Mobile Posse Acquisition Summary March 2020

Safe Harbor Statement

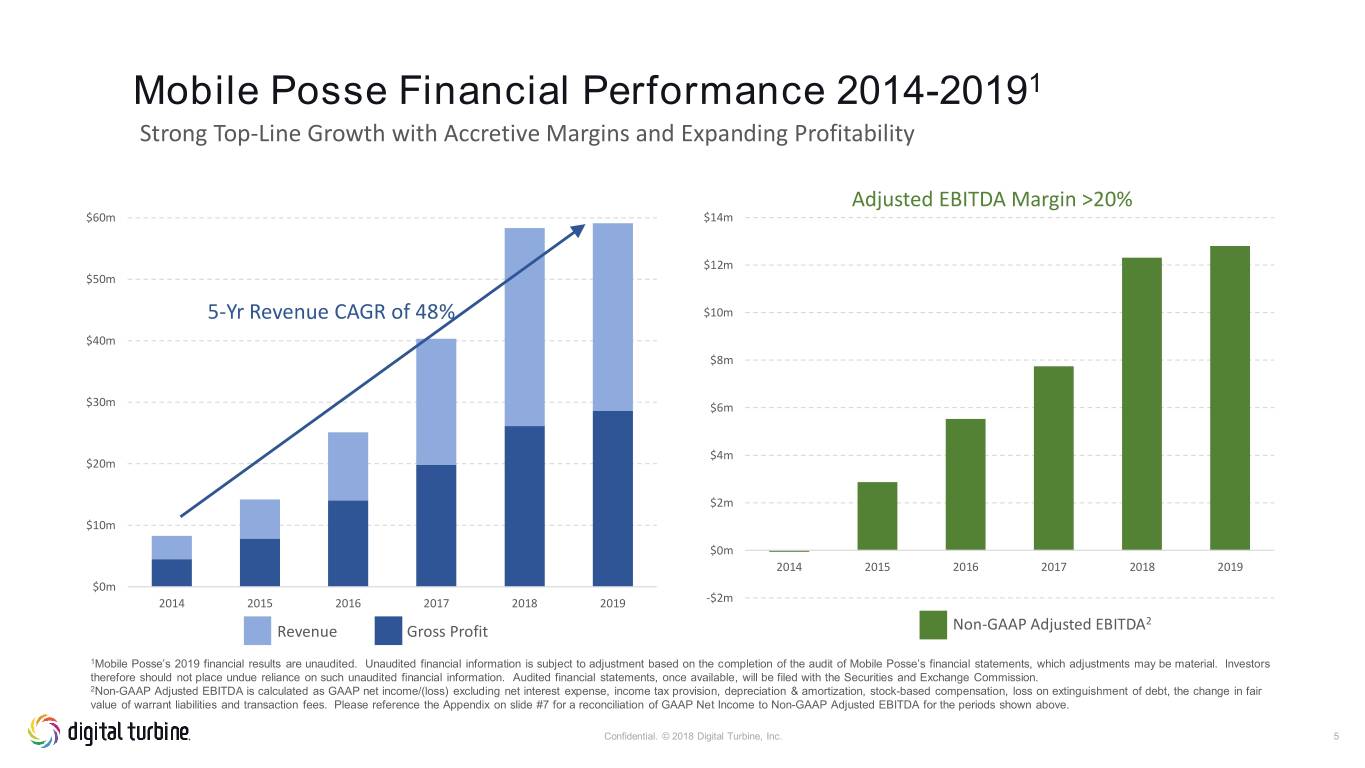

Mobile Posse Acquisition Factsheet ❑ Terms of the Acquisition ❑ Digital Turbine’s acquisition of Mobile Posse was completed on February 28, 2020 ❑ Estimated total purchase consideration is $66.0 million, including $41.5 million in cash paid at closing and an estimated earn- out of $24.5 million ❑ No share issuance or equity dilution as part of transaction ❑ The Mobile Posse Business ❑ Founded in 2005, Mobile Posse has ~65 highly talented employees with HQ in Alexandria, VA ❑ Established content discovery platform provides valuable media & advertising solutions for operator & OEM partners while delivering richer, more relevant content to end users. ❑ Achieved 2019 revenue of $59.1 million1, GAAP Net Income of $4.5 million1 and Non-GAAP Adjusted EBITDA of $12.8 million2; rapid revenue and profitability growth over the past 5+ years ❑ Highly profitable, recurring business model with gross margins approaching 50% and EBITDA margins in excess of 20% ❑ The Synergistic Rationale Behind the Acquisition ❑ Expected to be immediately financially accretive with favorable impact on blended profitability margins ❑ Further diversifies the DT Mobile Platform by adding new partners and enhanced product capabilities ❑ Promising cross-selling opportunities given respective partnerships and products 1Mobile Posse’s 2019 financial results are unaudited. Unaudited financial information is subject to adjustment based on the completion of the audit of Mobile Posse’s financial statements, which adjustments may be material. Investors therefore should not place undue reliance on such unaudited financial information. Audited financial statements, once available, will be filed with the Securities and Exchange Commission. 2Non-GAAP Adjusted EBITDA is calculated as GAAP net income/(loss) excluding net interest expense, income tax provision, depreciation & amortization, stock-based compensation, loss on extinguishment of debt, the change in fair value of warrant liabilities and transaction fees. Please reference the Appendix on slide #7 for a reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA. Confidential. © 20182019 Digital Turbine, Inc. 3

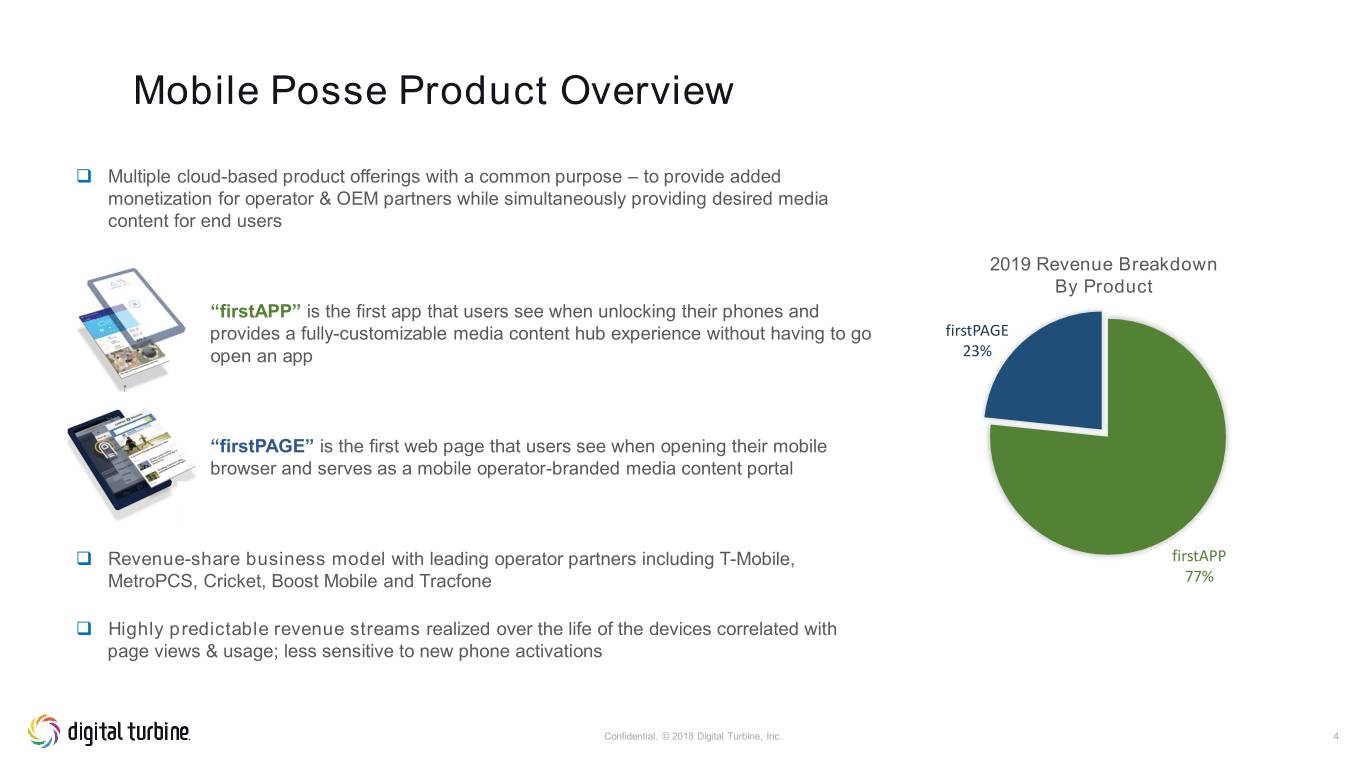

Mobile Posse Product Overview ❑ Multiple cloud-based product offerings with a common purpose – to provide added monetization for operator & OEM partners while simultaneously providing desired media content for end users 2019 Revenue Breakdown By Product ❑ “firstAPP” is the first app that users see when unlocking their phones and provides a fully-customizable media content hub experience without having to go firstPAGE open an app 23% ❑ “firstPAGE” is the first web page that users see when opening their mobile browser and serves as a mobile operator-branded media content portal ❑ Revenue-share business model with leading operator partners including T-Mobile, firstAPP MetroPCS, Cricket, Boost Mobile and Tracfone 77% ❑ Highly predictable revenue streams realized over the life of the devices correlated with page views & usage; less sensitive to new phone activations Confidential. © 2018 Digital Turbine, Inc. 4

Mobile Posse Financial Performance 2014-20191 Strong Top-Line Growth with Accretive Margins and Expanding Profitability Adjusted EBITDA Margin >20% $60m $14m $12m $50m 5-Yr Revenue CAGR of 48% $10m $40m $8m $30m $6m $4m $20m $2m $10m $0m 2014 2015 2016 2017 2018 2019 $0m 2014 2015 2016 2017 2018 2019 -$2m 2 Revenue Gross Profit Non-GAAP Adjusted EBITDA 1Mobile Posse’s 2019 financial results are unaudited. Unaudited financial information is subject to adjustment based on the completion of the audit of Mobile Posse’s financial statements, which adjustments may be material. Investors therefore should not place undue reliance on such unaudited financial information. Audited financial statements, once available, will be filed with the Securities and Exchange Commission. 2Non-GAAP Adjusted EBITDA is calculated as GAAP net income/(loss) excluding net interest expense, income tax provision, depreciation & amortization, stock-based compensation, loss on extinguishment of debt, the change in fair value of warrant liabilities and transaction fees. Please reference the Appendix on slide #7 for a reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA for the periods shown above. Confidential. © 2018 Digital Turbine, Inc. 5

Strategic Rationale Behind the Mobile Posse Acquisition What are the benefits to Digital Turbine and its shareholders? ❑ Complementary Products That Further Strengthen & Differentiate the DT Mobile Platform ❑ Reinforces competitive advantages via expansion of product capabilities and greater economies of scale with mobile content providers ❑ Inheriting a talented team of Mobile Posse product engineers and mobile advertising technology/personnel ❑ Familiar Revenue-Share Partnership Model with Attractive Recurring Revenue Features ❑ Long-term exclusive contracts with leading U.S. operators; revenue-share model aligns interests and yields predictable gross margins ❑ Revenue streams are more predictably generated via user interaction over the life of the device; less susceptible to new device activations ❑ Further Diversification of the Digital Turbine Business Model by Source Partner & Product ❑ Extends platform functionalities beyond core App Install market and adds highly strategic new partners, including T-Mobile/MetroPCS ❑ Following the acquisition, no single operator or OEM partner should be responsible for >30% of expected total revenue and non-Dynamic Install revenue should exceed 40% of expected total revenue ❑ Immediate Financial Benefits ❑ Accretive from Day One – highly profitable business model that will positively influence blended profitability margins ❑ Fully funded via cash on hand, attractively-priced debt capital and forward free cash flow; no equity dilution ❑ Significant Medium-Term Cross-Marketing Opportunities ❑ Promising new growth opportunities for the combined business via cross-marketing with respective partners and distribution footprints ❑ Ability to integrate products and onboard Mobile Posse products to existing Digital Turbine partners and vice versa Confidential. © 20182019 Digital Turbine, Inc. 6

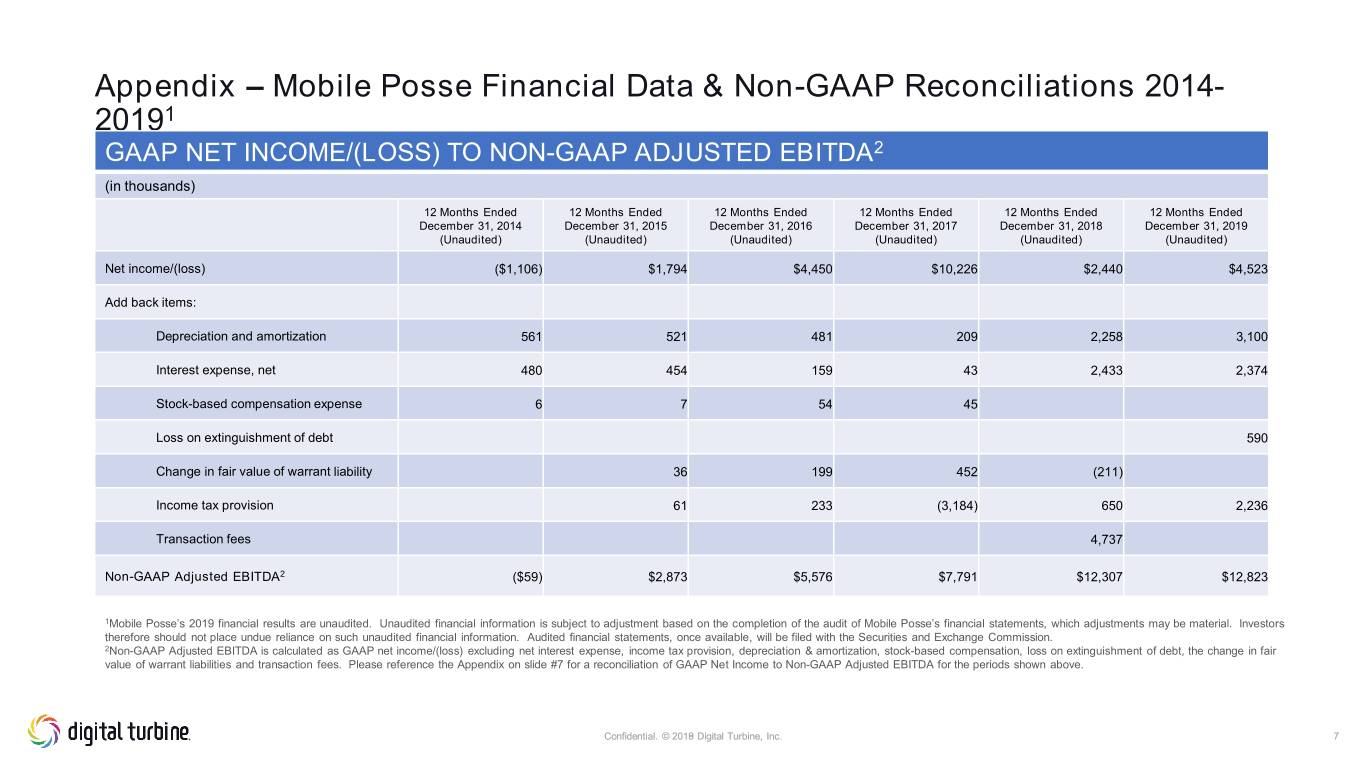

Appendix – Mobile Posse Financial Data & Non-GAAP Reconciliations 2014- 20191 GAAP NET INCOME/(LOSS) TO NON-GAAP ADJUSTED EBITDA2 (in thousands) 12 Months Ended 12 Months Ended 12 Months Ended 12 Months Ended 12 Months Ended 12 Months Ended December 31, 2014 December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 December 31, 2019 (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) Net income/(loss) ($1,106) $1,794 $4,450 $10,226 $2,440 $4,523 Add back items: Depreciation and amortization 561 521 481 209 2,258 3,100 Interest expense, net 480 454 159 43 2,433 2,374 Stock-based compensation expense 6 7 54 45 Loss on extinguishment of debt 590 Change in fair value of warrant liability 36 199 452 (211) Income tax provision 61 233 (3,184) 650 2,236 Transaction fees 4,737 Non-GAAP Adjusted EBITDA2 ($59) $2,873 $5,576 $7,791 $12,307 $12,823 1Mobile Posse’s 2019 financial results are unaudited. Unaudited financial information is subject to adjustment based on the completion of the audit of Mobile Posse’s financial statements, which adjustments may be material. Investors therefore should not place undue reliance on such unaudited financial information. Audited financial statements, once available, will be filed with the Securities and Exchange Commission. 2Non-GAAP Adjusted EBITDA is calculated as GAAP net income/(loss) excluding net interest expense, income tax provision, depreciation & amortization, stock-based compensation, loss on extinguishment of debt, the change in fair value of warrant liabilities and transaction fees. Please reference the Appendix on slide #7 for a reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA for the periods shown above. Confidential. © 20182019 Digital Turbine, Inc. 7