Mandalay Digital Group, Inc.

Appia Transaction Presentation

November 13, 2014

Exhibit 99.3 |

Mandalay Digital Group, Inc.

Appia Transaction Presentation

November 13, 2014

Exhibit 99.3 |

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 2

Safe Harbor Statements.

Use of Non-GAAP Financial Measures.

Statements in this presentation that are not statements of historical fact and

that concern future results from operations, financial position, economic

conditions, product releases, revenue and product synergies, cost savings,

product or competitive enhancements and any other statement that may be

construed as a prediction of future performance or events, including that

Appia's technology will enhance Mandalay Digital's existing products or

foster new technology innovation, perceived benefits from the business

combination to the surviving company, or that the acquisition will result in

increased revenue, cost savings and better competitive position, or that

Mandalay Digital will successfully integrate Appia’s technology, are

forward-looking statements that speak only as of the date made and which

involve known and unknown risks, uncertainties and other factors which may,

should one or more of these risks uncertainties or other factors

materialize, cause actual results to differ materially from those expressed or

implied by such statements. These factors include the occurrence of any

event, change or other circumstances that could give rise to the

termination of the merger agreement; the inability to complete the merger

within the expected time period or at all, including due to the failure to

obtain stockholder approval, or the failure to satisfy other conditions to

completion of the merger; risks related to disruption of management’s

attention from the ongoing business operations due to the proposed merger;

the effect of the announcement of the proposed merger on Mandalay’s or

Appia’s relationships with their respective customers, lenders,

operating results and businesses generally; material adverse changes in

Mandalay Digital’s or Appia’s operations or financial results prior to closing; the ability

to expand the combined company’s global reach, accelerate growth and create a

scalable, low-capex business model that drives EBITDA; failure to

realize anticipated operational efficiencies, revenue (including projected

revenue) and cost synergies and resulting revenue growth, EBITDA and free

cash flow conversion if the merger is consummated; the ability to achieve

internal strategic forecasts; inability to refinance the assumed Appia debt

subsequent to the closing or to refinance the debt on favorable terms; unforeseen

challenges related to relationships with operators, publishers and advertisers and

expanding and maintaining those relationships; the ability to execute upon,

and realize any benefits from, potential value creation opportunities

through strategic relationships in the future or at all, including the

ability to leverage advertising opportunities effectively and increase

revenue streams for carriers; unforeseen difficulties preventing rapid

integration of Appia’s app-install infrastructure into Digital Turbine’s existing

platform; the inherent and deal specific challenges in converting discussions with

carriers into actual contractual relationships; the Company’s ability

as a smaller company to manage international, and as a result of the

proposed merger, larger operations, varying and often unpredictable levels

of orders, the challenges inherent in technology development necessary to

maintain the Company’s competitive advantage ; the potential for

unforeseen or underestimated cash requirements necessary to enable

the transaction synergies to be realized, and other risks including those

described from time to time in Mandalay Digital Group's filings on Forms

10-K and 10-Q with the SEC, press releases and other

communications. You should not place undue reliance on these

forward-looking statements. The company does not undertake to update

forward- looking statements, whether as a result of new information,

future events or otherwise, except as required by law. Adjusted EBITDA is

calculated as income (loss) from continuing operations before interest

expense, foreign exchange gains (losses), financing and related expenses, debt

discount and debt settlement expense, gain or loss on extinguishment of debt,

acquisition and integration costs, income taxes, asset impairment charges,

depreciation and amortization, stock-based compensation expense,

change in fair value of derivatives, and accruals for discretionary

bonuses. Since Adjusted EBITDA is a non-GAAP measure that does not

have a standardized meaning, it may not be comparable to similar measures

presented by other companies. Readers are cautioned that Adjusted EBITDA

should not be construed as an alternative to net income (loss) determined in

accordance with U.S. GAAP as an indicator of performance, which is the

most comparable measure under GAAP. Adjusted EBITDA is used by management

as an internal measure of profitability. We have included Adjusted EBITDA

because we believe that this measure is used by certain investors to assess

our financial performance before non-cash charges and certain costs

that we do not believe are reflective of our underlying business. A

reconciliation of Adjusted EBITDA to U.S. GAAP net income is expected to be

included in the press release announcing the results of our second fiscal

quarter, however such reconciliation to future net income is not currently

available without unreasonable effort. The information that is unavailable

is primarily asset impairment and expenses related to stock-based

compensation; it is probable that when such amounts are available they

will result in a significant GAAP net loss for our second fiscal quarter

notwithstanding our expected Adjusted EBITDA results. This communication

is for informational purposes only and is neither an offer to purchase, nor

a solicitation of an offer to sell, subscribe for or buy any securities or

the solicitation of any vote in any jurisdiction pursuant to the proposed

transactions or otherwise, nor shall there be any sale, issuance or transfer

of securities in any jurisdiction in contravention of applicable law. No

offer of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as

amended. |

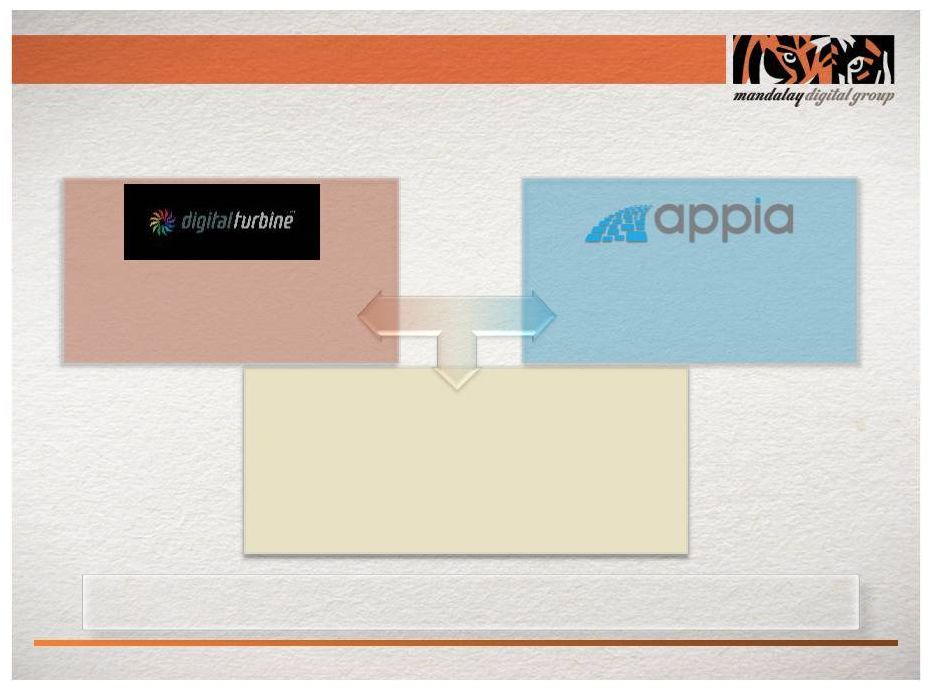

Digital Turbine + Appia:

Investment Highlights

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 3

Capturing window of opportunity to accelerate scale in

exploding market

•

Mandalay Digital and Appia

combine to create single, unique, mobile app and ad

ecosystem –

Name to change to Digital Turbine

•

Transforms competitive positioning through vertical integration

•

Mandalay stock to be issued at agreed-upon price of $4.50/share

–

Appia

investors to receive a number of shares equivalent to $100 million less debt and

expenses at agreed-upon value

•

Opportunity to achieve up to $14 million in revenue and ~$2 million cost

synergies •

Adds scale and accelerates ad revenue and existing DT product growth

•

Enhances MNDL’s financial profile: Appia

stakeholders becoming key new MNDL

investors |

Strategic Rationale: Transformation

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 4

Tremendous

opportunity in

exploding

marketplace*

•

$38 billion mobile app+ad market expected to grow 25 CAGR%

•

Smartphones

still

only

30%

of

global

user

base

–

but

growing*

•

86%

of

smartphone

users’

time

spent

in

apps

•

Wireless operators have most to gain and most to lose from monetizing

mobile

apps

–

away

from

Google

and

Facebook

Competitive

Positioning -

Enhances

revenue

opportunity for

operators

•

Vertically integrates DT’s distribution platform with Appia, #1 independent

mobile app advertising company

•

Appia fits hand-in-glove with MNDL app installation growth

•

Combines complementary customer bases, including Telcel Mexico, Claro in

South America and Metro PCS in US

•

Accelerates

growth

for

both

companies

–

ads

and

DT

product

suite

•

Diversification of revenue streams; operators major part of stream, but not

entire stream

Adds scale and

talent pool with

deep expertise

•

Access to leading publishers and advertisers in a single marketplace

•

Global

reach

with

active

campaigns

in

over

200

countries

–

in

all

major

formats

•

Gaining control of ad tech capabilities to help ensure execution

*Sources: @KPCB - Global Mobile App revenue per Strategy Analytics;

comprises virtual goods, in-app advertising, subscription and download

revenue. Global Mobile Advertising revenue per PWC; comprises browser,

search and classified advertising revenue- and Flurry.

|

MANDALAY DIGITAL GROUP, INC

Premium demand for customers

Ignite –

IQ

Content -

Pay

20+ global carrier partners

Premium supply of advertisers

210+ publishers

100+ advertisers and agencies

Traffic in 200+ countries globally

1BB+ users across multiple carriers

Delivers single app-driven ecosystem to

carriers to generate new revenue streams

Largest non-incentivized engine

Global

Highest LTV publishers

Vertically integrated

Leveraging App explosion

Capitalizing on RTB

Combined company

Peerless, Agnostic Value Proposition

Peerless, Agnostic Value Proposition

©

2014 Mandalay Digital Group, Inc.

Page 5 |

Deal Structure and Economics

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 6

•

Issuing approximately 19 million shares (assumes CQ115 close)

•

Jud Bowman, CEO Appia

•

Trident Capital

•

Venrock

•

DCM

•

Noro-Moseley

•

Wakefield Group

•

Relay Ventures

•

Eric Schmidt’s TomorrowVentures

•

Assumption of ~$10 million debt (Silicon Valley Bank and North Atlantic

Capital) •

Plan to refinance assumed indebtedness following closing

Shares to be issued are

subject to lockup agreements

Smart Money to Hold Significant Stake in Company

Smart Money to Hold Significant Stake in Company |

Financial Rationale Compelling

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 7

Financial Profile

•

Appia recorded $30 million revenue for twelve months ended 9/30/14

•

Expected to enhance gross profit and EBITDA profile through revenue and

cost synergies

Revenue and cost

synergies

•

Opportunity to achieve up to $14 million revenue synergies on app-installs

currently projected to be sourced by third parties, including Appia

•

Mandalay to capture third-party ad partner feeds

•

Approximately $2 million in expected cost synergies from campaign

management, CPI-infrastructure functions, duplicative corporate

headcount

Business Model

•

Combining complementary, scalable, low-capex business models

•

Direct access to advertisers boosts revenue profile

•

Drives incremental EBITDA/FCF

Integration

•

Eased by existing partnership and retention of Appia expert resources

•

App-install infrastructure and platform integrates immediately

•

Identified cost synergies

•

Appia founder and CEO Jud Bowman joining Mandalay board

|

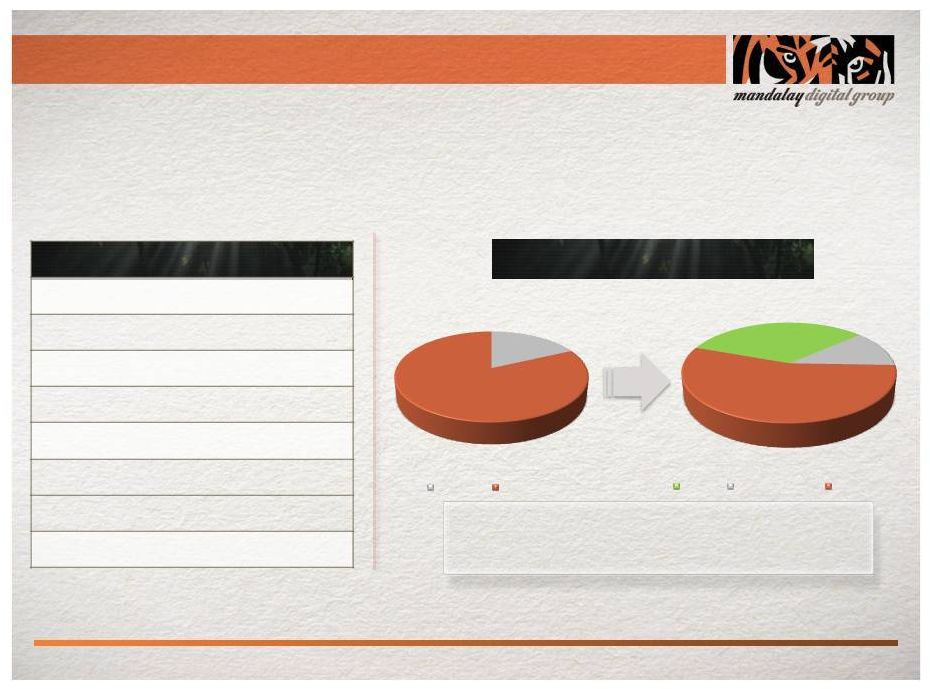

Pro

Forma: Board of Directors and Equity Ownership Structure

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 8

Board Composition Post Close

Rob Deutschman, Chairman

Peter Guber

Paul Schaeffer

Chris Rogers

Jeff Karish

Bill Stone

Jud Bowman

Additional Appia appointee

Equity Ownership Structure

Increased ownership by senior

executive/founders and long-term

strategic investors

18%

82%

% Shares Held Today

Insiders

Public Float

33%

12%

55%

% Shares Held Post Close

Appia

Other insiders

Public Float |

Transaction Process

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 9

Step

Expected Timing

Filing s-4

Thanksgiving

SEC Feedback

Christmas –

January

MNDL Shareholder Vote

20 business days after SEC clearance

Closing

Estimated first calendar quarter 2015 |

Summary

MANDALAY DIGITAL GROUP, INC.

©

2014 Mandalay Digital Group, Inc.

Page 10

•

Transformational acquisition expected to close C’Q115

•

Capturing window of opportunity to accelerate scale in

exploding market |

Additional Information

Thursday, 13 November 2014

Page 11

Additional Information and Where to Find It

In connection with the proposed transaction, Mandalay Digital intends to file

with the Securities and Exchange Commission (SEC) a registration statement

on Form S-4 that will include a proxy statement and a prospectus. The definitive proxy

statement/prospectus will contain important information about the proposed

transaction and related matters. INVESTORS AND SECURITY HOLDERS ARE

ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE,

BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may

obtain a free copy of the registration statement (when available) and

other documents filed by Mandalay Digital with the SEC at the SEC’s web site at

www.sec.gov. These documents may be accessed and downloaded for free at Mandalay

Digital’s website at www.mandalaydigital.com,

or

requested

from

Mandalay

Digital

by

mail

at

2811

Cahuenga

Boulevard

West,

Los

Angeles,

CA

90068, or by directing a request to MacKenzie Partners, Inc., 105, Madison

Avenue, New York, New York, 10016, (212)

929-5500,

proxy@mackenziepartners.com

.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of

Mandalay Digital. However, Mandalay Digital and its directors and

executive officers and certain members of management and employees may be deemed to be participants in the

solicitation of proxies from Mandalay Digital’s stockholders in respect of

the proposed transaction. Information regarding the directors

and

executive

officers

of

Mandalay

may

be

found

in

its

Form

10-K/A

for

the

fiscal

period

ended

March

31,

2014,

which

was filed with the SEC on July 29, 2014. Other information regarding the

interests of those persons and other persons in the proxy solicitation and

a description of their direct and indirect interest, by security holdings or otherwise, will be contained in the proxy

statement/prospectus and other relevant materials to be filed with the SEC when

they become available. You may obtain free copies of this document

as described in the preceding paragraph. MANDALAY DIGITAL GROUP, INC.

|

Digital Turbine |