply Side Bill Stone

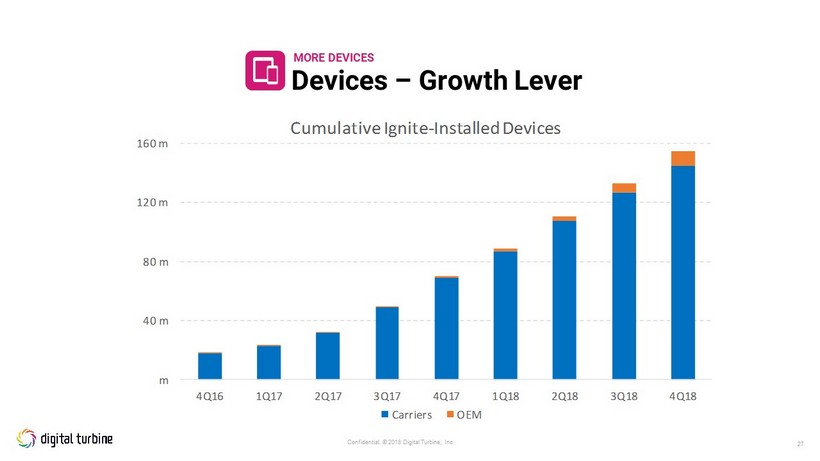

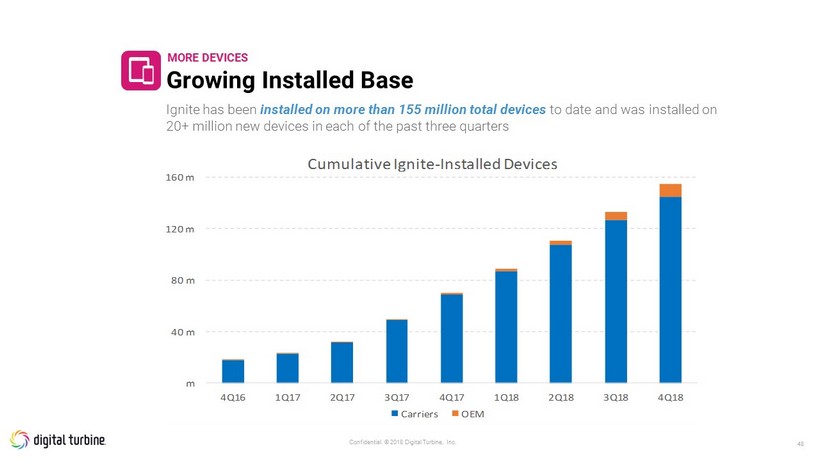

27 Confidential. © 2018 Digital Turbine, Inc. Devices – Growth Lever MORE DEVICES m 40 m 80 m 120 m 160 m 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 Cumulative Ignite - Installed Devices Carriers OEM

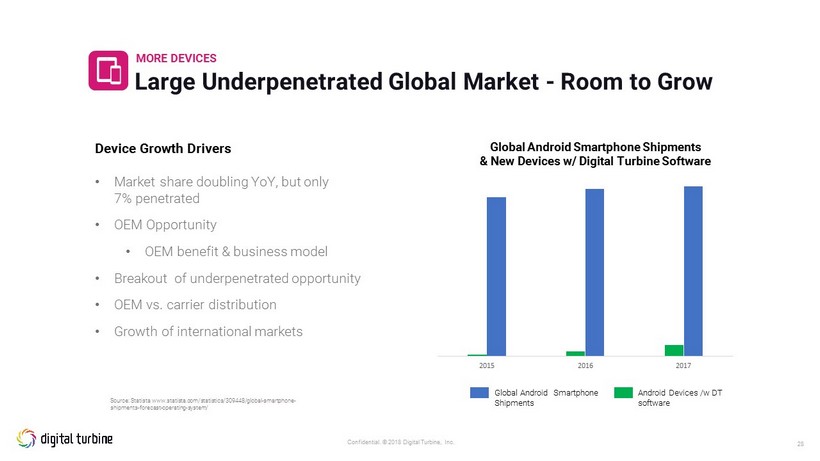

28 Confidential. © 2018 Digital Turbine, Inc. Large Underpenetrated Global Market - Room to Grow Device Growth Drivers • Market share doubling YoY, but only 7% penetrated • OEM Opportunity • OEM benefit & business model • Breakout of underpenetrated opportunity • OEM vs. carrier distribution • Growth of international markets Global Android Smartphone Shipments & New Devices w/ Digital Turbine Software Global Android Smartphone Shipments Android Devices /w DT software Source: Statista www.statista.com /statistics/309448/global - smartphone - shipments - forecast - operating - system/ 2015 2016 2017 MORE DEVICES

América Móvil Roberto L ópez Diaz

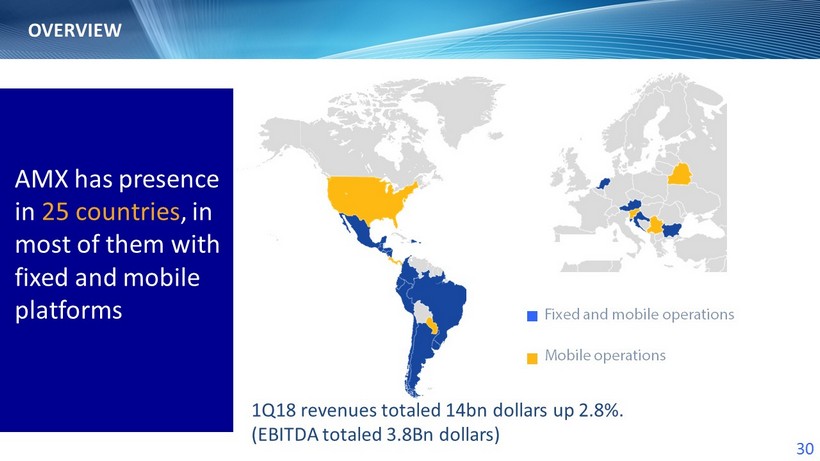

30 AMX has presence in 25 countries , in most of them with fixed and mobile platforms Fixed and mobile operations Mobile operations 1Q18 revenues totaled 14bn dollars up 2.8%. (EBITDA totaled 3.8Bn dollars) OVERVIEW

31 ABOUT AMERICA MOVIL • AMX is one of the largest integrated telcos in the world with 362 million accesses and operations in 25 countries . • 1Q18 revenues totaled 14bn dollars up 2.8% . (EBITDA totaled 3.8Bn dollars) • Our postpaid subscriber base was up 7.4% year - on - year • We are well diversified geographically (USA/LATAM/EUROPE) • Outside of China, AMX is the fourth largest company among global telecom companies in terms of wireless subscribers • We have 43% of the wireless market in Latin America • Near to 70% of smartphone penetration in Latin America • Data represents 54% of service revenues , • Data services in both, the mobile and fixed platforms, continue to drive revenue growth

América Móvil : Digital Strategy

33 Data Services are the new “Core Business” and we are working in new revenue sources DIGITAL STRATEGY Data Monetization Mobile Marketing Services and Content Enabler App Distribution IoT

34 Digital Turbine Relationship DIGITAL STRATEGY Why Digital Turbine • Global scale • Proven solution – top tier telecom adoption • Robust platform and products • Media & app ecosystem relationships Next Steps • Simplify operational approach • Deploying additional products

35 AMX and Digital Turbine DIGITAL STRATEGY • Strong relationships with other Carriers : Verizon … • • Revenue performance and experience in the field • Product and roadmap • APK vs SDK Improved functionality and performance • Single tap installs Incremental Revenue and better user experience • Notifications

36 AMX and Digital Turbine – Operations upate DIGITAL STRATEGY • Headwinds • SDK slow to deploy due to integration with contenedor • Advertisement revenue slow to ramp up. LATAM market not yet educated • Tailwinds • Lots of devices • Improvement in local & global campaigns • APK and new features that will allow new revenue streams

América Móvil : Gracias!

Q&A – Product & Platform

Coffee Break

The Demand Side Matt Tubergen, EVP Digital Turbine Media

41 Confidential. © 2018 Digital Turbine, Inc.

Fireside Discussion with Yelp & Oath Matt Tubergen, EVP Digital Turbine Media Guest Panelists David McKie , Yelp and Alexander Matthews, Oath

Financial Overview Barrett Garrison, CFO

44 Confidential. © 2018 Digital Turbine, Inc. Financial Overview Outline • SOX Compliance & Wells Notice Update • Strong Revenue Growth ⁃ Proliferation of Digital Turbine Platform Enabled Devices ⁃ Additional Platform Product Offerings ⁃ Increased Advertiser Demand/Revenue Per Device • Margin Expansion & Operating Leverage in the Model • Free Cash Flow Generation • Balance Sheet Summary

45 Confidential. © 2018 Digital Turbine, Inc. SOX Compliance & Wells Notice • Fully SOX Compliant as of FYE 2018 • Prior “material weaknesses”, which formed the basis for an informal SEC inquiry, have now been fully remediated • SEC - Issued Wells Notice • Given proposed settlement terms, the resolution of this matter is unlikely to have a material impact on the Company or its financial position

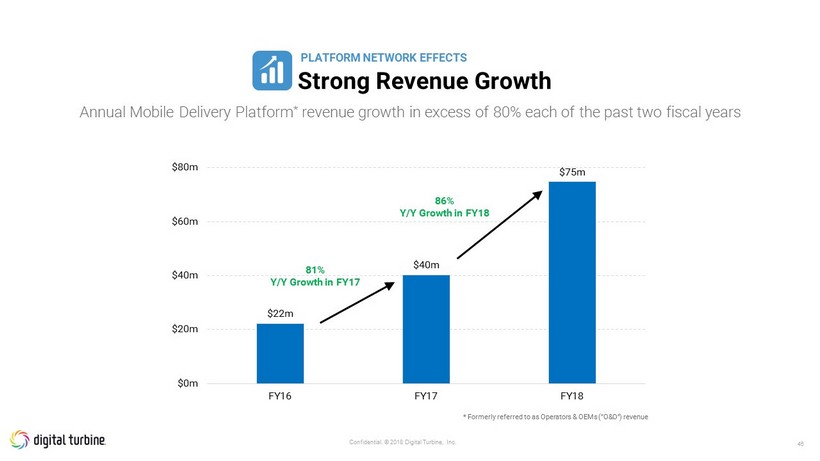

46 Confidential. © 2018 Digital Turbine, Inc. $22m $40m $75m $0m $20m $40m $60m $80m FY16 FY17 FY18 86% Y/Y Growth in FY18 81% Y/Y Growth in FY17 Strong Revenue Growth Annual Mobile Delivery Platform * revenue growth in excess of 80% each of the past two fiscal years * Formerly referred to as Operators & OEMs (”O&O”) revenue PLATFORM NETWORK EFFECTS

47 Confidential. © 2018 Digital Turbine, Inc. Advertiser Demand New Products More Devices x = Platform Network Effects Growth Drivers Multiple levers to drive accelerated growth x

48 Confidential. © 2018 Digital Turbine, Inc. Growing Installed Base Ignite has been installed on more than 155 million total devices to date and was installed on 20+ million new devices in each of the past three quarters MORE DEVICES m 40 m 80 m 120 m 160 m 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 Cumulative Ignite - Installed Devices Carriers OEM

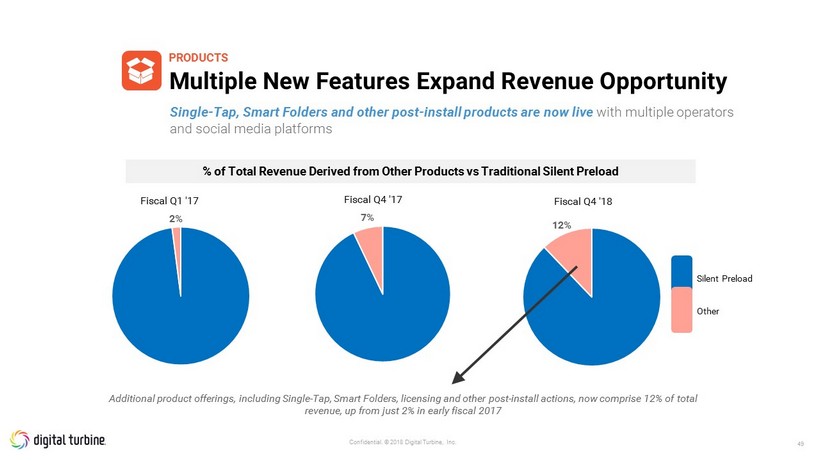

49 Confidential. © 2018 Digital Turbine, Inc. Multiple New Features Expand Revenue Opportunity Single - Tap, Smart Folders and other post - install products are now live with multiple operators and social media platforms 2% Fiscal Q1 '17 7% Fiscal Q4 '17 12% Fiscal Q4 '18 Additional product offerings, including Single - Tap, Smart Folders, licensing and other post - install actions, now comprise 12% of total revenue, up from just 2% in early fiscal 2017 % of Total Revenue Derived from Other Products vs Traditional Silent Preload Silent Preload Other PRODUCTS

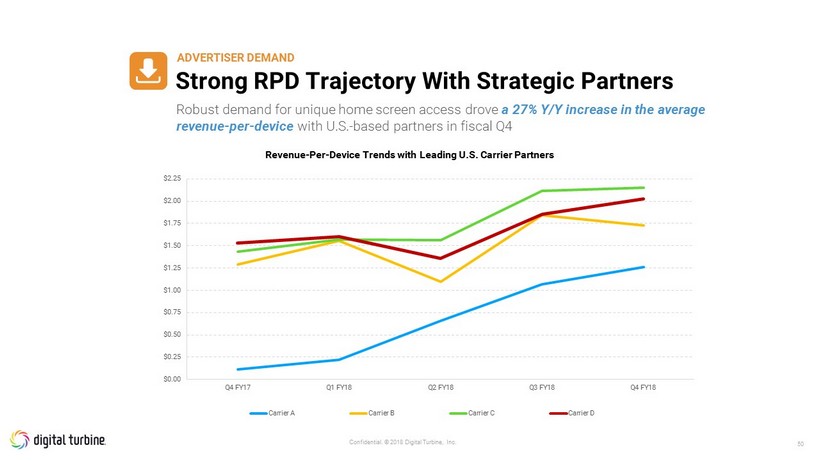

50 Confidential. © 2018 Digital Turbine, Inc. Revenue - Per - Device Trends with Leading U.S. Carrier Partners $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 Q4 FY17 Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18 Carrier A Carrier B Carrier C Carrier D Strong RPD Trajectory With Strategic Partners Robust demand for unique home screen access drove a 27% Y/Y increase in the average revenue - per - device with U.S. - based partners in fiscal Q4 ADVERTISER DEMAND

51 Confidential. © 2018 Digital Turbine, Inc. Multiple drivers of growth combine to create a $300m opportunity in 3 - 5 years , representing an implied CAGR of 30 - 60% Longer - Term Growth Targets Current Annual Rate (TTM) 3 - 5 Year Growth Targets U.S. ROW Total U.S. ROW Total # of Annual New Devices 45 million 39 million 85 million 75 million 150 million 225 million RPD – Silent* $1.50 $0.17 $0.88 $2.25 $0.30 $0.95 RPD - Added Products $0.00 $0.00 $0.00 $0.75 $0.20 $0.38 Total RPD $1.50 $0.17 $0.88 $3.00 $0.50 $1.33 Total Annual Revenue $68 million $7 million $75 million $225 million $75 million $300 million Android Market Share** 7% 17% * Silent revenue includes nominal revenue from other products in current view ** Based on market data provided by Statista PLATFORM NETWORK EFFECTS

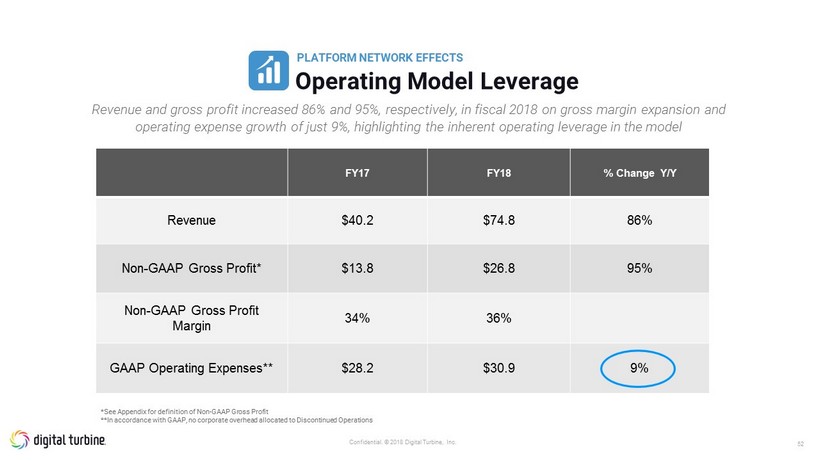

52 Confidential. © 2018 Digital Turbine, Inc. Revenue and gross profit increased 86% and 95%, respectively, in fiscal 2018 on gross margin expansion and operating expense growth of just 9%, highlighting the inherent operating leverage in the model Operating Model Leverage FY17 FY18 % Change Y/Y Revenue $40.2 $74.8 86% Non - GAAP Gross Profit* $13.8 $26.8 95% Non - GAAP Gross Profit Margin 34% 36% GAAP Operating Expenses** $28.2 $30.9 9% *See Appendix for definition of Non - GAAP Gross Profit **In accordance with GAAP, no corporate overhead allocated to Discontinued Operations PLATFORM NETWORK EFFECTS

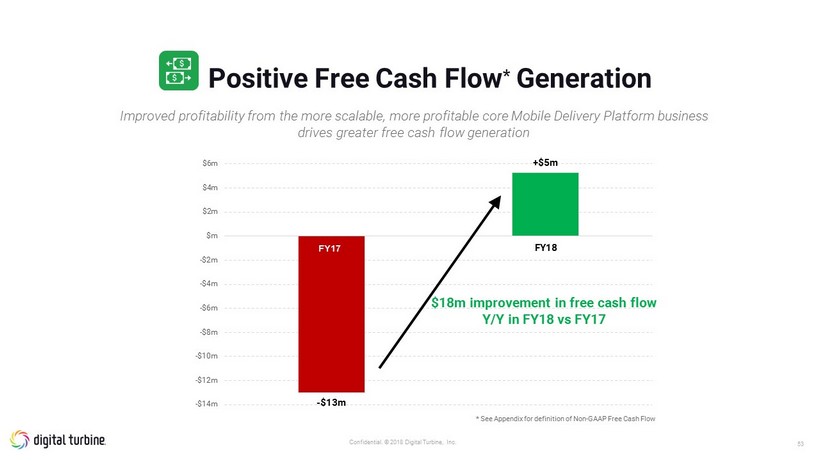

53 Confidential. © 2018 Digital Turbine, Inc. Improved profitability from the more scalable, more profitable core Mobile Delivery Platform business drives greater free cash flow generation Positive Free Cash Flow * Generation - $13m +$5m -$14m -$12m -$10m -$8m -$6m -$4m -$2m $m $2m $4m $6m FY17 FY18 $18m improvement in free cash flow Y/Y in FY18 vs FY17 * See Appendix for definition of Non - GAAP Free Cash Flow FY17

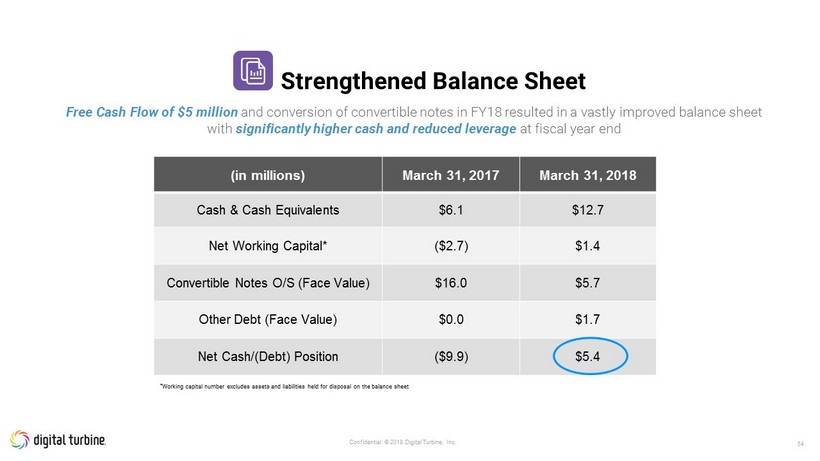

54 Confidential. © 2018 Digital Turbine, Inc. (in millions) March 31, 2017 March 31, 2018 Cash & Cash Equivalents $6.1 $12.7 Net Working Capital* ($2.7) $1.4 Convertible Notes O/S (Face Value) $16.0 $5.7 Other Debt (Face Value) $0.0 $1.7 Net Cash/(Debt) Position ($9.9) $5.4 Strengthened Balance Sheet Free Cash Flow of $5 million and conversion of convertible notes in FY18 resulted in a vastly improved balance sheet with significantly higher cash and reduced leverage at fiscal year end * Working capital number excludes assets and liabilities held for disposal on the balance sheet

55 Confidential. © 2018 Digital Turbine, Inc. Appendix: Non - GAAP Measures of Performance • Non - GAAP Gross Profit is defined as GAAP gross profit adjusted to exclude the effect of the amortization of intangibles and depreciation of software. • Non - GAAP Free Cash Flow is calculated as GAAP cash flow from continuing operations less capital expenditures.

Q&A Thank you