Mobile Posse, Inc.

Financial Statements

and Independent Auditor's Report

December 31, 2019 and 2018

Page

Independent Auditor's Report | 2 |

Financial Statements

Balance Sheets | 4 |

Statements of Income | 5 |

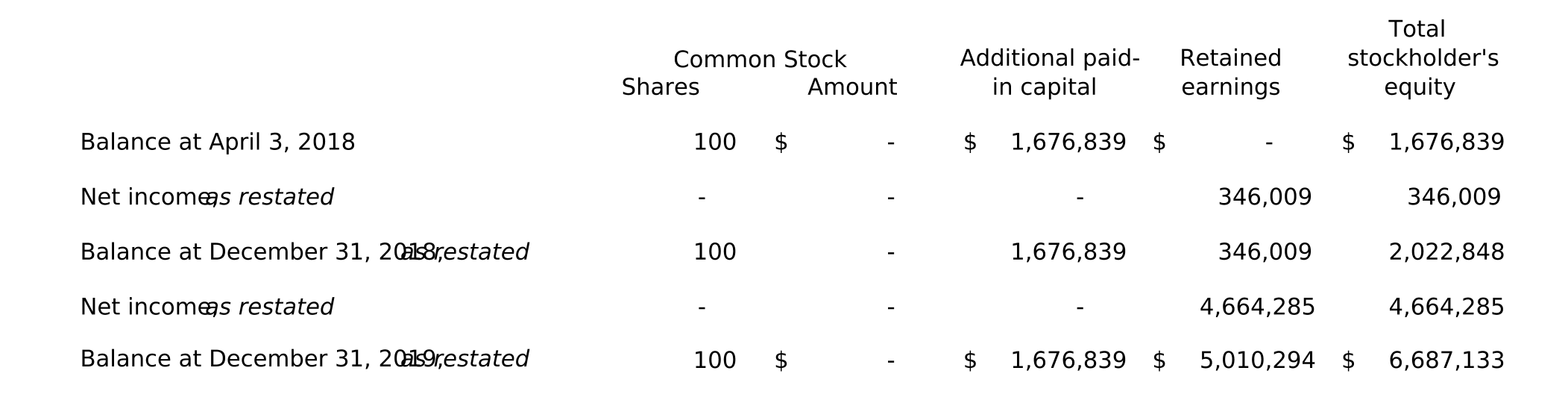

Statements of Stockholder's Equity | 6 |

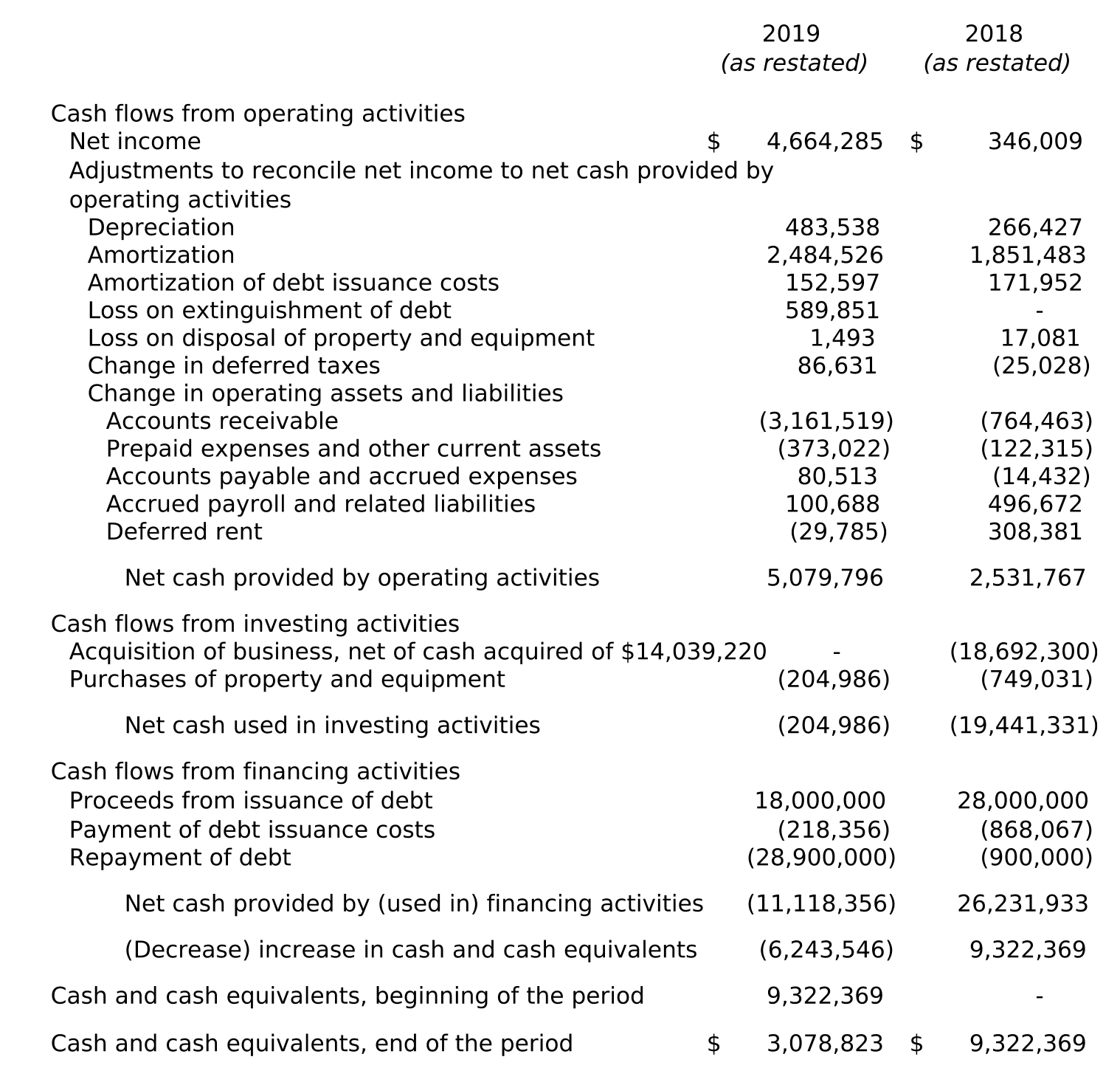

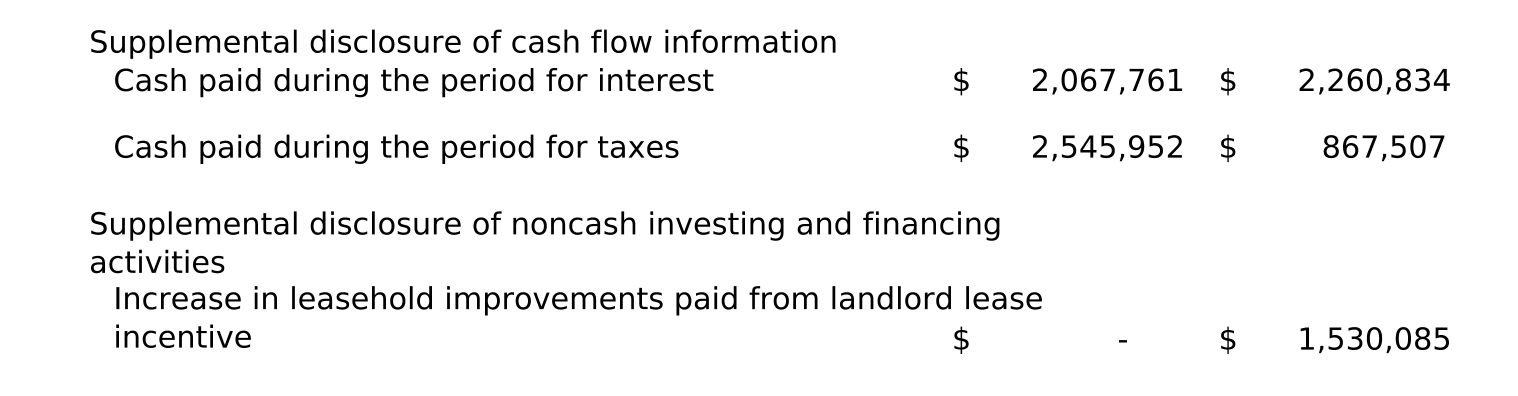

Statements of Cash Flows | 7 |

Notes to Financial Statements | 9 |

Independent Auditor's Report

To the Board of Directors

Mobile Posse, Inc.

Mobile Posse, Inc.

We have audited the accompanying financial statements of Mobile Posse, Inc., which comprise the balance sheets as of December 31, 2019 and 2018, and the related statements of income, stockholder's equity and cash flows for the year ended December 31, 2019 and the period from April 3, 2018 through December 31, 2018, and the related notes to the financial statements.

Management's Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor's Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Mobile Posse, Inc. as of December 31, 2019 and 2018, and the results of its operations and its cash flows for the year ended December 31, 2019 and the period from April 3, 2018 through December 31, 2018 in accordance with accounting principles generally accepted in the United States of America.

Emphasis of Matter - Restatement

As described in Note 15 to the financial statements, the Company has restated its previously issued financial statements to correct certain amounts due to errors in the Company’s calculation of its income tax provisions. Our opinion is not modified with respect to that matter.

/s/ CohnReznick LLP

Tysons, Virginia

March 18, 2020, except for Notes 3, 5, 8, 14 and 15 as to which the date is May 13, 2020

Note 1 - Nature of business and organization

Mobile Posse, Inc. ("Mobile Posse", or the "Company") was incorporated in the State of Delaware on October 25, 2005 and is headquartered in Arlington, Virginia. On April 3, 2018 (the "Acquisition Date"), ACME Mobile, LLC ("ACME Mobile") consummated a business combination with the Company pursuant to an agreement and plan of merger, dated as of April 3, 2018, which provided for the acquisition of all of the capital stock of Mobile Posse by ACME Mobile (the "Acquisition"). The accompanying financial statements include only the operations of the Company from the Acquisition Date. See Note 3 for a further discussion of the Acquisition.

Mobile Posse is the leading platform for creating frictionless content experiences on smartphones. Its Firstly Mobile content discovery platform is designed to understand the mobile journey and intelligently intersect it with interesting content. Through three solutions - firstAPP, firstPAGE, and firstPLACE - carriers and OEMS are empowered to reinvent and monetize the smartphone experience for their subscribers. By eliminating swipes, taps, waits and other "friction" that slows down the user, Firstly Mobile serves premium content when the user unlocks their phone, opens a mobile browser, or swipes to the right. By engaging users in these moments, Mobile Posse creates new revenue streams for top wireless carriers, OEMs and other mobile players.

Business risks and uncertainties

The Company is subject to the risks and challenges associated with companies at a similar stage of development including dependence on key individuals, successful development and marketing of its products and services, competition from substitute products and services and larger companies with greater financial, technical management and marketing resources. Any of the following factors could have a significant negative effect on the Company's future financial position, results of operations and cash flows: adverse changes in the Company's relationship with significant customers or failure to secure contracts with other customers, intense competition, failure to attract and retain key personnel, failure to protect intellectual property, decrease in the migration trends from traditional advertising methods to digital and mobile media and the inability to manage growth.

Note 2 - Summary of significant accounting policies

Push-down accounting

Because the acquisition of Mobile Posse resulted in the Company (see Note 3) being wholly owned, the Company elected to prepare the financial statements using push-down accounting which requires the assets and liabilities to be recorded at fair value as of the Acquisition Date.

Change in accounting principle

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers (Topic 606). The ASU and all subsequently issued clarifying ASUs replaced most existing revenue recognition guidance for accounting principles generally accepted in the United States of America ("GAAP"). The ASU also required expanded disclosures relating to the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The Company adopted the new standard effective January 1, 2019, the first day of the Company's fiscal year using the modified retrospective transition method, under which prior periods were not revised to reflect the impacts of the new standard.

As part of the adoption of the ASU, the Company elected the following transition practical expedients: (i) to reflect the aggregate of all contract modifications that occurred prior to the date of initial application when identifying satisfied and unsatisfied performance obligations, determining the transaction price, and allocating the transaction price; and (ii) to apply the standard only to contracts that are not completed at the initial date of application. Because contract modifications are minimal, there is not a significant impact as a result of electing these practical expedients.

The Company's revenue is primarily generated by delivering clicks and impressions to our customers resulting in digital advertising revenue. Those sales predominantly contain a single delivery element and revenue is recognized at a single point in time when ownership, risks and rewards transfer. Accordingly, the timing of revenue recognition is not materially impacted by the new standard.

The adoption of the new standard did not result in a cumulative adjustment to stockholder's equity.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions regarding certain types of assets, liabilities, revenue and expenses. Such estimates primarily relate to unsettled transactions and events as of the date of the financial statements. Accordingly, upon settlement, actual results may differ from estimated amounts.

Cash and cash equivalents

The Company considers all highly-liquid investments with an original maturity of three months or less at the date of acquisition to be cash equivalents.

Accounts receivable

Accounts receivable balances are due from customers throughout the U.S. Credit is extended based on evaluation of a customer's financial condition and, generally, collateral is not required.

The Company records an allowance for doubtful accounts based on historical experience and management's expectation for future losses. The Company considers an account past due when payment has not been received under the terms of the contract or invoice for an extended period of time. The Company bases its estimates on historical experiences and on various other assumptions that are believed to be reasonable under the circumstances. As of December 31, 2019 and 2018, the allowance for doubtful accounts totaled $297,869 and $0, respectively.

Concentration of credit risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist of cash and cash equivalents and accounts receivable. To reduce credit risk, the Company places its cash with high credit quality financial institutions.

Property and equipment

Property and equipment acquired after the Acquisition (see Notes 1 and 3) are stated at cost, net of accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets, generally ranging from two to five years. Leasehold improvements are amortized using the straight-line method over the estimated useful lives of the improvements or the term of the lease, whichever is shorter.

Expenditures for maintenance and repairs are charged to expense as incurred. Expenditures for major renewals and betterments that extend the useful lives of property and equipment are capitalized and depreciated over the remaining useful lives of the asset. When assets are retired or sold, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the statements of income.

Goodwill and intangibles

Goodwill represents the excess of the total consideration paid over the fair value of the net tangible and identifiable intangible assets of the Company. See Note 3 for specific identified intangible and tangible assets. Certain intangible assets acquired are recognized as assets apart from goodwill. Intangible assets consist of tradenames and trademarks and acquired technology. Intangible assets are amortized on a straight-line basis over the estimated useful lives of 5 years.

On January 16, 2014, the FASB issued ASU No. 2014-02, Intangibles - Goodwill and Other (Topic 350): Accounting for Goodwill. This ASU allows for an accounting alternative for private companies that simplifies and reduces the costs associated with the subsequent accounting for goodwill. Under ASU No. 2014-02, a private company can elect to amortize goodwill over a 10-year period (or less under certain circumstances) and test goodwill for impairment only when a triggering event is identified. A private company that elects this accounting alternative could make an accounting policy decision to perform its impairment testing at the entity level or the reporting-unit level. In accordance with the Acquisition (see Notes 1 and 3), the Company adopted ASU No. 2014-02 as an accounting policy election.

Impairment of long-lived assets

The Company reviews the carrying value of long-lived assets for impairment when events or changes in business circumstances indicate the carrying value may not be recoverable. An impairment loss is recognized when an asset's carrying value exceeds its fair value as calculated using a discounted future cash flow analysis. During the year ended December 31, 2019 and period ended December 31, 2018, no impairment loss was recognized in the accompanying financial statements.

Financing fees

The Company capitalizes debt issuance costs related to debt instruments and revolving loan facilities. Debt issuance costs related to debt instruments are amortized to interest expense over the term of the related debt using the effective yield method. Financing fees related to the loan facilities were amortized utilizing the straight-line method. Amortization expense for the year ended December 31, 2019 and period ended December 31, 2018 were $152,597 and $171,952, respectively.

Deferred rent

Rent expense is recorded on a straight-line basis over the initial lease term and renewal periods which are reasonably assured. The difference between rent expense and rent paid is recorded as deferred rent in the accompanying balance sheets.

Revenue recognition

The Company recognizes revenue from the delivery of click-based ads in the period in which a user clicks on the content, and action-based ads in the period in which a user takes the action the advertiser contracted for. The Company recognizes revenue from the display of impression-based ads in the contracted period in which the impressions are delivered. Impressions are considered delivered when an ad is displayed to users.

The Company has entered into contracts with mobile operators and other vendors which require the Company to pay a fee based on a percentage of either gross or net advertising revenue earned ("Revenue Share"). Revenue Share percentages vary depending on the rates negotiated with the mobile operator or respective vendor.

The Company evaluates whether it is the principal (report revenues on a gross basis) or agent (report revenues on a net basis). Generally, the Company reports its revenues net of contractually agreed upon expenses deducted by the customer in their payments to us. Where we are the agent, the main element of control, monetization of advertising inventory, remains with our customers. Revenue share paid to mobile operators and other vendors are recorded as cost of revenues.

The Company does not have any significant financing components as payment is received at or shortly after the point of sale. Costs incurred to obtain a contract will be expenses as incurred when the amortization period is less than a year.

Research and development

Research and development expenditures are expensed as incurred.

Income taxes

Mobile Posse is organized as a "C" corporation in accordance with Delaware law. The Company accounts for income taxes using the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

The Company has considered its income tax positions, including any positions that may be considered uncertain by the relevant tax authorities in the jurisdictions in which the Company operates. As of December 31, 2019 and 2018, the Company had no uncertain tax positions and no unrecognized tax benefits. Potential interest and penalties associated with uncertain tax positions are recorded as a component of income tax expense. The Company has not incurred any penalties relating to income taxes recognized in the financial statements as of and for the periods ended December 31, 2019 and 2018.

The Company's primary tax jurisdiction is in the United States. Generally, federal, state and local authorities may examine the Company's tax returns for three years from the date of filing and the current and prior three years remain subject to examination as of December 31, 2019.

Subsequent events

The Company has evaluated the potential impact of subsequent events on the financial statements herein through March 18, 2020, the date the financial statements were available to be issued (see Note 13).

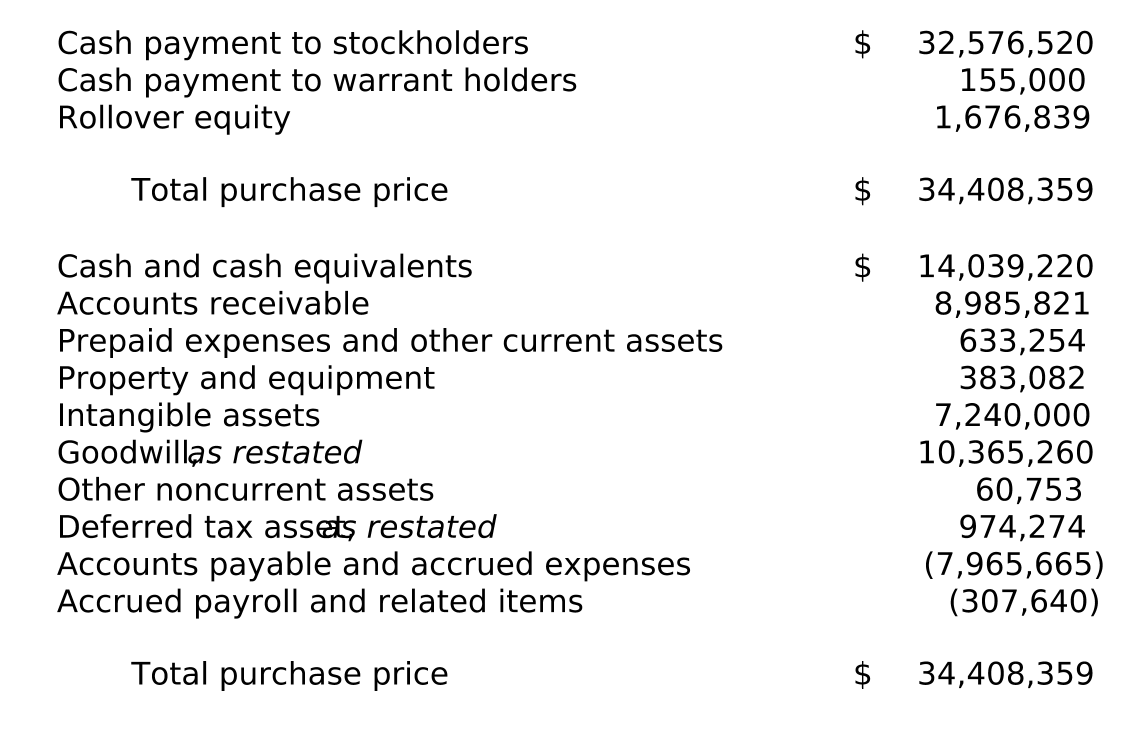

Note 3 - Acquisition of Mobile Posse

On April 3, 2018, ACME Mobile completed the Acquisition in which AMMP Acquisition Corporation ("Sub"), a wholly owned subsidiary of ACME Mobile, acquired 100% of the capital stock of Mobile Posse. As a result of the Acquisition, Mobile Posse became a wholly owned subsidiary of ACME Mobile.

In addition to the consideration paid for Mobile Posse, ACME Mobile agreed to pay an additional $4,401,912 to six individuals subject to maintaining continuous employment with the Company through May 3, 2018 (the "Stay Bonuses"). Since the Stay Bonuses were awarded to Mobile Posse's employees as a condition of their continued employment after the consummation of the Acquisition, and their employment was for the benefit of the combined entity, management determined the arrangement met the conditions for a transaction that was separate from the Acquisition. Accordingly, all of the related compensation cost was considered compensation for postcombination service and, therefore, recognized as postcombination compensation cost and included in transaction fees on the statements of income.

As a result of the change in control, the Company applied the option of "pushdown" accounting, which established a new basis of accounting as of the Acquisition Date.

Management, with the assistance of a third-party valuation firm, has estimated the fair value of the assets and liabilities of the Company as of the Acquisition Date. The post-acquisition identifiable intangible assets consist primarily of technology and trade names and trademarks. Accordingly, the Company has recorded an allocation of the purchase price to the tangible and identifiable intangible assets acquired and liabilities assumed based on their fair values as of the April 3, 2018 acquisition date. The excess of the purchase price over the aggregate estimated fair value of net assets acquired was allocated to goodwill. The calculation of purchase price and purchase price allocation is as follows:

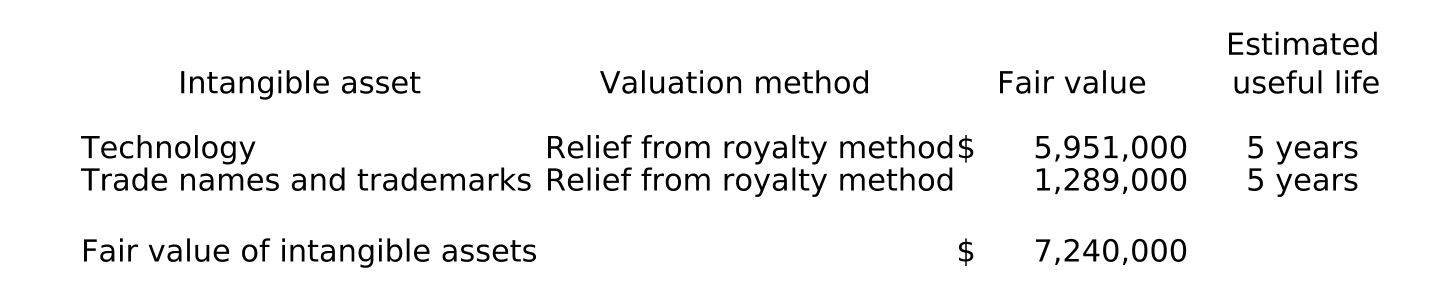

The Company has identified intangible assets consisting of technology and trade names and trademarks totaling $7,240,000 using the valuation methods listed below and their estimated useful lives at the date of the Acquisition:

The fair value of technology was measured based upon significant inputs that were not observable in the market and, therefore, classified as Level 3 assets. The fair value was provided by an independent valuation firm; key assumptions included (a) management's projections of future cash flows based upon past experience and future expectations and (b) discount rate of 33% and royalty rates ranging from 22.4% to 30.6%.

The fair value of trade names and trademarks was measured based upon significant inputs that were not observable in the market and, therefore, classified as Level 3 assets. The fair value was provided by an independent valuation firm; key assumptions included (a) management's projections of future cash flows based upon past experience and future expectations and (b) discount rate of 33% and royalty rate of 2%.

For the period April 3, 2018 through December 31, 2018, the Company incurred $4,687,108 of transaction expenses directly related to the Acquisition, primarily Stay Bonuses previously described.

Note 4 - Intangible assets

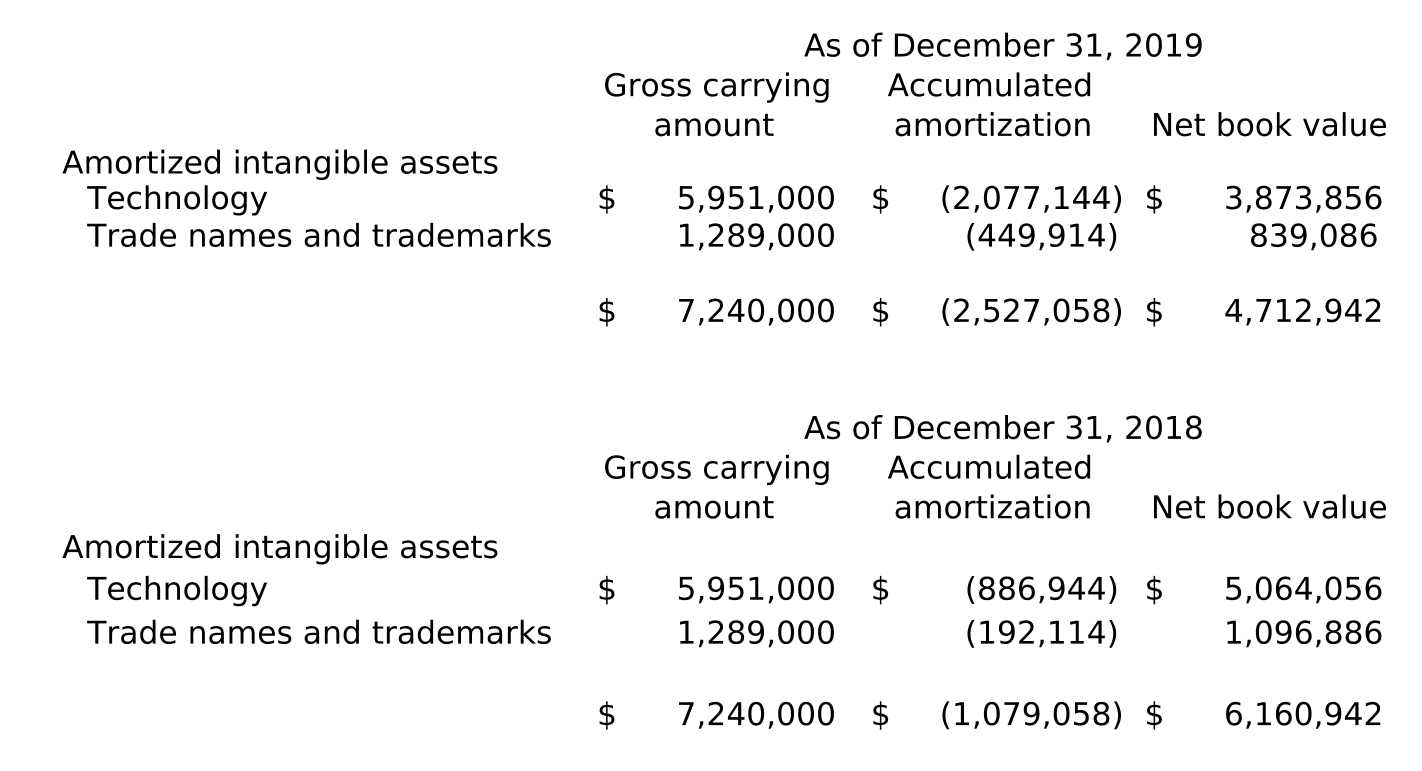

Intangible assets consist of the following as of December 31, 2019 and 2018:

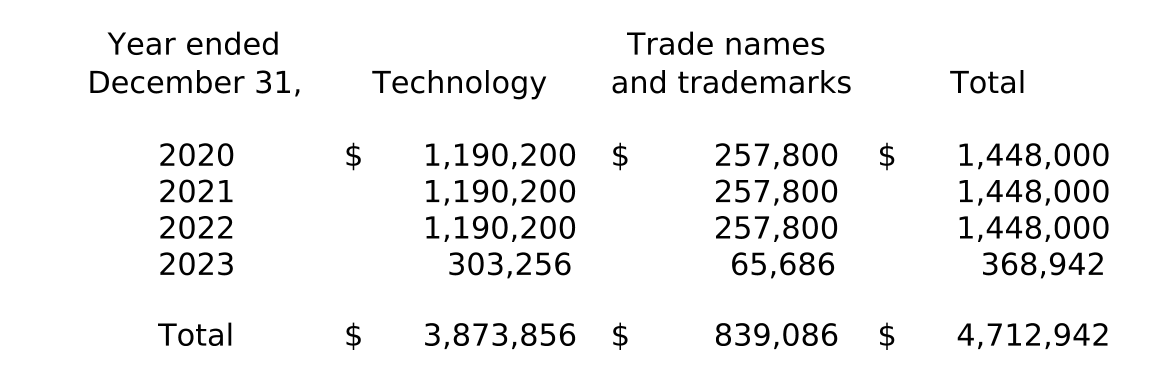

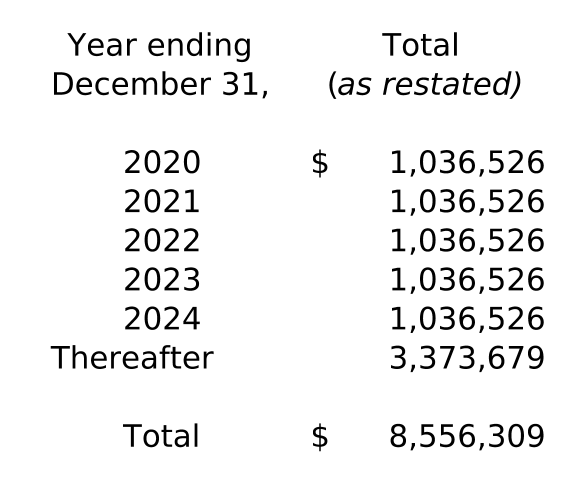

Amortization expense totaled $1,448,000 for the year ended December 31, 2019 and $1,079,058 for the period ended December 31, 2018. The expected annual amortization expense for the next four years is listed in the table below:

Note 5 - Goodwill

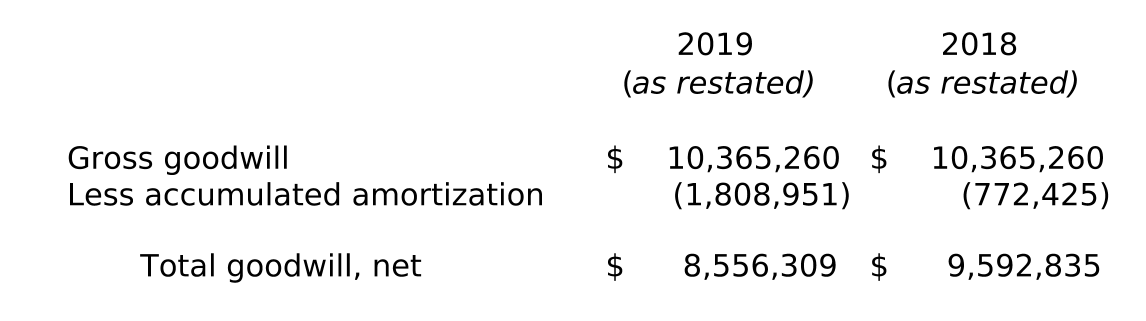

Goodwill consists of the following as of December 31, 2019 and 2018:

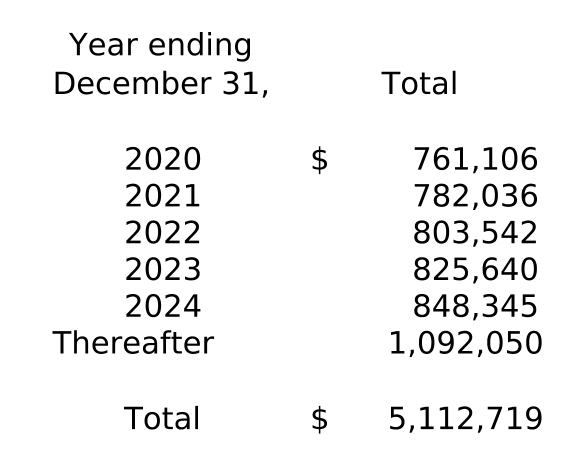

Amortization expense totaled $1,036,526 for the year ended December 31, 2019 and $772,425 for the period ended December 31, 2018. The expected annual amortization expense for goodwill is listed in the table below:

Note 6 - Property and equipment

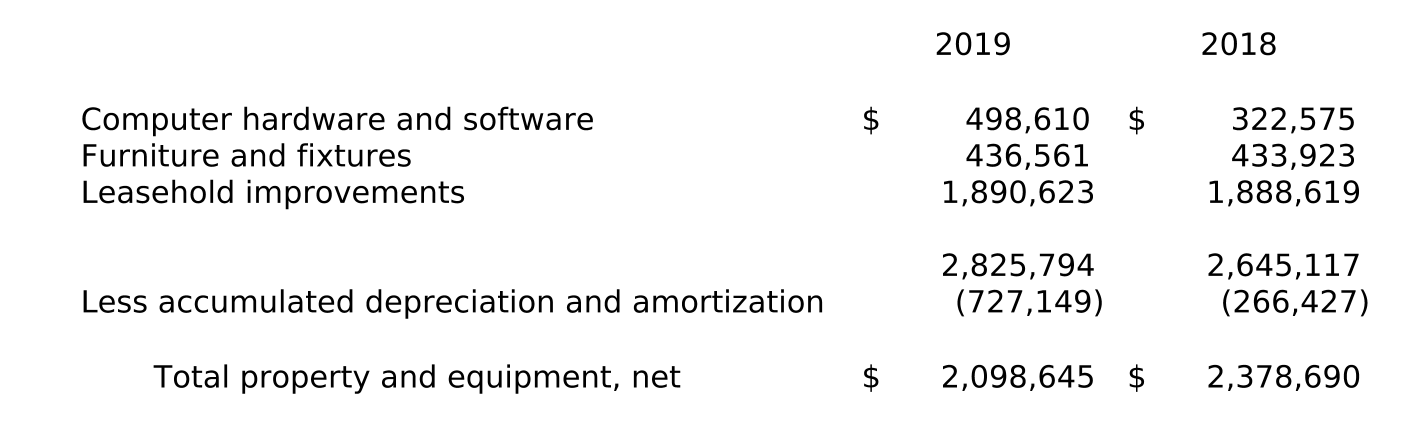

Property and equipment consist of the following as of December 31, 2019 and 2018:

Depreciation and amortization expense on property and equipment was $483,538 for the year ended December 31, 2019 and $266,427 for the period ended December 31, 2018.

Note 7 - Debt

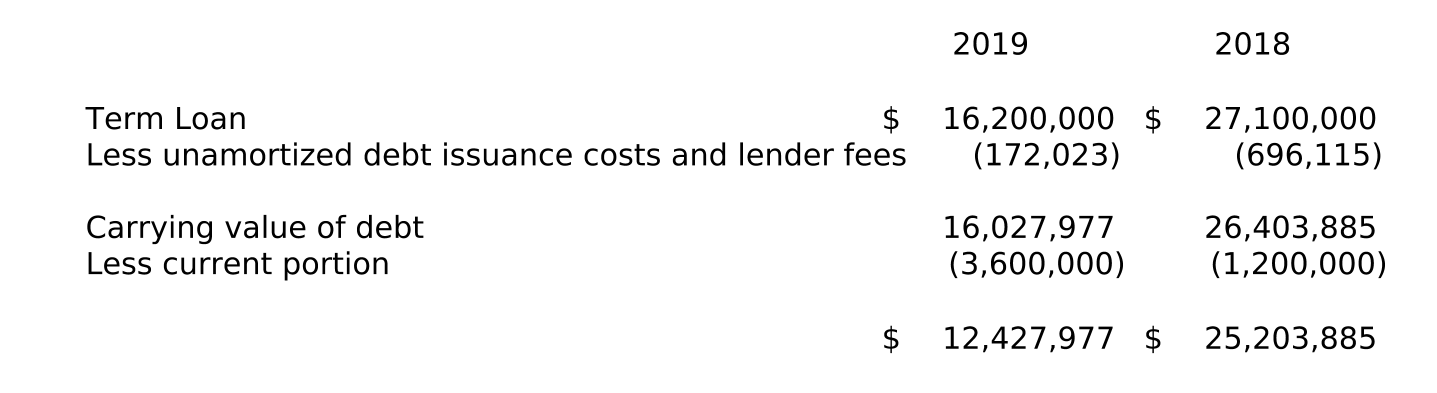

Long-term debt is summarized as follows:

Prospect Term Loan

On April 3, 2018 (the "Prospect Closing Date"), Mobile Posse, as borrower, and ACME Mobile, as guarantor, entered into a loan agreement (the "Prospect Term Loan Agreement") with the lenders from time to time party thereto and Prospect Capital Corporation ("Prospect") as administrative agent and collateral agent for a $28,000,000 term loan facility (the "Prospect Term Loan") that matures on April 3, 2023 (the "Prospect Maturity Date"). Concurrently, the Company borrowed the full $28,000,000 under the Prospect Term Loan to (i) finance a portion of the Acquisition and the Stay Bonuses, and (ii) pay transaction fees, costs and expenses incurred in connection with the Prospect Term Loan Agreement.

The Prospect Term Loan bears interest at a rate per annum equal to the greater of (a) 10.5% and (b) the LIBOR Rate, as defined in the Prospect Term Loan Agreement, plus a margin of 8.5%, payable in cash monthly in arrears, beginning on April 30, 2018. The interest rate at December 31, 2018 was 11.3%.

The Prospect Term Loan is payable in equal monthly principal installments of $100,000 each, beginning on April 30, 2018, and on the last day of each succeeding month, with a final payment of the remaining principal and interest on the Prospect Maturity Date.

In connection with the Prospect Term Loan Agreement, the Company incurred debt issuance costs and lender fees totaling $868,067. Debt issuance costs and lender fees are presented in the balance sheets as a reduction to "Long-term debt." Interest expense associated with the amortization of debt issuance costs and lender fees totaled $106,264 for the year ended December 31, 2019 and $171,952 for the period ended December 31, 2018.

JPMorgan Credit Agreement

On July 19, 2019 (the "JPMorgan Closing Date"), Mobile Posse, as borrower, and ACME Mobile, as guarantor, entered into a credit agreement (the "Credit Agreement") with JPMorgan Chase Bank ("JPMorgan") as lender. The Credit Agreement includes a revolving commitment in the form of revolving loans and letters of credit of $2,000,000 and a term commitment in the form of a term loan ("JPMorgan Term Loan") of $18,000,000. On the JPMorgan Closing Date, the Company drew the full amount of the JPMorgan Term Loan. The Credit Agreement matures on July 19, 2022 (the "JP Morgan Maturity Date").

The Company used the funds from the JPMorgan Term Loan and cash on hand to fully extinguish the Prospect Term Loan. In connection with the extinguishment of the Prospect Term Loan, the Company recorded a loss on extinguishment of $589,851, which represented the unamortized debt issuance costs and lender fees of the Prospect Term Loan as of the date of extinguishment.

The JPMorgan Term Loan bears interest at the Adjusted LIBOR Rate, as defined in the JPMorgan Term Loan Agreement, for the interest period in effect for the borrowing plus an applicable rate, payable in cash quarterly, beginning on September 30, 2019. The interest rate at December 31, 2019 was 5.43%.

The JPMorgan Term Loan is payable in equal quarterly principal installments of $900,000 each, beginning on September 30, 2019, and on the last day of each succeeding quarter, with a final payment of the remaining principal and interest on the Maturity Date.

In connection with the Credit Agreement, the Company incurred debt issuance costs and lender fees totaling $218,356. Debt issuance costs and lender fees are presented in the balance sheets as a reduction to "Long-term debt." Interest expense associated with the amortization of debt issuance costs and lender fees totaled $46,333 for the year ended December 31, 2019.

The Credit Agreement contains customary affirmative and negative covenants, including covenants that limit or restrict the Company and its subsidiaries' ability to, among other things, incur indebtedness, grant liens, certain sale and leaseback transactions, merge or consolidate, dispose of assets, make investments, capital expenditures, make acquisitions, enter into transactions with affiliates, pay dividends or make distributions and repurchase stock. The Company is also required to maintain compliance with a total leverage ratio and a fixed charge coverage ratio. The Credit Agreement includes customary events of default. The Credit Agreement is secured by, among other things, substantially all of the assets of the Company, a first priority pledge of the stock of Mobile Posse and is guaranteed by ACME Mobile.

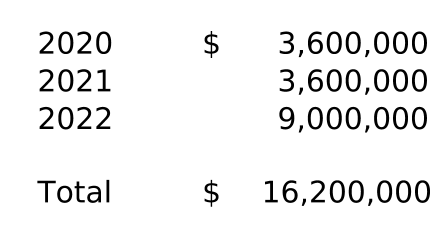

The aggregate contractual maturities of the JPMorgan Term Loan (excluding unamortized debt issuance costs) were as follows as of December 31, 2019:

Interest expense totaled $2,221,511 for the year ended December 31, 2019 and $2,260,834 for the period ended December 31, 2018.

Note 8 - Income taxes

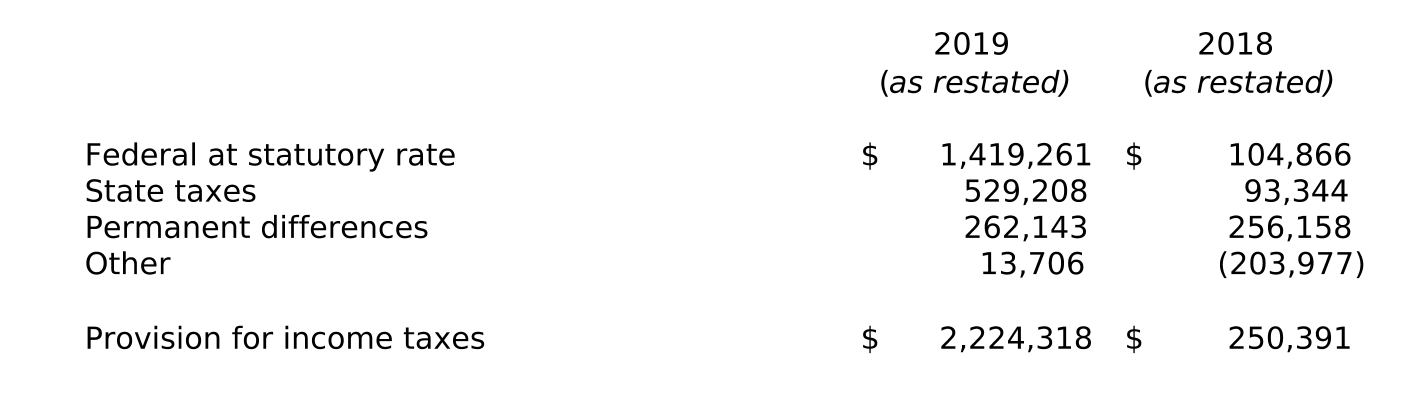

The reconciliations of the reported estimated income tax expense to the amount that would result by applying the U.S. federal statutory tax rate to the net income for the year ended December 31, 2019 and period ended December 31, 2018 are as follows:

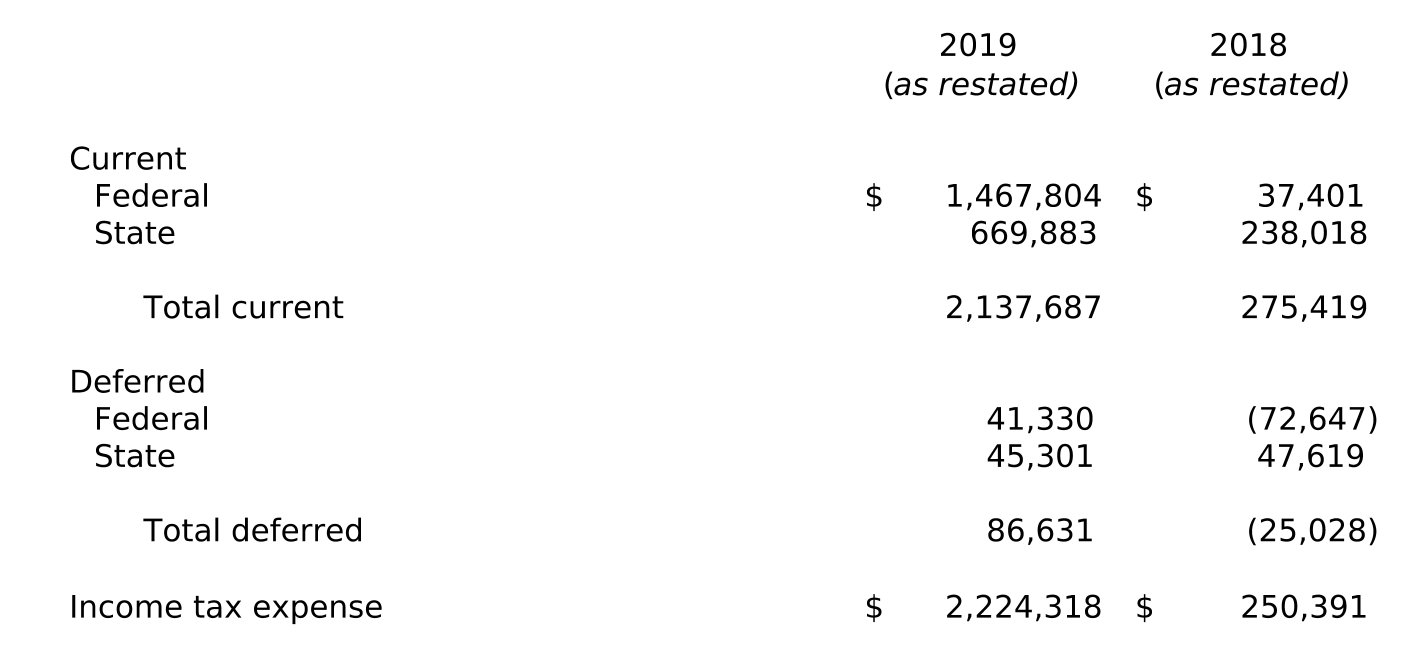

The components of income taxes for the year ended December 31, 2019 and period ended December 31, 2018 are as follows:

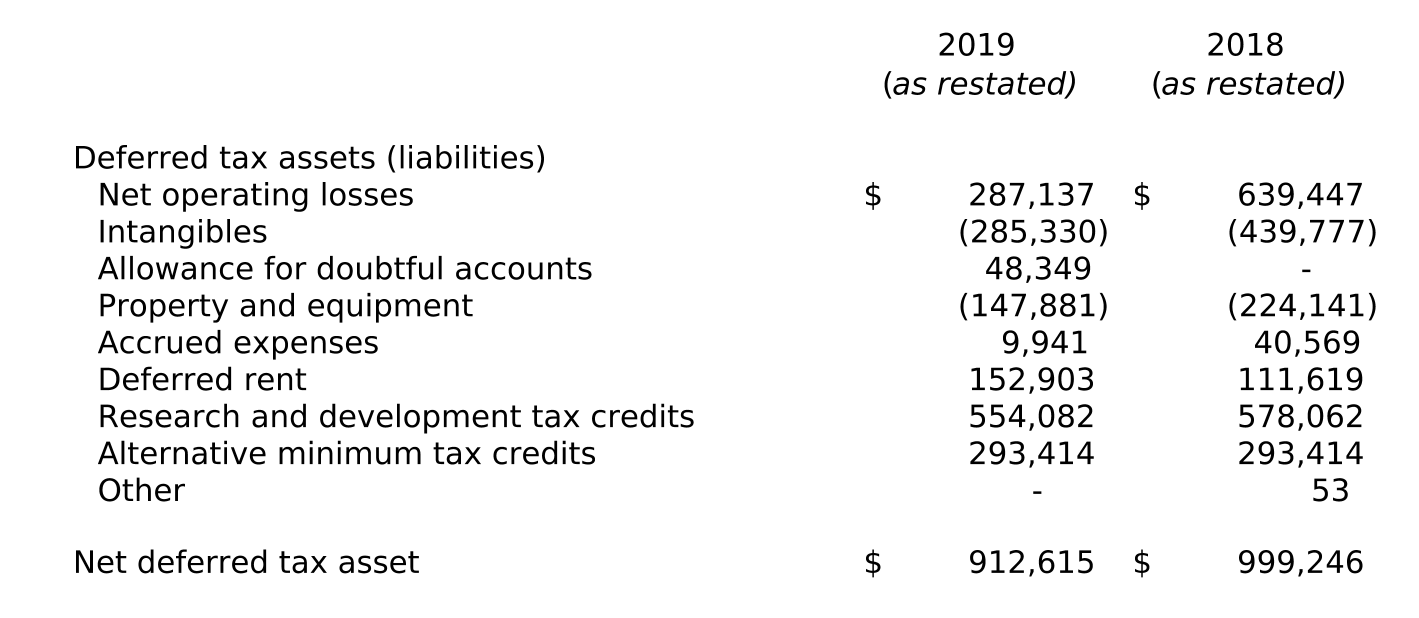

Deferred income taxes reflect net tax effects of temporary differences between carrying amounts of assets and liabilities for financial reporting purposes and the amounts reported for income tax purposes. Components of the Company's deferred tax assets and liabilities as of December 31, 2019 and 2018 are as follows:

The Company has available as of December 31, 2019, approximately $1,104,000 of unused operating loss carryforwards that expire in various years through 2043 if not utilized, and that may be applied against future taxable income. Utilization of these carryforwards may be subject to a substantial annual limitation due to the ownership change limitations provided by the Internal Revenue Code of 1986, as amended and similar state provisions. The annual limitation may result in the expiration of net operating loss and tax credit carryforwards before utilization.

Net operating losses generated in 2018 and thereafter may be carried forward permanently. However, the extent to which they can be used to offset future taxable income will be limited to 80% of the respective future year's taxable income. In addition, net operating loss carryforwards may be limited in situations where there is a change in the Company's ownership. Depending on the extent of any potential future ownership change, net operating loss carryforwards may become partially or fully unavailable prior to being utilized. Net operating losses generated in 2018 and thereafter will generally not be available to carryback to earlier tax years, but may be carried forward permanently.

Note 9 - Stockholder's equity

On April 3, 2018, in connection with the Acquisition, the Company adopted the seventh amended and restated articles of incorporation, which authorized the Company to issue up to 100 shares of common stock, with a par value of $0.001.

Note 10 - Equity Incentive Plan

On April 3, 2018, ACME Mobile adopted the 2018 Equity Incentive Plan ("Plan"). The Plan authorizes the granting of unit-based awards to employees of the Company in order to provide incentives to its employees, directors, officers, nonemployee directors, and independent contractors. Under the Plan, awards may be granted as options, membership appreciation rights, bonus equity awards, restricted equity awards, restricted equity units, dividend equivalent awards or any other types of awards which may be authorized under the Plan. Under FASB Accounting Standards Codification Topic 718, Compensation – Stock Compensation, awards by a parent company issued to employees of a subsidiary are accounted for as share-based compensation on the subsidiary.

Under the Plan, unit-based awards are granted at the fair market value of the ACME Mobile's Common Units on the grant date. ACME Mobile has reserved 8,000,000 Common Units for issuance under the Plan. Units under the Plan may be granted for periods of up to 10 years at prices that may not be less than the fair value of the shares on the date of grant. At December 31, 2019, 2,356,894 Common Units are available for future grant under the Plan.

The Plan is administered by ACME Mobile's Board of Managers, which determines the terms of options, including exercise price, the number of units subject to the grant, the vesting schedule and the terms and conditions of any exercise. No units granted under the Plan are transferable by the grantee, other than by will or the laws of descent and distribution.

During the year ended December 31, 2019 and the period ended December 31, 2018, ACME Mobile issued Common Units in the form of Limited Exercise Options ("Awards") and Profits Interests with certain employees and members of management of the Company. The Awards and Profits Interests generally vest over two to four years. The Awards are contingently exercisable upon a change in control event.

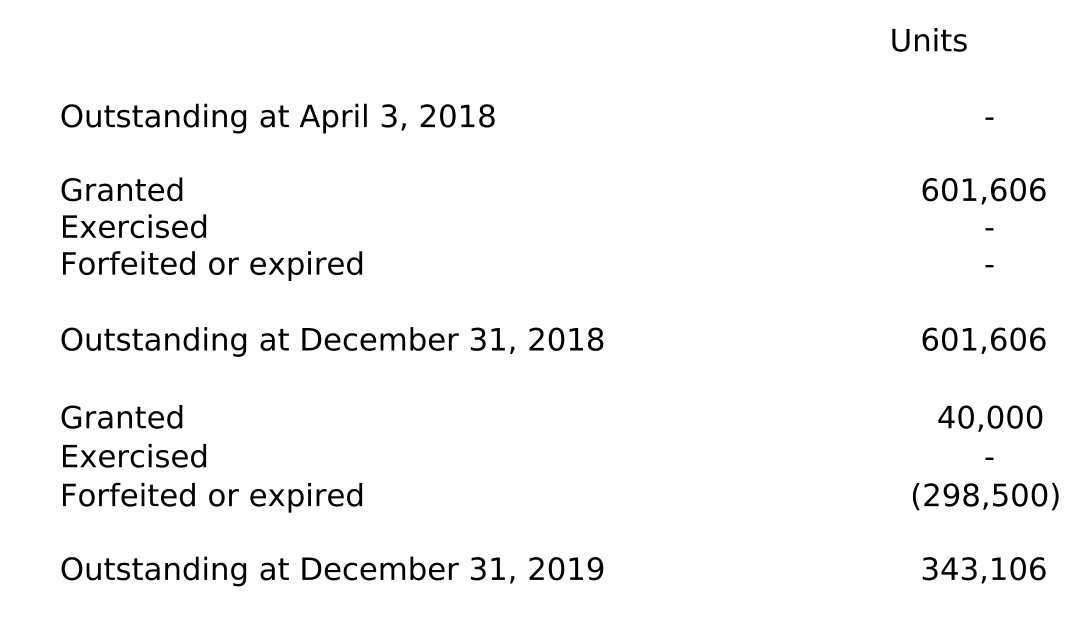

A summary of activity related to the issuance of Awards during the years ended December 31, 2019 and 2018 is presented below:

The aggregate fair value of the Awards issued during the year ended December 31 2019 and period ended December 31, 2018, as determined by the Board of Managers, was approximately $3,700 and $55,000, respectively. No compensation expense related to the issuance of Awards was incurred for the year ended December 31, 2019 or the period ended December 31, 2018 as all Awards are contingently exercisable. The unrecognized expense of approximately $58,700 will be recorded once the contingency is resolved upon a change in control event.

Additionally, under the Plan, ACME Mobile issued 2,400,000 and 2,900,000 Profits Interests during the year ended December 31, 2019 and the period ended December 31, 2018, respectively. The total aggregate fair value of the Profits Interests issued during the year ended December 31, 2019 and period ended December 31, 2018, as determined by the Board of Managers, is not material. No awards were forfeited during the year ended December 31, 2019 or period ended December 31, 2018 and 5,300,000 Profits Interests remain outstanding as of December 31, 2019.

Note 11 - Concentrations

For the year ended December 31, 2019 and period ended December 31, 2018, revenue from sales to four customers approximated 72% of revenue and three customers approximated 82% of revenue, respectively. As of December 31, 2019 and 2018, approximately 52% and 72% of accounts receivable were due from three customers. The majority of the Company's product distribution comes from one North American mobile operator.

Note 12 - Commitments and contingencies

On August 25, 2017, Mobile Posse entered into an amendment to its lease agreement resulting in the relocation of the Company's headquarters within the same building in Arlington, Virginia. The amended lease is for an initial term of seven years and ten months from the date of relocation, expiring on March 31, 2026.

Future minimum rents are as follows:

Rent expense totaled $536,638 and $370,624 for the year ended December 31, 2019 and period ended December 31, 2018, respectively.

Employment agreement

The Company has entered into employment agreements with its chief executive officer and chief financial officer. The agreements provide for a base salary, contingent bonus compensation, severance provisions, and non-compete and nondisclosure restrictions.

Litigation

The Company is involved in various claims and legal actions that arise in the ordinary course of business. Management does not believe that the ultimate resolution of these actions will have a material adverse effect on the Company's financial position, results of operations, liquidity and capital resources. A significant increase in the number of litigated claims or an increase in amounts owing under successfully litigated claims could materially adversely affect the Company's business, financial condition, results of operations and cash flows.

Note 13 - Subsequent events

Acquisition of Company

On February 6, 2020, the Company, together with ACME Mobile and certain equity holders of ACME Mobile, entered into a Stock Purchase Agreement (the "Purchase Agreement") with Digital Turbine Media, Inc. ("DT Media"), pursuant to which DT Media would acquire (the "DT Acquisition") all of the outstanding capital stock of Mobile Posse in exchange for $41,500,000 in cash and an additional earn-out, based on the Company achieving certain future target net revenues, less associated revenue shares, over a 20-month period (the "Earn-Out Period") following the closing of the DT Acquisition. Under the terms of the earn-out, over the Earn-Out Period, DT Media would pay ACME Mobile a certain percentage of actual net revenues (less associated revenue shares) of the Company depending on the extent to which the Company achieves certain target net revenues (less associated revenue shares) for the relevant period. The earn-out payments would be paid every three months with a true-up calculation and payment after the first nine months of the Earn-Out Period. The Purchase Agreement contains customary representations and warranties, covenants, closing conditions, and indemnification provisions. The DT acquisition closed on February 28, 2020.

Litigation settlement

On May 18, 2018, a former employee of the Company filed a shareholder class action case against the Company and its former directors in the Court of Chancery, Delaware (the "Court"). The parties to the case agreed to a settlement and notified the Court on March 3, 2020. The settlement amount of $650,000 was deposited in escrow by the Company's insurance carrier ($400,000) and attorney ($250,000). No amounts were paid or expected to be paid by the Company to settle the matter other than legal fees for representation.

Note 14 - COVID-19

On March 11, 2020, the World Health Organization declared the outbreak of a novel coronavirus ("COVID-19") as a global pandemic, which continues to spread throughout the United States and around the world. As of May 13, 2020, the Company is aware of changes in its business as a result of COVID-19 but uncertain of the impact of those changes on its financial position, results of operations or cash flows. Management believes any disruption, when and if experienced, could be temporary; however, there is uncertainty around when any disruption might occur, the duration and hence the potential impact. As a result, the Company is unable to estimate the potential impact on its business as of May 13, 2020.

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was signed into law in response to the COVID-19 pandemic. The CARES Act provides numerous tax provisions and stimulus measures, including temporary changes regarding the prior and future utilization of net operating losses, temporary changes to the prior and future limitations on interest deductions, and technical corrections from prior tax legislation for tax depreciation of certain qualified improvement property. The Company is in the process of evaluating the provisions of the CARES Act relating to income taxes which may result in adjustments to certain deferred tax assets and liabilities which will be accounted for as of the date the CARES Act was enacted in 2020. Any potential adjustment has not been determined as of the date of these financial statements.

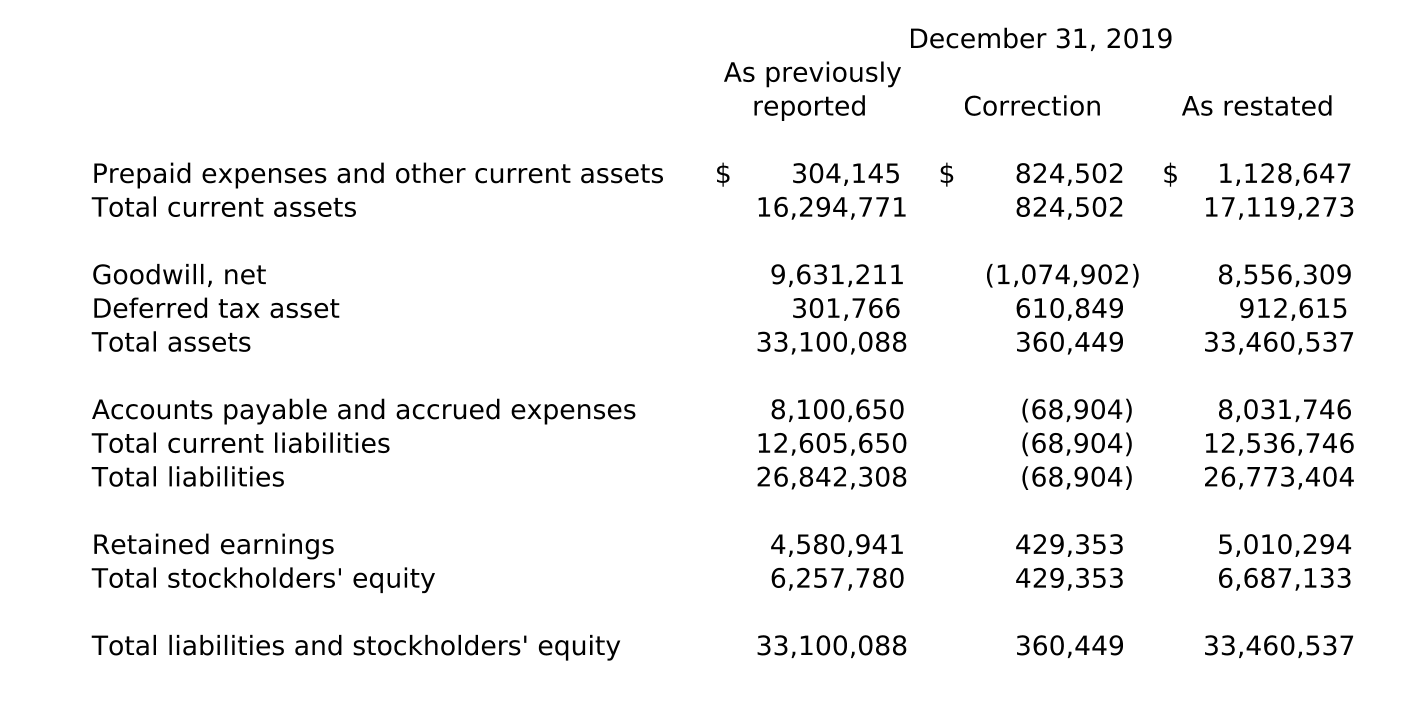

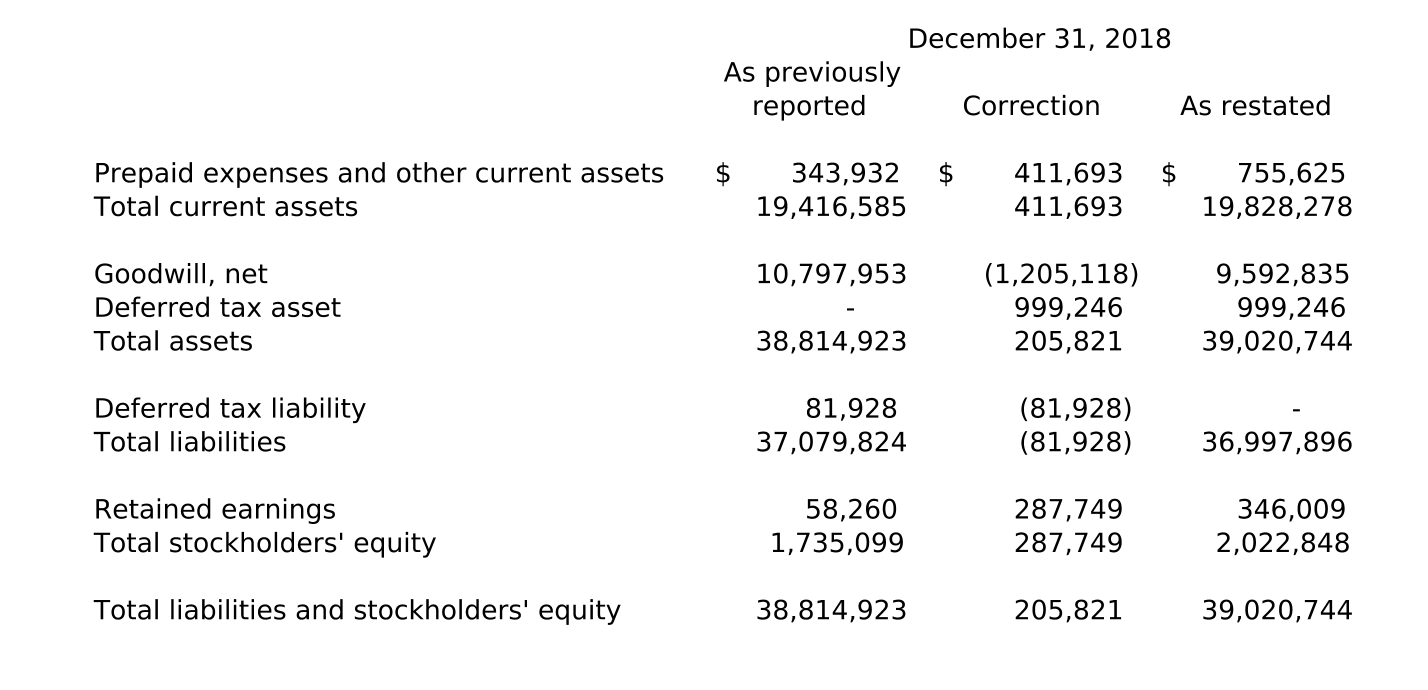

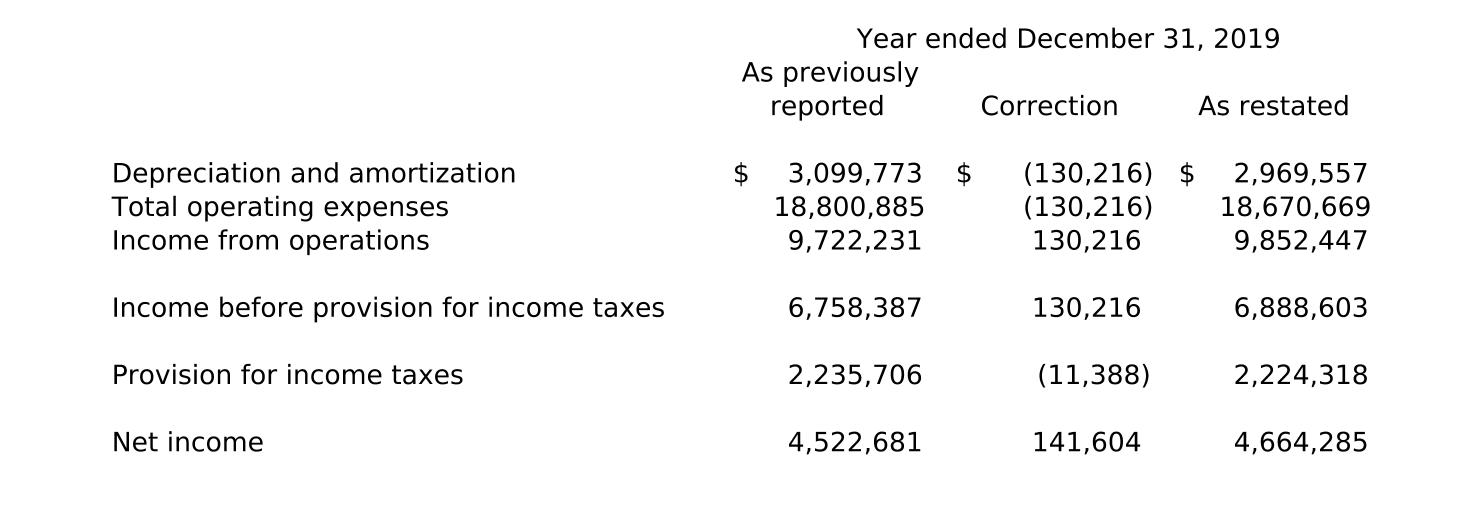

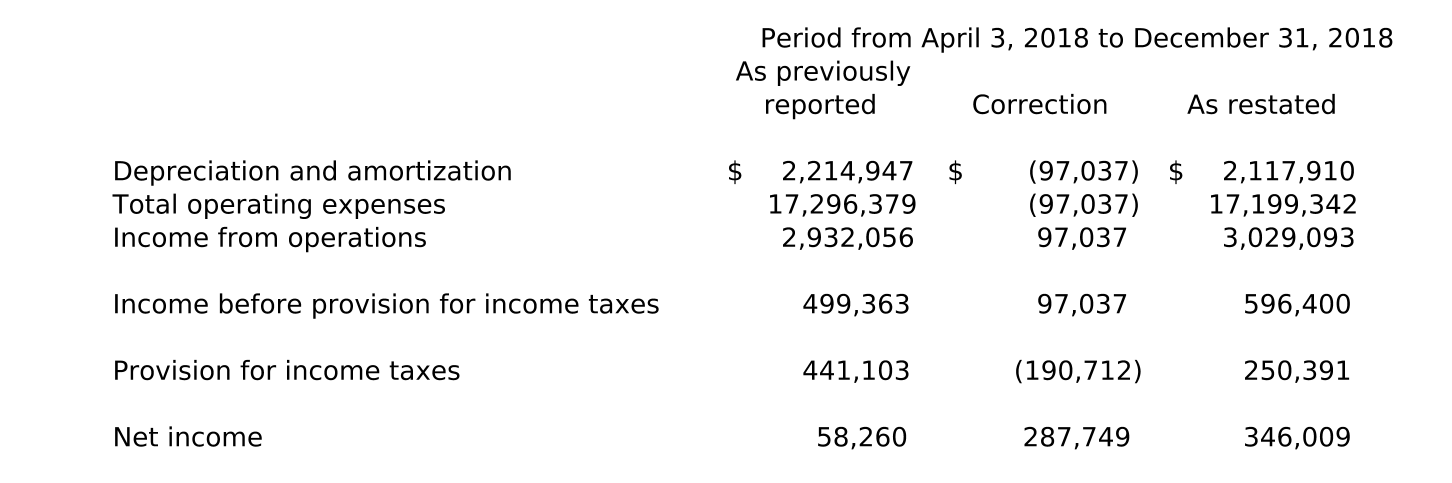

Note 15 - Restatement

Subsequent to the issuance of the 2019 financial statements, the Company identified and corrected errors that originated in 2018. The errors were caused by the Company incorrectly accounting for income tax provisions and tax related balance sheet amounts. The initial error was corrected in the opening balance sheet as of April 3, 2018 which resulted in the recognition of a net deferred tax asset of $974,274 and a reduction in goodwill of $1,302,155, as indicated in Note 3. Notes 5 and 8 reflect the correction of the related errors.

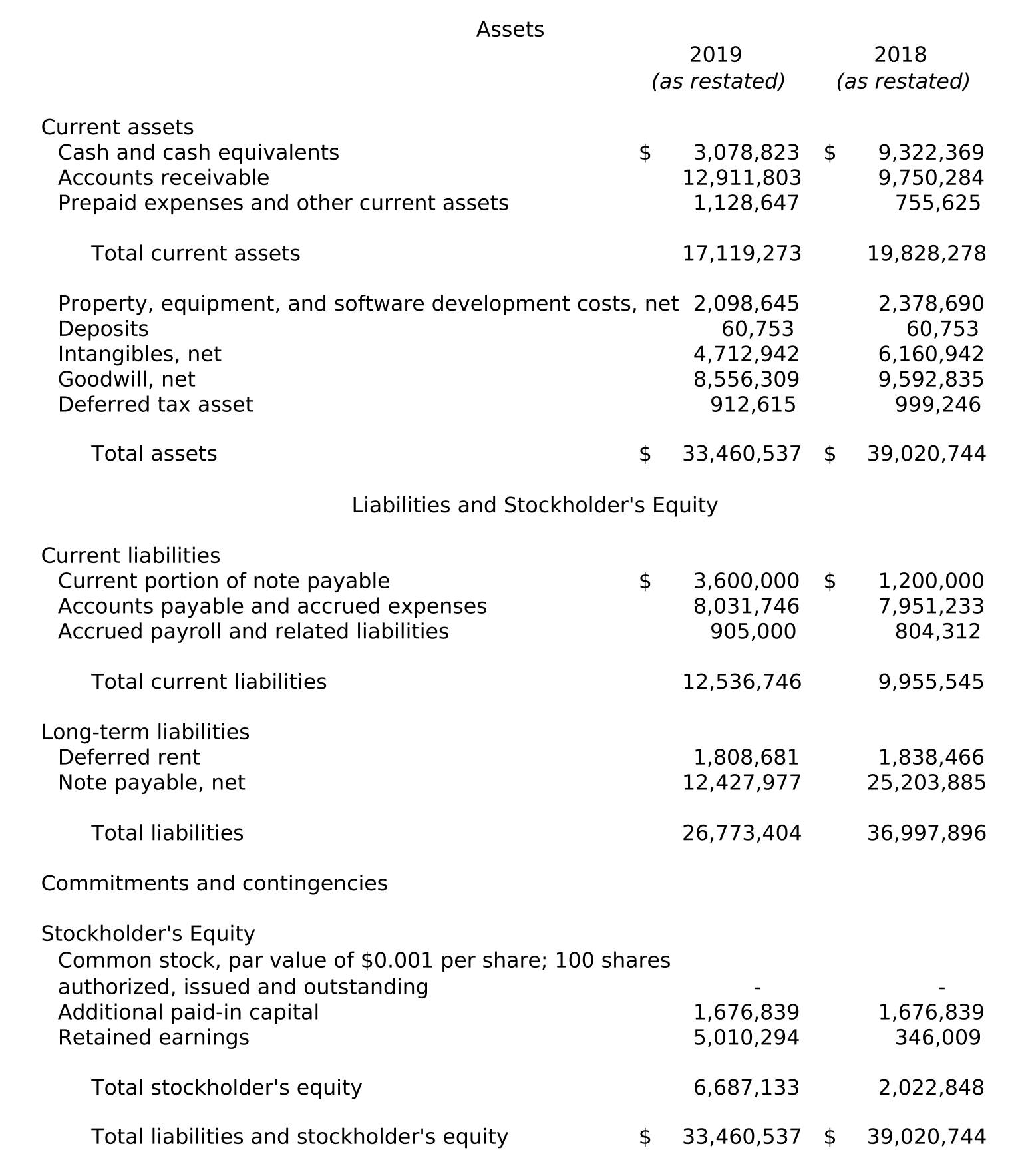

The effects of these errors on the balance sheets are as follows:

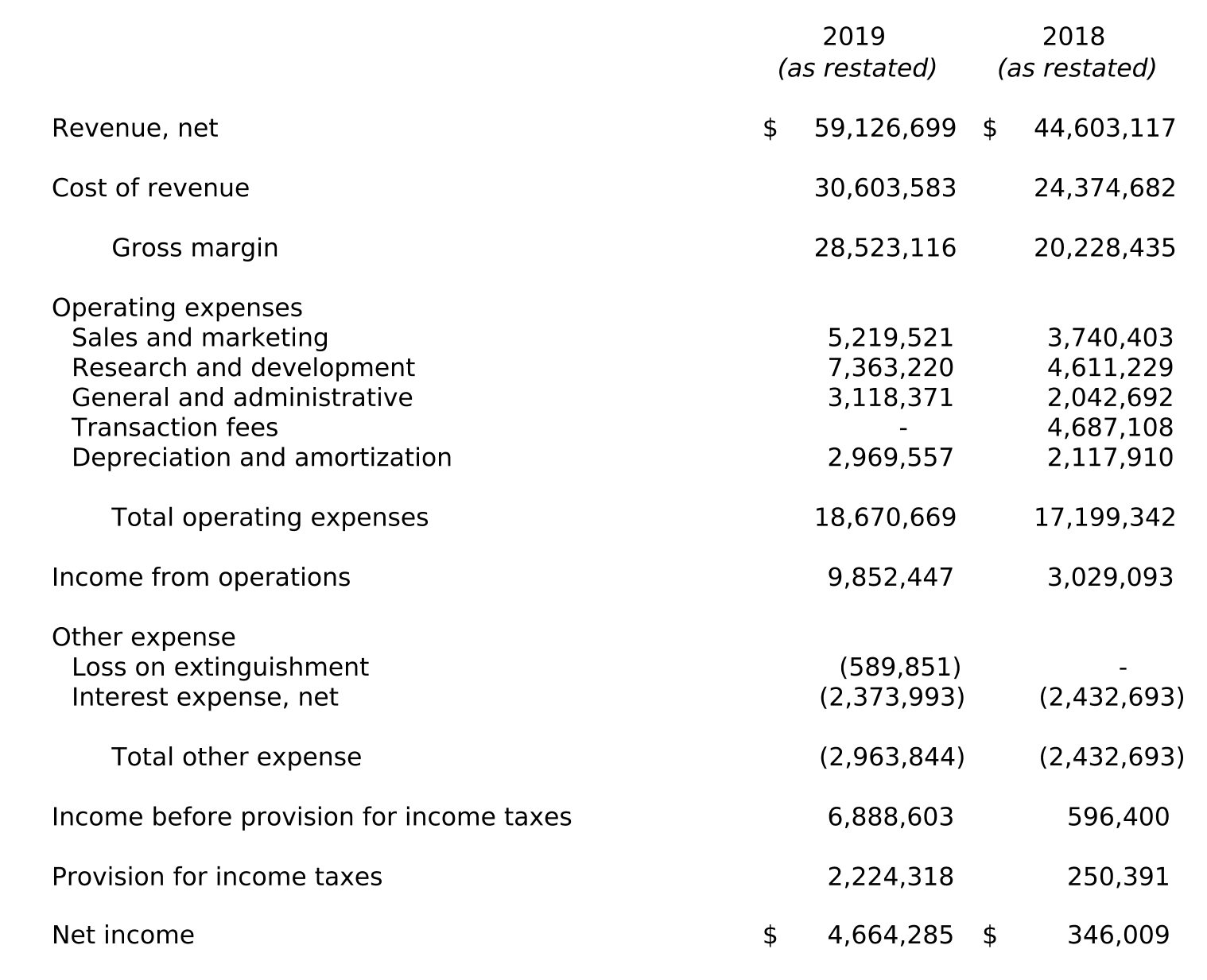

The effects of these errors on the statements of income are as follows:

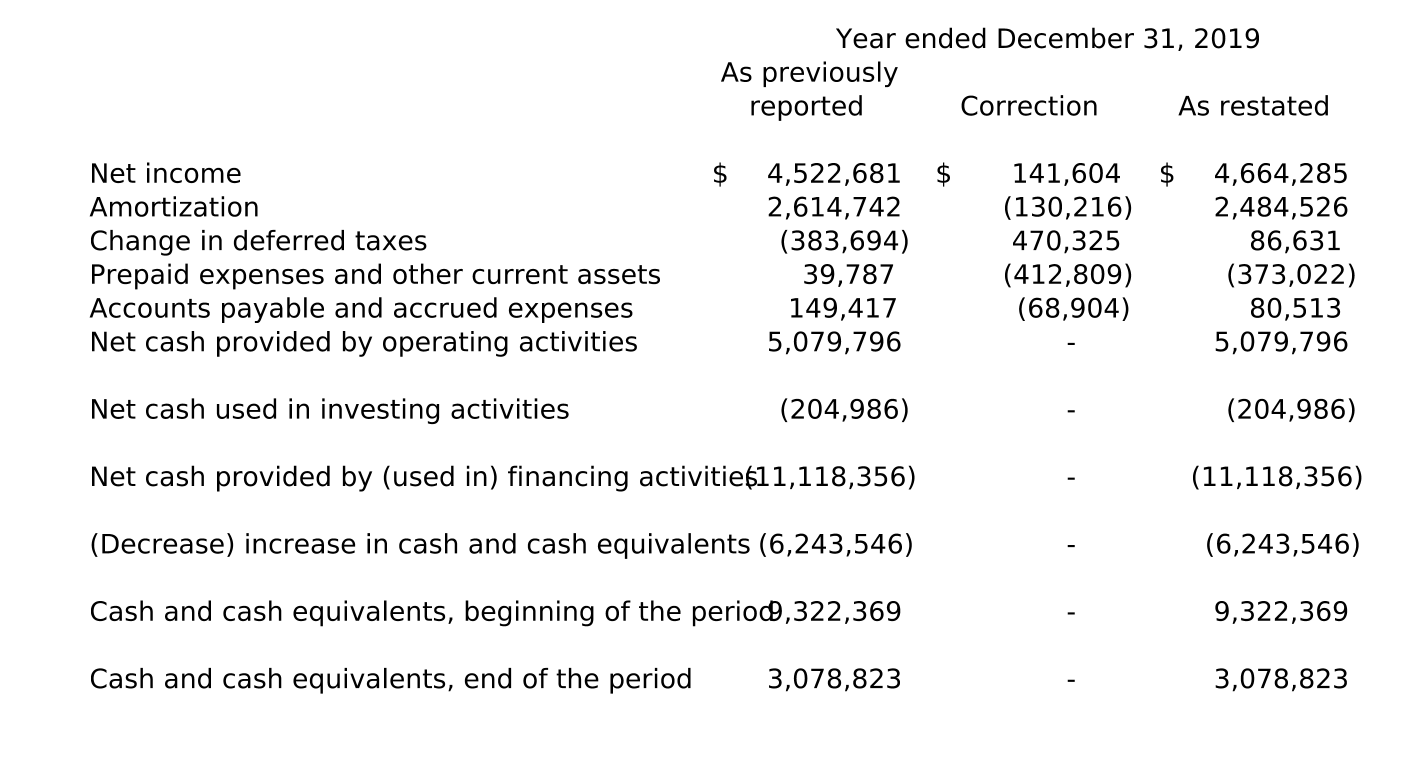

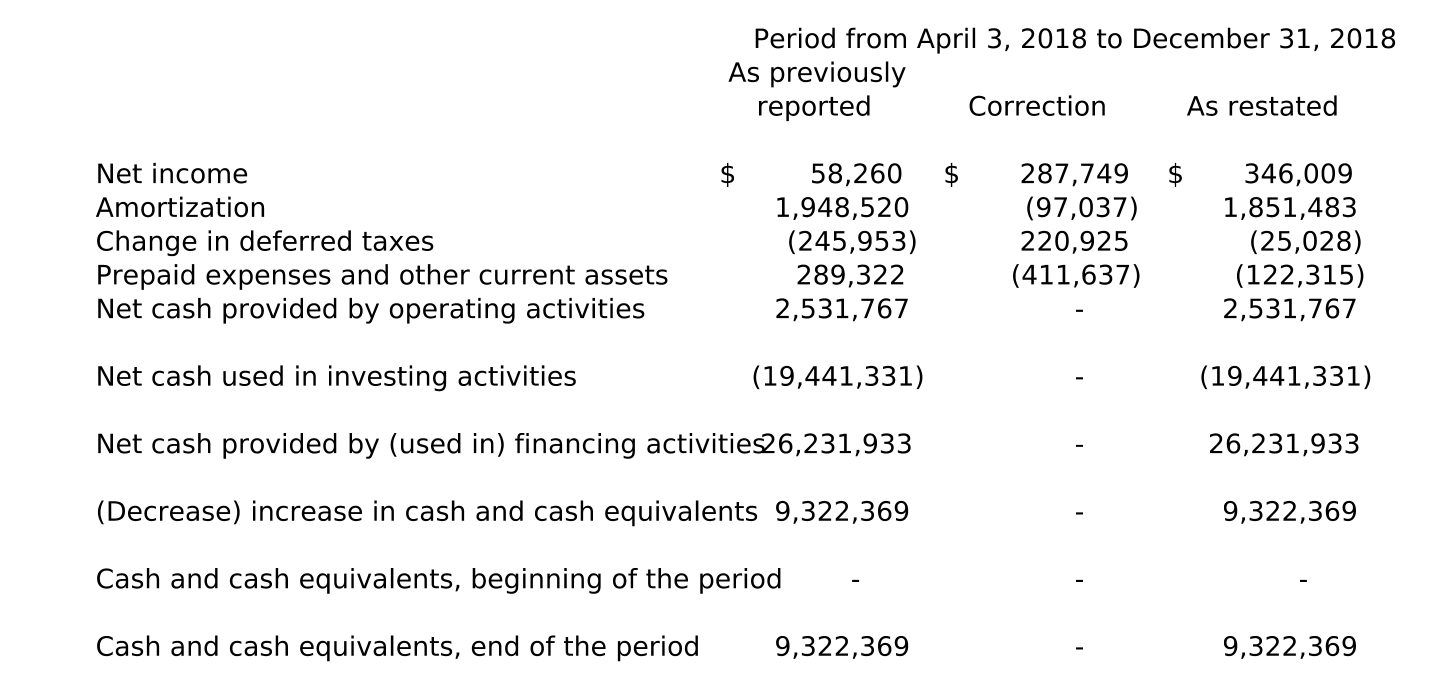

The effects of these errors on the statements of cash flows are as follows: